Stock to Watch Today - Rupeedesk Reports - 11.10.2023

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

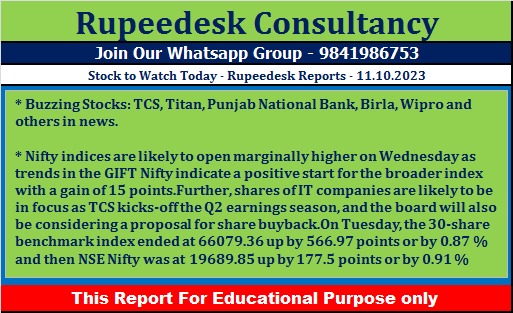

Buzzing Stocks: TCS, Titan, Punjab National Bank, Birla, Wipro and others in news.

Tata Consultancy Services (TCS): The stock will be in focus as the company is scheduled to announce its September quarter earnings on October 11. Delta Corp, Samhi Hotels, Signature Global (India), Zaggle Prepaid Ocean Services, Dipna Pharmachem, Justride Enterprises, National Standard (India), Plastiblends India, and Sanathnagar Enterprises will also release quarterly earnings scorecards on the same day.

Bank of Baroda: The Reserve Bank of India has directed Bank of Baroda to suspend, with immediate effect, any further onboarding of their customers onto the ‘bob World’ mobile application. This action is based on certain material supervisory concerns observed in the manner of onboarding their customers onto this mobile application. Any further onboarding of customers of the bank on the ‘bob World’ application will be subject to rectification of the deficiencies observed and strengthening of the related processes by the bank to the satisfaction of RBI. The bank has been further directed to ensure that already onboarded ‘bob World’ customers do not face any disruption on account of this suspension.

Wipro: The leading IT services company completed its subscription to the equity share capital of FPEL on October 10 for Rs 6.3 crore. On September 1, the company signed a definitive agreement to subscribe to a 9.5% stake in FPEL Ujwal, which is engaged in the business of developing, building, and managing a portfolio of solar power assets. The transaction is expected to be completed by May 31, 2024.

Titan Company: The jewellery-to-watch-to-eyewear maker said its board of directors will meet on October 17 to consider the issuance of non-convertible debentures on a private placement basis, within the permissible borrowing limits.

Punjab National Bank: V Sundaresan has taken charge of the Credit Review and Monitoring Division in the bank, with effect from October 10. Sundaresan was the chief general manager of the bank.

Birla Corporation: The flagship company of the MP Birla Group has received an order from the Office of Collector (Mining), Satna, Madhya Pradesh, imposing a penalty of Rs 8.43 crore for excess production of limestone from captive mining for the period from 2000-01 to 2006-07, without obtaining environment clearance. The company did not take environmental clearance due to the ambiguity in the provisions of EIA Notification 1994, which was only clarified subsequently by the principles laid down in the Common Cause judgement of the Supreme Court dated August 2, 2017. However, the company had valid consent to operate the mines from the State Pollution Control Board.

Union Bank of India: Sudarshana Bhat has been elevated to the post of Chief General Manager of Union Bank, with effect from October 10. Sudarshana Bhat was the general manager of the bank. Earlier, Lal Singh was the Chief General Manager of Union Bank, who has now been appointed as Executive Director of Bank of Baroda by the Central Government.

NCL Industries: The company has announced cement production for the quarter ended September FY24 at 6,59,300 metric tonnes (MT), up 9% over a year-ago period, and cement dispatches at 6,69,587 MT, up 11% YoY, while cement boards production grew by 12% YoY to 21,509 MT, and cement boards dispatches increased 9% to 20,239 MT.

Akzo Nobel India: The paint manufacturing company has received a demand order for the collection of GST along with interest and penalties from the office of the Deputy Commissioner, Karnataka GST Department. The demand order cum penalty stood at Rs 9.95 lakh. The ITC was availed of on ineligible credits pertaining to FY2017–18.

EIH Associated Hotels: Shib Sanker Mukherji has resigned from the office of Chairman and Director of the company due to personal reasons, with effect from October 10.

Goyal Salt: The raw salt refining company will list its shares on the NSE Emerge on October 11. The issue price is Rs. 38 per share. The shares will be available for trading in the trade-for-trade segment.

Sunita Tools: The company is set to debut on the BSE SME on October 11. The issue price is Rs. 145 per share. The stock will be available in the trade-for-trade segment for 10 trading days.

Fine Organic Industries: The chemical manufacturing firm has incorporated a wholly owned subsidiary company, namely Fine Organic Industries (SEZ), in India. The new subsidiary will do the business of manufacturing specialty chemical products.

Oneclick Logistics India: The logistics services and solutions provider, is set to debut on the NSE Emerge on October 11. The offer price is Rs 99 per share, and the market lot size is 1,200 shares. The shares will be available for trading in the trade-for-trade segment.

Canarys Automations: The trading in equity shares of the IT solutions company will commence on the NSE with effect from October 11. The issue price has been fixed at Rs. 31 per share. Its equity shares will be available for trading in series ST, i.e., the trade-for-trade segment.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment