Stock to Watch Today - Rupeedesk Reports - 27.12.2023

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

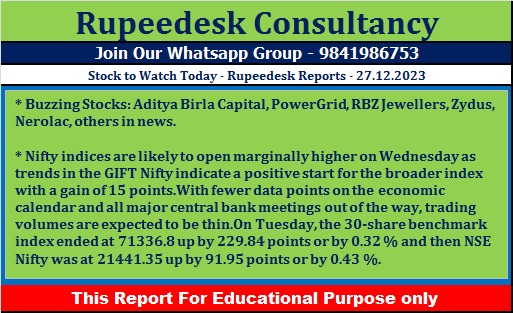

Buzzing Stocks: Aditya Birla Capital, PowerGrid, RBZ Jewellers, Zydus, Nerolac, others in news.

Aditya Birla Capital (ABCL): The company has made investments of Rs 850 crore on a rights basis in Aditya Birla Finance (ABFL) and Rs 50 crore in Aditya Birla Capital Digital (ABCDL). After the said investments, there is no change in the percentage shareholding of ABCL, and both ABCDL and ABFL continue to be wholly owned subsidiaries of the company.

Power Grid Corporation of India: The project under “evacuation of renewable energy (RE) in Tirunelveli and Tuticorin wind energy zone (Tamil Nadu) 500 MW” has been commissioned with effect from December 24. For which, the notification for commercial operation (DOCO) was received on December 26. Further, Power Grid has acquired Vataman Transmission (VTL), the project SPV, to establish a transmission system for the evacuation of an additional 7 GW of RE power from Khavda RE Park, for Rs 18.19 crore, and Koppal II Gadag II Transmission (KIIGIITL), the project SPV to establish a transmission system for the Transmission Scheme for Integration of Renewable Energy Zone (Phase-II) in Koppal-II (Phase-A and B) and Gadag-II (Phase-A) in Karnataka, on a build, own, operate, and transfer (BOOT) basis, from the bid process coordinator, PFC Consulting, for Rs 18.45 crore.

Zydus Lifesciences: Subsidiary Zydus Healthcare has received an intimation from the Income Tax Department, determining the income tax demand of Rs 284.58 crore for the assessment year 2023-2024 while processing the return of income of Zydus Healthcare. The company strongly believes that once the rectification is made, the entire demand will be deleted.

RBZ Jewellers: The Ahmedabad-based jewellery retailer will list its equity shares on December 27. The issue price has been set at Rs 100 per share.

Credo Brands Marketing: The Mufti Menswear is set to debut on the bourses on December 27. The final issue price has been fixed at Rs. 280 per share.

Happy Forgings: The forgings and high-precision machined component maker will be listed on the BSE and NSE on December 27. The final issue price is Rs. 850 per share.

Kansai Nerolac Paints: The paint manufacturing company said the Board of Directors has approved a proposal for entering into an agreement for sale with Aethon Developers, the subsidiary of Runwal Developers, for the sale of its land parcel at Lower Parel, Mumbai, for Rs 726 crore. Accordingly, the company has entered into an agreement for sale with Aethon.

Vedanta: The mining company will start trading ex-dividend with effect from December 27. The company has announced an interim dividend of Rs 11 per share for FY24.

SJVN: The state-owned company has secured a 100 MW solar power project from Gujarat Urja Vikas Nigam (GUVNL). The company successfully bagged the quoted capacity of a 100 MW solar project at Rs 2.63 per unit on a build-own-operate basis. This ground-mounted solar project will be developed by the company’s wholly owned subsidiary, i.e., SJVN Green Energy (SGEL), at a tentative cost of Rs 550 crore.

Karnataka Bank: The lender has enabled the facility of payment of direct taxes (income tax and advance tax) for its customers. It is already providing the facility of online remittance through the ICEGATE portal for customs duty payments and the GSTN portal for goods and service tax payments, as well as over-the-counter mode on behalf of the Central Board for Indirect Taxes and Customs (CBIC).

Piramal Consumer Products: Subsidiary Piramal Consumer Products Private (PCPPL) has agreed to enter into an agreement with AASAN Corporate Solutions (ACSPL), a promoter group company, for the acquisition of Piramal Tower at Peninsula Corporate Park, Lower Parel, Mumbai, for Rs 875 crore. The company has invested Rs 289.59 crore in PCPPL through a subscription-to-rights issue. There is no change in the shareholding percentage of the company in PCPPL after the said investment.

Indiabulls Housing Finance: Mathew Cyriac, the former private equity co-head in Blackstone India, picked up an additional 24.99 lakh equity shares, or 0.52 percent of paid-up equity, in the housing finance company at an average price of Rs 213.57 per share. High-net-worth individuals already held 1 percent shares in Indiabulls Housing as of September 2023.

Electro Force (India): The company will list its equity shares on the NSE Emerge on December 27. The equity shares will be available for trading in the trade-for-trade segment. The offer price is Rs. 93 per share.

Zed Learn: The petition under Section 7 of the Insolvency and Bankruptcy Code has been filed by Axis Bank before the National Company Law Tribunal, Mumbai, to initiate the Corporate Insolvency Resolution Process (CIRP) of Zed Learn. The company has received notice of the said case from NCLT. The company is compiling information to verify the facts claimed in said petition.

Shanti Spintex: The equity shares of the company will be listed on the BSE in the list of 'MT' Group of securities. The scrip will be in the trade-for-trade segment for 10 trading days. The issue price is Rs 70 per share.

Lumax Auto Technologies: Foreign portfolio investor Asia Investment Corporation Mauritius exited Lumax Auto by selling its entire shareholding of 28,11,262 equity shares via open market transactions at an average price of Rs 386 per share, which amounted to Rs 108.5 crore. However, Gryphon Growth Fund VCC was the buyer of all those shares.

Vishnu Prakash R. Punglia: The company has received a letter of award from the government of Uttarakhand for two projects worth Rs 899 crore. Vishnu Prakash will develop a water supply system with 18 years of operation and maintenance (O&M) in Haldwani and Kotdwar, Uttarakhand.

UGRO Capital: The company said a meeting of the Investment and Borrowing Committee is scheduled to be held on December 29 to consider raising funds by way of the issuance of non-convertible debentures through public issue.

Valiant Laboratories and Global Surfaces: Vikasa India EIF I Fund: Incube Global Opportunities bought 2.82 lakh shares in Valiant at an average price of Rs 176.64 per share. The fund also picked 2.75 lakh shares in Global Surfaces at an average price of Rs 181.23 per share.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment