Stock to Watch Today - Rupeedesk Reports - 19.10.2023

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

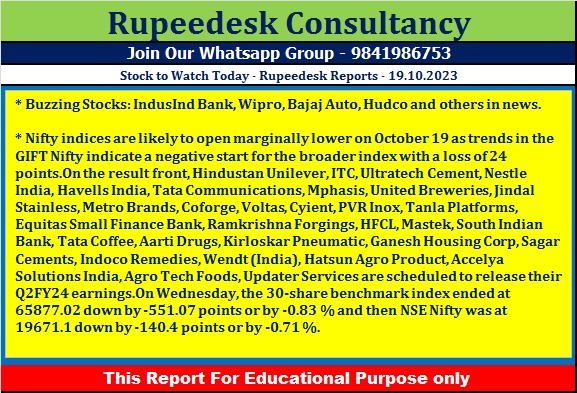

Buzzing Stocks: IndusInd Bank, Wipro, Bajaj Auto, Hudco and others in news.

Wipro: The technology services and consulting company has recorded revenue from operations at Rs 22,395.8 crore for the quarter ended September FY24, falling 1.6 percent sequentially, with the dollar revenue falling 2.3 percent QoQ to $2,713.3 million and revenue in constant currency declining 2 percent during the same period. IT services EBIT margin increased by 10 bps QoQ to 16.1 percent for the quarter. The company expects revenue from the IT services business segment to be in the range of $2,617–2,672 million, falling 3.5–1.5 percent in constant currency terms. Meanwhile, the firm has announced the merger of its five subsidiaries with itself.

Results on October 19: Hindustan Unilever, ITC, Nestle India, UltraTech Cement, Voltas, Coforge, Cyient, PVR Inox, Aarti Drugs, Agro Tech Foods, Equitas Small Finance Bank, Hatsun Agro Product, Havells India, HFCL, Indoco Remedies, Jindal Stainless, Mastek, Metro Brands, Mphasis, Ramkrishna Forgings, South Indian Bank, Tanla Platforms, Tata Coffee, Tata Communications, United Breweries, and Updater Services will be in focus ahead of quarterly earnings on October 19.

Bajaj Auto: The Pune-based automobile company has reported standalone profit at Rs 1,836.1 crore for the quarter ended September FY24, growing 20 percent over a year-ago period, with better-than-expected operating numbers. Standalone revenue from operations increased by 5.6 percent year-on-year to Rs 10,777.3 crore, supported by double-digit volume growth, with the sustained buoyancy on the domestic front cushioning the weak, albeit improving export performance. Sales volume dropped 8.7 percent year over year to 10.5 lakh units during the quarter. The quarterly EBITDA surpassed the Rs 2,000-crore milestone for the first time, growing 21 percent YoY to Rs 2,133 crore, with a margin expansion of 260 bps YoY at 19.8 percent in Q2 FY24. The company said the board had adopted a revised dividend distribution policy.

IndusInd Bank: The private sector lender has recorded standalone profit at Rs 2,181.5 crore for the quarter ended September FY24, growing 22.09 percent YoY, with a fall in provisions and stable asset quality. Net interest income grew by 18 percent YoY to Rs 5,076.7 crore during the same period, while net interest margin remained flat at 4.29 percent QoQ but grew 5 bps YoY.

Housing & Urban Development Corporation: The Government of India has decided to exercise the oversubscription option and will sell additional 3.5 percent stake or 7 crore equity shares in the offer-for-sale on October 19, in addition to the base issue size of 3.5 percent or 7 crore shares, as the OFS has received a good response from non-retail investors on October 18 and was subscribed nearly twice the base size. The OFS will open for retail investors on October 19.

LTIMindtree: The IT services company has registered slightly better than expected earnings for the July-September period of FY24, with profit rising 0.9 percent QoQ to Rs 1,161.8 crore and revenue increasing 2.3 percent to Rs 8,905.4 crore. Revenue in dollar terms grew by 1.6 percent QoQ to $1,075.5 million, and the same in constant currency increased by 1.7 percent during the same period. The EBIT margin dropped 70 bps sequentially to 16 percent for Q2 FY24. The company has declared an interim dividend of Rs. 20 per share.

Persistent Systems: The Pune-based technology services company has reported profit at Rs 263.3 crore for the quarter ended September FY24, growing 15.1 percent sequentially, with revenue rising 3.9 percent to Rs 2,411.7 crore for the quarter. Revenue in dollar terms increased by 3.1 percent QoQ to $291.7 million, and topline in constant currency terms grew by 3.2 percent, coming in better than analysts' estimates.

Bandhan Bank: The Kolkata-based private sector lender recorded profit at Rs 721.2 crore for the July–September period of FY24, increasing 245 percent YoY due to a sharp fall in provisions, but asset quality weakened. Net interest income for the quarter at Rs 2,443.4 crore increased by 11.4 percent YoY, with loan growth at 12.3 percent and deposits rising 12.8 percent. Meanwhile, the bank said the board has approved the appointment of Abhijit Ghosh, who is currently head of finance and accounts, as the interim CFO, with effect from October 20 until a new CFO is appointed.

Mastek: The digital engineering and cloud transformation company has received a three-year contract from the UK’s Government Digital Service (GDS). The three-year contract is valued at 8.5 million pounds, with options available to extend to a total of five years. The company, in collaboration with UK GDS, will design, build, and operate the GOV.UK One Login Technical Service Desk (TSD).

VA Tech Wabag: Pankaj Malhan has resigned as Deputy Managing Director and Group CEO (key managerial personnel) of the company due to personal reasons. He will be relieved from the services of the company with effect from October 30.

Trident: The Income Tax Department is conducting a search at premises and plants of the company, since October 17. The entire IT assets of all the senior officials including the undersigned are under the control of Income Tax Department, for scrutiny. The officials of the company are fully cooperating with the Income Tax Department and are responding to the queries raised by them.

Maruti Suzuki India: The country's largest car manufacturing company has received a favourable order from CESTAT (Customs, Excise and Service Tax Appellate Tribunal), Chandigarh. The appeals filed by the company for period April 2006 to March 2012 have been allowed. The said appeals were filed by the company against the order of the Commissioner-Central Excise dated August 3, 2012. The total tax and penalty amount involved is Rs 3.8 million and the CESTAT has deleted the said demand.

RITES: The state-run engineering services company has signed Memorandum of Understanding (MoU) with INTECSA-INARSA, S.A.U, a company incorporated in Spain, to achieve the effectiveness of synergy and co-operation on a long term basis. They will explore business interests in relation to the development and execution of projects in Republic of Guyana and Republic of Colombia.

Alkyl Amines Chemicals: The company has commenced commercial production in the newly set up plant at its existing Kurkumbh site. The new plant will enhance company's manufacturing capacity of Ethyl Amines.

Power Mech Projects: The company said the board of directors have approved the opening of QIP (qualified institutions placement) issue on October 18 for raising of funds via issue of equity shares. The floor price has also been approved at Rs 4,085.44 per share. The said issue will be close on October 23.

Lemon Tree Hotels: The hotel chain has signed a License Agreement for its 72 rooms property in Badrinath, Uttarakhand. The hotel is expected to be operational by FY25. Subsidiary Carnation Hotels will be operating this hotel.

Welspun Corp: The pipe solutions company has received a contract for export of LSAW pipes and bends to the Middle East which will be executed from its facilities in Anjar, India. The contract is for supply of approximately 61,000 MT bare pipes and bends which will be used for offshore production and transport of gas. With this order, it has cumulatively received total orders of 1,91,000 MT of line pipes, to be executed from India and USA facilities.

ICICI Lombard General Insurance Company: The general insurance company has recorded profit at Rs 577.3 crore for the quarter ended September FY24, falling 2.2% compared to year-ago period. Excluding one time impact of reversal of tax provision in Q2FY23, profit grew by 24.8% in Q2FY24. Gross direct premium income of the company was at Rs 6,086 crore during the quarter, up 17.4% YoY. Gross premium written grew by 18.3% YoY to Rs 6,272.32 crore in Q2FY24. Underwriting loss at Rs 146 crore for the quarter narrowed from loss of Rs 152.3 crore YoY, while operating profit increased by 17% YoY to Rs 597.15 crore during the same period. The company has announced an interim dividend of Rs 5 per share.

Shoppers Stop: The retail chain has reported consolidated profit at Rs 2.73 crore for July-September period FY24, declining sharply by 83.1% YoY due to lower operating margin and higher exceptional loss with tepid topline growth. Revenue from operations for the quarter grew by 2.6% on-year to Rs 1,039.1 crore.

Astral: The CPVC pipes & fittings manufacturing company has registered a massive 90% on-year growth in consolidated profit at Rs 131.2 crore for the quarter ended September FY24, driven by robust operating performance. Revenue from operations grew by 16.3% year-on-year to Rs 1,363 crore for the quarter.

RPG Life Sciences: The pharmaceutical products manufacturing company has registered a 29.5% on-year growth in profit at Rs 25.86 crore for quarter ended September FY24, driven by healthy topline and operating performance. Revenue for the quarter at Rs 153.58 crore increased by 14% over a year-ago period.

Titagarh Rail Systems: The company has recorded consolidated profit at Rs 70.6 crore for July-September period FY24, growing 46.4% over the corresponding period last fiscal, with revenue from operations rising 54% YoY to Rs 935.5 crore.

Bharat Agri Fert & Realty: The company will launch the soft booking for its construction project Wembley in Thane, Maharashtra, on Dussehra, on October 24.

Bajaj Healthcare: The APIs, intermediates and formulations manufacturer has commissioned Alkaloid extraction plant in Vadodara, Gujarat. The existing capacity for extracting Alkaloid from poppy gum was 100 metric tons per annum, which now extended to 300 metric tons per annum.

Gujarat Pipavav Port: Wisdomtree India Investment Portfolio Inc has bought 24.71 lakh shares, which is equivalent to 0.51% of paid-up equity, in the company, at an average price of Rs 138.23 per share.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment