Stock to Watch Today - Rupeedesk Reports - 04.10.2023

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

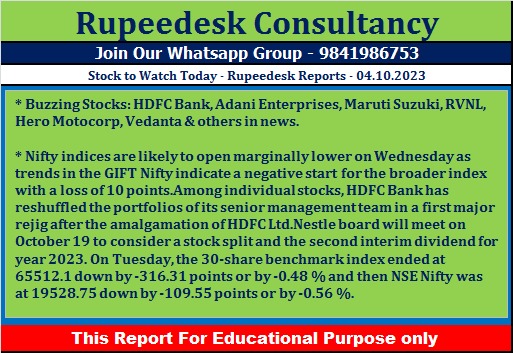

Buzzing Stocks: HDFC Bank, Adani Enterprises, Maruti Suzuki, RVNL, Hero Motocorp, Vedanta & others in news.

HDFC Bank: CNBC TV18 reported changes in leadership roles held in the HDFC Bank as Arvind Kapil, the Group Head, will now spearhead the mortgage business, while Arvind Vohra has moved on as the Group Head of retail assets. Parag Rao, Group Head, will be additionally responsible for marketing and liability product group, while Smita Bhagat & Sampath Kumar will be the two new retail branch banking heads. Ramesh Lakshminarayanan, currently the CIO, would lead the IT & digital function, while Rakesh Singh, the Group Head, would spearhead the creation of banking as a service (BaaS).

Adani Enterprises: Green Vitality RSC, the 100-percent subsidiary of Abu Dhabi's International Holding Company (IHC), has bought 6.43 lakh shares, which is equivalent to 0.06 percent of paid-up equity, in Adani Enterprises via open market transactions on October 3. With this, IHC's shareholding in the company has increased from to 5.04 percent, up from 4.98 percent.

Rail Vikas Nigam Limited: RVNL emerged as the lowest bidder for the development of distribution infrastructure at north zone of Himachal Pradesh under the the Revamped Reformsbased and Results-linked, Distribution Sector Scheme (loss reduction works). This project from Himachal Pradesh State Electricity Board is worth Rs 444.26 crore and is expected to be completed within 24 months.

Life Insurance Corporation of India: The life insurance major has received an order from the Income Tax Authority, demanding a penalty of Rs 84.02 crore. The Corporation has received notice for the assessment years 2012-13, 2018-19 & 2019-20.

APL Apollo Tubes: The structural steel tube company has reported sales volume at 6,74,761 tonnes in Q2FY24, growing 12 percent from over a year-ago period. This is the highest quarterly sales volume reported by the company. For H1FY24, the company reported sales volume of 13,36,262 tonnes, an increase of 30 percent YoY.

Maruti Suzuki India: The country's largest car manufacturing company has received draft Assessment Order for FY20. In the said order, certain additions or disallowances amounting to Rs 2,159.7 crore with respect to returned income (the income disclosed by the company in its income tax return) have been proposed. The company will file its objections before the Dispute Resolution Panel. There is no impact on financial, operational or any other activities of the company due to this draft Assessment Order. Meanwhile, its total production for September 2023 at 1.75 lakh units fell 1.4 percent compared to the 1.77 lakh units produced in the same month last year.

Avenue Supermarts: The D-Mart operator has reported standalone revenue from operations at Rs 12,308 crore for the quarter ended September FY24, up 18.5 percent over Rs 10,385 crore in same period last year. The total number of stores as of September 2023 stood at 336.

Zensar Technologies: Samir Gosavi has resigned as Senior Vice President of the company with effect from October 20, 2023, to pursue opportunities outside the organisation. Samir Gosavi is an employee of the subsidiary Zensar Technologies Inc. USA.

Hero MotoCorp: The world's largest two-wheeler maker is set to commence deliveries of its first co-developed premium motorcycle Harley-Davidson X440 on October 15. It has been organising test rides for pre-booked customers since September 1, and the new booking window will open from October 16.

Titagarh Rail Systems: The company has signed a contract worth Rs 857 crore with the Gujarat Metro Rail Corporation. The company will manufacture 72 numbers of standard gauge cars for the first phase of Surat Metro Rail. The execution of the contract is slated to commence 76 weeks after the signing of the contract and is expected to be completed in 132 weeks thereafter.

Bank of Maharashtra: The public sector lender has announced deposit growth of 22.2 percent year-on-year at Rs 2.39 lakh crore for the quarter ended September FY24, while gross advance grew by 23.55 percent YoY to Rs 1.83 lakh crore during the same period.

Bajaj Finserv: Bajaj Allianz General Insurance Company (BAGIC), an unlisted material subsidiary of the company, has received a show cause cum demand notice from the Directorate General of GST Intelligence, Pune, alleging a tax demand of Rs 1,010 crore. The alleged demand and the impugned show cause cum demand notice pertains to non-payment of GST on the co-insurance premium accepted as follower in case of coinsurance transactions and non-payment of GST on re-insurance commission accepted on the reinsurance premium ceded to various Indian and Foreign reinsurance companies during the period July 2017 to March 2022.

Vedanta: The company has announced total aluminium production at 594 kt for the quarter ended September FY24, up 2 percent, but mined metal production was down by 1 percent to 252 kt YoY. Overall power sales grew by 12 percent to 4,048 million units.

VST Tillers Tractors: The company has set up a joint venture VST ZETOR in collaboration with HTC Investments. The joint venture company will be initially launching three tractors in the 40-50 HP range. These products are jointly developed by VST and ZETOR after taking valuable feedback from the farming community in India for almost 1 year.

Trident: The company has commissioned their new rooftop solar power project of 9.50 MWp capacity at Budhni, Madhya Pradesh. The power generated from this new solar power project will be consumed captively for manufacturing facilities at Budhni, Madhya Pradesh, resulting in considerable reduction of the carbon footprint.

Pidilite Industries: Subsidiary Pidilite MEA Chemicals LLC and Spain's Corporacion Empresarial Grupo Puma SL have incorporated a joint venture company in the UAE namely PidilitePuma MEA Chemicals LLC. The joint venture company will carry on the business of manufacturing construction chemicals. Pidilite MEA and Grupo Puma, Spain will hold 50 percent shareholding each in the joint venture company.

Oracle Financial Services Software: The board members have approved the appointment of Makarand Padalkar as the Managing Director and Chief Executive Officer of the company, Avadhut Ketkar as Chief Financial Officer, and Gopala Ramanan Balasubramaniam as an Additional Director of the company, with effect from October 5.

Virinchi: The company has reappointed M V Srinivasa Rao as Wholetime Director and CFO for five years with effect from November 12, 2023 to November 11, 2028.

Yes Bank: The private sector lender has reported deposits growth of 17.2 percent YoY and 6.8 percent QoQ at Rs 2.34 lakh crore, while its advances increased by 9.5 percent YoY and 5.2 percent QoQ to Rs 2.10 lakh crore.

V-Mart Retail: The company has announced total revenue of Rs 549 crore for the quarter ended September FY24, up 8% compared to Rs 506 crore in the corresponding period last year, due to the shift in the Hindu calendar that has seen the festive sales period (leading to Durga Puja, Dusshehra) moving from Q2 to Q3 in the current year.

Sudal Industries: Shareholders have approved the re-appointment of Sudarshan Chokhani as a Managing Director for three years with effect from September 1, 2023 to August 31, 2026, liable to retirement by rotation.

UPL: UPL Corporation Limited, Mauritius has incorporated a subsidiary UPL Lanka Bio in Sri Lanka, with effect from October 2. UPL Lanka Bio is a wholly owned subsidiary of UPL Corporation, Mauritius and a step-down subsidiary of UPL.

TeamLease Services: Sumit Sabharwal has resigned as Chief Executive Officer – HRTech of the company with effect from October 3.

Satin Creditcare Network: The company said the Board of Directors of the company will be meeting on October 6 to consider raising funds via issuance of non-convertible debentures on private placement.

Sasken Technologies: The company has announced collaboration with Qualcomm Technologies, Inc., a pioneer in wireless technologies, through the Qualcomm IoT Accelerator Program. This collaboration marks a significant milestone in the realm of Internet of Things (IoT) innovation and underscores both companies' commitment to shaping the future of connected devices and services.

ADF Foods: Balark Banerjea has been appointed as President – Indian Domestic Business in the category of senior management personnel of the company, with effect from October 3.

Varroc Engineering: Subsidiary Varroc Polymers (VPL) has entered into a power purchase agreement with AMP Energy C&I Six & AMP Energy C&I Five (special purpose vehicles - SPVs), for establishing renewable power plants in Karnataka and Tamil Nadu. These plants would be having the captive capacity of 30 MWp and 21 MWp respectively, under the captive power scheme. The subsidiary is in the process of acquiring 1 percent and 3 percent stake in the said SPVs, for Rs 40 lakh and Rs 80 lakh, respectively.

South Indian Bank: The private sector lender has reported gross advances at Rs 74,975 crore for the quarter ended September FY24, up 10.3 percent over a year-ago period, and total deposit increased by 9.8 percent to Rs 97,146 crore during the same period, as per provisional data. CASA grew by 2.01 percent YoY to Rs 31,162 crore in Q2FY24.

Updater Services: The facility management services company will list its equity shares on the BSE and NSE, in the T+3 timeline, on October 4. The issue price has been fixed at Rs 300 per share. The allotment date for the company was September 30.

Raymond: The company said board members have approved investment of up to Rs 301 crore in one or more tranches in Ten X Realty, a step down wholly owned subsidiary of the company. Out of the said investment, the company will invest up to Rs 125 crore in the form of redeemable preference shares, and the balance amount of Rs 176 crore will be invested by providing inter corporate deposit (ICD) to Ten X Realty.

Digikore Studios: The visual effects services firm is set to debut on the NSE Emerge on October 4. The offer price is Rs 171 per share. Its equity shares will be available for trading in trade-for-trade segment.

Subex: Shiva Shankar Naga Roddam has resigned as the Chief Operating Officer of the company due to personal reasons. He will be relieved from his duties on December 31, 2023.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment