Stock to Watch Today - Rupeedesk Reports - 21.12.2023

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

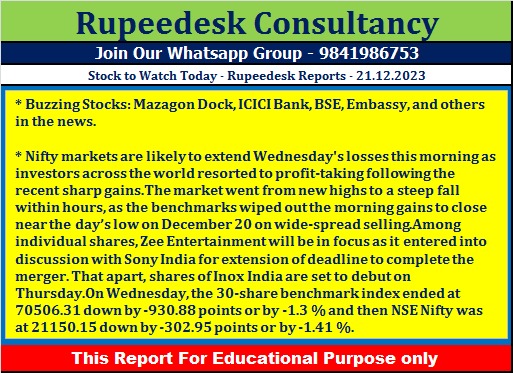

Buzzing Stocks: Mazagon Dock, ICICI Bank, BSE, Embassy, and others in the news.

Mazagon Dock Shipbuilders: The state-owned shipbuilding company has signed a contract worth Rs 1,600 crore with the Acquisition Wing of the Ministry of Defence for the construction and delivery of six next-generation offshore patrol vessels (NGOPVs) for the Indian Coast Guard (ICG).

BSE: The SEBI has granted its approval for the appointment of Pramod Agrawal as Chairman of the Governing Board of the stock exchange, with effect from January 17, 2024. S. S. Mundra, Chairman and Public Interest Director, will be ending his term on January 16, 2024.

Inox India (INOXCVA): The cryogenic tank manufacturing company is set to list its equity shares on the BSE and NSE. The final issue price has been fixed at Rs. 660 per share. Analysts expect the listing premium to be in the range of 75–80 percent over the issue price.

UltraTech Cement: The country's largest cement company, has entered into a Share Subscription and Shareholders Agreement to acquire 26 percent of the equity shares of Clean Max Terra for Rs 20.25 crore. Clean Max Terra is engaged in the generation and transmission of renewable energy. The acquisition is to meet the company’s green energy needs, optimising energy costs, and comply with regulatory requirements for captive power consumption under electricity laws.

ICICI Bank: The Reserve Bank of India has approved the re-appointment of Sandeep Batra as Executive Director of the bank with effect from December 23, 2023, to December 22, 2025. This renewed term of two years is within the five-year term as previously approved by the shareholders.

Cochin Shipyard: The public sector undertaking company has signed a contract worth Rs 488.25 crore with the Ministry of Defence (MoD). The work package includes the repair and maintenance of the equipment and systems onboard the naval vessel. The work on the same has already commenced during Q2 FY24 based on the Approval of Necessity (AoN) from MoD and is expected to be completed by Q1 FY25.

Karur Vysya Bank: Rajesh E. T., the current Chief of Internal Vigilance, has been transferred to the Inspection and Audit Department to manage and develop the department's software applications, effective January 3, 2024. Hence, Ajin Raj will take charge as Chief of Internal Vigilance of the bank, effective January 3, 2024. Further, the bank has decided to surrender its Certificate of Registration as a merchant banker.

Embassy Office Parks REIT: Global investment firm Blackstone sold its entire 23.5 percent stake in Embassy REIT for around Rs 7,100 crore to various foreign and domestic investors for Rs 316 apiece. Around 19 crore units of the REIT were sold at an average price of Rs 316 apiece to multiple investors, including SBI Mutual Fund, ICICI Prudential MF, HDFC MF, Fidelity Funds South East Asia Fund, Capital Group, and APAC Company XXIII.

AstraZeneca Pharma India: The pharma company will launch Enhertu in January 2024 in India. It received import and market permission in Form CT-20 from the Drugs Controller General of India for Tanstuzumab deruxtecan 100 mg/5 mL vial lyophilized powder for concentrate for solution for infusion (Enhertu) in May this year. Enhertu is indicated for the treatment of adult patients with unresectable or metastatic HER2-positive breast cancer who have received a prior anti-HER2-based regimen.

Flair Writing Industries: The writing instrument manufacturing company reported a 3.2 percent sequential growth in net profit at Rs 33.2 crore for the quarter ended September FY24 and 4.2 percent quarter-on-quarter growth in revenue at Rs 257 crore. EBITDA for the quarter was Rs 53.8 crore, up 2.9 percent QoQ, but margin fell 30 basis points to 20.9 percent in Q2 FY24.

India Shelter Finance Corporation: Nippon India Mutual Fund has bought 10,10,000 equity shares in the affordable housing finance company via open market transactions for Rs 572.81 per share, and Goldman Sachs Funds - Goldman Sachs India Equity Portfolio purchased 5,91,027 equity shares for Rs 593.08 per share. BofA Securities Europe SA has net bought 5,11,016 shares in the company for Rs 595.82 per share.

Landmark Cars: Bajaj Finance sold 3.2 lakh shares in the luxury car retailer at Rs 805.58 per share, which amounted to Rs 25.77 crore.

Allcargo Logistics: The LCL (less-than-container load) volume for November 2023 was marginally down 0.35 percent as compared to November 2022 and remained flat (up 0.11 percent) as compared to October 2023. From January 2023 onwards, the volume includes ~1.5 percent contribution from the new acquisition in Germany. The demand continues to remain subdued, reflecting a tough macroeconomic environment for global trade. A major decline was witnessed across key geographies of the Americas, LATAM, and Europe, while some improvement was witnessed in APAC, led by China and India.

Nippon Life India Asset Management: IndusInd Bank sold 1,78,57,355 equity shares, or a 2.86 percent stake in the company, at Rs 445.35 per share, amounting to Rs 795.27 crore. SBI Mutual Fund purchased 32,68,590 equity shares at the same price, amounting to Rs 145.6 crore, and ICICI Prudential Mutual Fund bought 47,01,405 equity shares at the same price, amounting to Rs 209.4 crore.

Satin Creditcare Network: The microfinance institution has announced the completion of its qualified institutional placement (QIP) and raised Rs 250 crore via the allotment of 1,08,36,584 equity shares to qualified institutional buyers for Rs 230.70 per share. The issue launched on December 14 received a good response from institutional investors such as ICICI Prudential Life Insurance Company, Bandhan Mutual Fund, and Bajaj Allianz Life Insurance Company, among others, and was oversubscribed 1.9 times.

Praveg: The eco-responsible luxury resorts company has received the work order for the development, operation, maintenance, and management of at least 50 tents at Agatti Island, Union Territory of Lakshwadeep. The work order is for three years and could be extended up to another two years. With the addition of this resort, Praveg will now have nine properties in operation and 10 under development.

Shree OSFM E-Mobility: The company will list its equity shares on the NSE Emerge on December 21. The issue price is Rs 65 per share. Its equity shares will be available for trading in the trade-for-trade segment.

Benchmark Computer Solutions: The company will debut on the BSE SME on December 21. The issue price is Rs 66 per share. The stock will be in the trade-for-trade segment for 10 trading days.

Siyaram Recycling Industries: The company is going to list its equity shares on the BSE SME on December 21. The issue price is Rs. 46 per share. The stock will be in the trade-for-trade segment for 10 trading days.

Symphony: HDFC Mutual Fund Multi Cap Fund has bought 6 lakh shares in Symphony at a price of Rs 880 per share. However, Swayat Trading Co. was the seller in this deal.

Shriram Pistons & Rings: Ace investor Sunil Singhania-backed Abakkus Growth Fund-1, Abakkus Emerging Opportunities Fund-1, Abakkus Growth Fund-2, and Abakkus Asset Manager LLP purchased 29.54 lakh equity shares in the company at a price of Rs 1,103.6 per share, which amounted to Rs 326.01 crore. AL Mehwar Commercial Investments LLC (NOOSA) bought 4,36,030 shares at the same price, but K S Kolbenschmidt GMBH sold 39 lakh equity shares in the company at the same price, amounting to Rs 430.4 crore.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment