Stock to Watch Today - Rupeedesk Reports - 07.11.2023

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

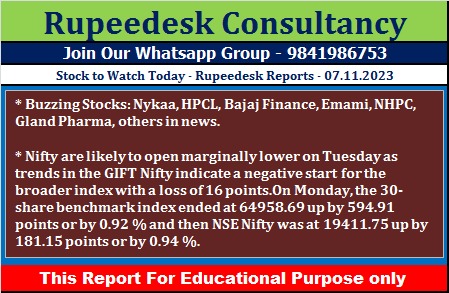

Buzzing Stocks: Nykaa, HPCL, Bajaj Finance, Emami, NHPC, Gland Pharma, others in news.

FSN E-Commerce Ventures: The Nykaa operator has recorded consolidated profit of Rs 5.85 crore for the quarter ended September FY24, growing 42.3 percent over the last year, driven by healthy operating and topline performance. Consolidated revenue from operations grew by 22.4 percent YoY to Rs 1,507 crore despite the festive season witnessing a delay this year, moving into October versus commencing in September last year. EBITDA increased by 32 percent to Rs 80.6 crore, and margin expanded by 38 bps to 5.4 percent compared to the corresponding period last fiscal on both direct and indirect cost efficiencies.

Bajaj Finance: The leading non-banking finance company has launched a qualified institutions placement (QIP) on November 6 for fund raising. The floor price has been fixed at Rs. 7,533.81 per share. The firm may offer a discount of up to 5 percent on the floor price. The fund raised from the QIP issue may be around Rs 8,800 crore, reports CNBC-TV18, quoting sources.

Gland Pharma: The pharma company recorded consolidated profit of Rs 194.1 crore for the July–September period of FY24, falling 20 percent despite a healthy topline, impacted by weak EBITDA margin performance. Consolidated revenue increased 32 percent YoY to Rs 1,373.4 crore in Q2 FY24.

Hindustan Petroleum Corporation: The oil marketing company has registered a 17.5 percent sequential decline in standalone profit at Rs 5,118.2 crore for the July–September period of FY24, dented by a lower topline. Standalone revenue from operations dropped 14.5 percent quarter-on-quarter to Rs 95,701 crore, and EBITDA declined 14.9 percent to Rs 8,217 crore in Q2 FY24.

Emami: The FMCG company has registered a 3.1 percent on-year fall in consolidated profit at Rs 178.5 crore for the quarter ended September FY24, despite healthy operating performance, dented by lower other income. Consolidated revenue from operations increased by 6 percent YoY to Rs 864.5 crore in Q2 FY24, with domestic business growing 4 percent and international business growth at 12 percent. EBITDA jumped 20 percent year over year to Rs 234 crore, and margin expanded by 300 basis points to 27 percent during the quarter.

Ujjivan Financial Services: The non-banking finance company recorded consolidated profit of Rs 225.8 crore for the quarter ended September FY24, falling 12 percent compared to the year-ago period, impacted by impairments on financial instruments. Revenue from operations grew by 44 percent YoY to Rs 1,496.2 crore during the quarter.

NHPC: The state-owned power generation company has recorded consolidated profit of Rs 1,546 crore for the July–September period of FY24, rising 0.7 percent over the year-ago period despite lower topline and operating performance, supported by a tax write-back. Consolidated revenue from operations increased by 11.6 percent YoY to Rs 2,931.3 crore during the quarter. Meanwhile, the company said the board has approved the Joint Venture Agreement for the formation of a joint venture company between NHPC and Andhra Pradesh Power Generation Corporation.

Bank of India: Rajesh Sadashiv Ingle has been elevated to the post of Chief General Manager of the Bank of India, with effect from November 6. Rajesh Sadashiv Ingle was the general manager of the bank.

Gujarat State Petronet: The gas transmission company has reported consolidated profit of Rs 590.4 crore for the quarter ended September FY24, growing 36 percent QoQ, driven by strong operating performance. Revenue from operations grew by 3.8 percent sequentially to Rs 4,265.2 crore for the quarter.

Redington: The technology solutions provider has recorded consolidated profit of Rs 311.6 crore for the quarter ended September FY24, falling 20.5 percent compared to the corresponding period last fiscal despite a healthy topline impacted by weak operating performance. Revenue from operations grew by 16.6 percent YoY to Rs 22,220 crore in Q2 FY24.

Central Bank of India: The Government of India has extended the term of office of M. V. Rao as Managing Director and CEO of the Central Bank of India till July 31, 2025. His current term will expire on February 29, 2024.

Honasa Consumer: The beauty and personal care products brand Mamaearth Parent is set to debut on the bourses on November 7. The final issue price has been fixed at Rs. 324 per share.

Maitreya Medicare: The Gujarat-based multispeciality hospital will list its shares on the NSE Emerge on November 7. The final issue price has been set at Rs. 82 per share. Its equity shares will be available for trading in the trade-for-trade segment.

Mish Designs: The company will make its debut on the BSE SME on November 7. The issue price is Rs. 122 per share. The stock will be available for trading in the trade-for-trade segment for 10 days.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment