Stock to Watch Today - Rupeedesk Reports - 16.10.2023

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

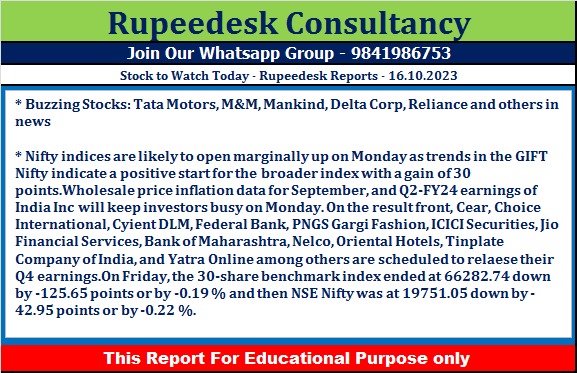

Buzzing Stocks: Tata Motors, M&M, Mankind, Delta Corp, Reliance and others in news

Tata Motors: The automobile major has entered into share-purchase agreements with certain investors for the sale of a 9.9% stake in its subsidiary Tata Technologies for Rs 1,613.7 crore. TPG Rise Climate SF Pte Ltd., a climate-focused private equity fund, is buying a 9 percent stake in Tata Technologies, and Ratan Tata Endowment Foundation is acquiring a 0.9 percent stake in Tata Motors. The transaction will be completed by October 27. Meanwhile, Mitsuhiko Yamashita will cease to be a non-executive, non- director of Tata Motors, from October 27.

Mahindra & Mahindra: The utility and commercial vehicle maker has announced total production of 79,410 units for September, growing 21.9 percent over the year-ago period. Sales during the month increased by 18.1 percent YoY to 73,185 units, but exports declined 4.7 percent to 2,419 units in the same period.

Reliance Industries: Reliance Retail Ventures has received the subscription amount of Rs 4,966.80 crore from Platinum Owl C 2018 RSC Limited (acting in its capacity as the trustee of Platinum Jasmine A 2018 Trust) and allotted 4,11,81,006 equity shares to ADIA. ADIA is the sole beneficiary and settlor of the Platinum Jasmine Trust.

Adani Enterprises: The Ministry of Corporate Affairs, Hyderabad, has initiated an investigation of the books of accounts and other books and papers of Mumbai International Airport (MIAL) and Navi Mumbai International Airport (NMIAL), step-down subsidiaries of Adani Enterprises. The Ministry of Corporate Affairs sought information and documents pertaining to the prior period, starting from 2017–18 to 2021–22. Adani Enterprises completed acquisitions of MIAL and NMIAL during the financial year 2021–22.

Avenue Supermarts: The Mumbai-based company, which owns and operates D-Mart stores, has recorded a 9.2 percent on-year decline in consolidated profit at Rs 623 crore for the quarter ended September FY24, impacted by a lower margin and a high base. In Q2 FY23, the profit was supported by lower tax costs. Revenue from operations grew by 18.67 percent year-on-year to Rs 12,624 crore, while EBITDA increased by 12.67 percent to Rs 1,005 crore, but margin dropped 40 basis points to 8 percent during the same period due to a lesser contribution from the higher margin general merchandise and apparel business.

Delta Corp.: Deltatech Gaming, a subsidiary of the casino gaming company, has received an intimation for payment of shortfall tax under the CGST Act and West Bengal GST Act from the Directorate General of GST Intelligence, Kolkata. The amount of the alleged tax shortfall is Rs 6,236.81 crore for the period between January 2018 and November 2022 and Rs 147.51 crore for the July 2017 to October 2022 period.

NHPC: The Teesta-V power station of the company in Sikkim, with a 510 MW capacity, was affected by a flash flood in the Teesta Basin on October 4. The expected quantum of loss or damage caused by the natural calamity is Rs 788 crore, wherein the material damage is Rs 297 crore and the business loss is Rs 491 crore. The assets and business interruption loss of the power station are fully insured under the megainsurance policy.

Godrej Properties: Subsidiary Godrej Redevelopers (Mumbai) Private Limited (GRMPL) has received an order from the Additional Commissioner, CGST and Central Excise, Navi Mumbai, for a GST demand of Rs 48.31 crore along with interest and a penalty of Rs 48.31 crore under the Central Goods and Services Tax Act. They alleged non-payment of GST in relation to one of the projects developed by GRMPL in Mumbai.

Indian Bank: The public sector lender has declared non-performing assets (NPAs) worth Rs 24.76 crore, including Rs 16.20 crore from Samsarapu Polaraju, Samsarapu Narasimha Raju, and Maheswari Constructions & Engineering Works, which have submitted fake documents and done diversion of funds. Further, the bank reported NPAs worth Rs 8.56 crore from S V Exports due to diversion of funds.

Godrej Properties: Subsidiary Godrej Redevelopers (Mumbai) Private Limited (GRMPL) has received an order from the Additional Commissioner, CGST and Central Excise, Navi Mumbai, for a GST demand of Rs 48.31 crore along with interest and a penalty of Rs 48.31 crore under the Central Goods and Services Tax Act. They alleged non-payment of GST in relation to one of the projects developed by GRMPL in Mumbai.

Mankind Pharma: The Sikkim manufacturing facility of the pharma company has resumed operations as usual with effect from October 13. Operations at the said manufacturing facility were disrupted due to a disturbance in power supply because of flash floods.

Tata Steel Long Products: The Tata Group company's net loss for the quarter ended September FY24 narrowed to Rs 135.8 crore from Rs 333.4 crore in the year-ago period despite a lower topline, aided by lower input costs. Revenue from operations fell 9.4 percent YoY to Rs 1,734 crore during the quarter.

Bajaj Finance: The Reserve Bank of India has imposed a monetary penalty of Rs 8.50 lakh on Bajaj Finance for non-compliance with the'monitoring of frauds in NBFCs directions.

Persistent Systems: The Pune-based IT services firm has appointed Ayon Banerjee as the Chief Strategy and Growth Officer, with effect from October 13.

Union Bank of India: The Reserve Bank of India has imposed a monetary penalty of Rs 1 crore on Union Bank of India for non-compliance with directions related to loans and advances—statutory and other restrictions.

Dalmia Bharat: The cement manufacturing company recorded consolidated profit of Rs 124 crore for the quarter ended September FY24, growing 121.4 percent over the year-ago period, driven by healthy operating numbers with a fall in power and fuel expenses. Revenue from operations for the quarter grew by 6 percent year-on-year to Rs 3,149 crore. Cement volume increased 6.6 percent YoY to 6.2 million metric tonnes, which was in line with estimates. Further, the subsidiary has received board approval to increase cement grinding capacity by 0.5 million metric tonnes at Rohtas Cement Works, Bihar, at a cost of Rs 91 crore, which is expected to be completed in FY25.

NBCC (India): The construction company has received a work order worth Rs 80 crore from the Visakhapatnam Port Authority. The work order includes the renovation and refurbishment of an office building at Visakhapatnam Port Authority.

Bajaj Electricals: The company has received a supply of services contract worth Rs 564.2 crore from Power Grid Corporation of India for and on behalf of its SPV (special purpose vehicle), Ananthpuram Kurnool Transmission.

Super Spinning Mills: The company said the board members have appointed Padmavathy P as Chief Financial Officer of the company, with effect from October 13. Padmavathy has been associated with the company for 23 years and has done various finance roles in the company.

Transformers and Rectifiers: Amarendra Kumar Gupta has resigned as Chief Financial Officer of the company with effect from October 14 due to personal reasons. The company is in the process of appointing a new Chief Financial Officer.

RBL Bank: The Reserve Bank of India has imposed a monetary penalty of Rs 64 lakh on RBL Bank for non-compliance with certain directions.

Laurus Labs: Its associate company Immunoadoptive Cell Therapy (ImmunoACT) has received the approval of India’s first CAR-T cell therapy, NexCAR19 (Actalycabtagene autoleucel), from the Central Drugs Standard Control Organisation (CDSCO). NexCAR19 is used for the treatment of r/r B-cell lymphomas and leukaemia.

Intellect Design Arena: The financial technology company has signed a digital transformation programme with a universal bank in the Philippines. This is the largest bank-wide transformation programme in Asia.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment