Stock to Watch Today - Rupeedesk Reports - 25.09.2023

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

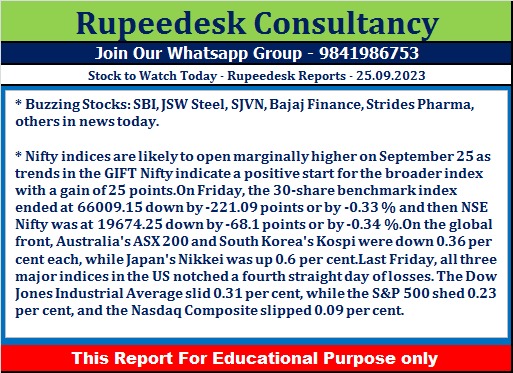

Buzzing Stocks: SBI, JSW Steel, SJVN, Bajaj Finance, Strides Pharma, others in news today.

State Bank of India: The country’s largest lender has raised Rs 10,000 crore at a coupon rate of 7.49% through its fourth infrastructure bond issuance. The investors were across provident funds, pension funds, insurance companies, mutual funds and corporates. The proceeds of bonds will be utilised in enhancing long-term resources for funding infrastructure and the affordable housing segment.

JSW Steel: The company has executed the Termination Agreement with National Steel Holding (NSHL) for termination of the joint venture agreement for establishing scrap shredding facilities in India and the Securities Purchase Agreement with NSHL to purchase NSHL's 50% stake held in NSL Green Recycling. After the transaction, NSL will become a wholly owned subsidiary of JSW Steel.

Shree Renuka Sugars: The sugar company has received the board approval for entering into binding agreements to acquire Anamika Sugar Mills for Rs 235.5 crore, to build up a presence in Uttar Pradesh. It will also infuse up to Rs 110 crore in Anamika through equity shares for redemption of 100% of outstanding cumulative redeemable preference shares (CRPS) issued by Anamika in favour of SICPA India. Also it received board approval for raising of funds up to Rs 285 crore through issue of non-convertible debentures on a private placement.

Vijaya Diagnostic Centre: Shareholders of the diagnostic chain at annual general meeting have approved the appointment of Sura Suprita Reddy, a part of promoter and promoter group, as managing director and chief executive officer of the company for five consecutive years with effect from July 1, 2023. Sura has been associated with the company since 2003, and has been heading the overall strategy, clinical excellence, operations, and expansion of the company since 2003.

Emami: The FMCG company has appointed Manish Gupta at President – sales, consumer care division, with effect from September 19. He has more than 25 years of professional experience in FMCG sales and distribution.

Wipro: Wipro Appirio, K K, a step-down subsidiary of the IT services company, has been voluntarily liquidated with effect from September 5. The completion of its liquidation reflected in the commercial registry records on September 22.

Vaibhav Global: Subsidiary Shop TJC Ltd (UK) has successfully executed an Asset Sale Agreement to acquire assets of Ideal World, a teleshopping brand in the United Kingdom. With this agreement, Shop TJC will acquire the Ideal World’s IP rights, broadcasting rights, studio equipment along with other intangible assets. The transaction will be funded through internal accruals.

Lemon Tree Hotels: The hotel chain has opened its latest franchised property - Lemon Tree Hotel, Mcleodganj. This is the third property of the group in Himachal Pradesh.

Sterling and Wilson Renewable Energy: The renewable energy company said the board of directors will hold a meeting on September 27 to consider the raising of funds via non-convertible debt instruments or equity shares. The fund raising will be either through preferential issue on a private placement basis, qualified institutions placement, or rights issue.

Kirloskar Oil Engines: Anurag Bhagania has resigned from the post of Chief Financial Officer (CFO) of the company, due to personal reasons. Anurag will cease to be CFO of the company with effect from November 22.

SJVN: The state-owned hydroelectric power generation company has received in-principle approval from the board members for monetisation of partial earnings of the Nathpa Jhakri Hydro Power Station (NJHPS) through securitisation of its future return on equity.

Suzlon Energy: State-owned REC has withdrawn its nominee, Ajay Mathur, from the board of Suzlon Energy as the financial assistance granted by the REC led consortium in terms of the rupee term loan agreement has been paid in full. Ajay Mathur has ceased to be the Nominee Director of Suzlon with effect from September 21.

IRCON International: The public sector undertaking has executed the contract agreement with Sri Lanka Railways, Sri Lanka for the work of procurement of design, installation, testing, commissioning and certifying of signalling and telecommunication system from Maho Junction to Anuradhapura, under the Indian line of credit at a price of $14.89 million (Rs 122 crore). The work will be completed by IRCON within 24 months from the date of signing of contract.

Bajaj Finance: The non-banking finance company said the board of directors will hold a meeting on October 5, to consider raising of funds through preferential issue, qualified institutions placement (QIP).

Reliance Industries: Subsidiary Reliance Retail Ventures has received the subscription amount of Rs 2,069.50 crore from Alyssum Asia Holdings II Pte Ltd (KKR) and allotted 1,71,58,752 equity shares to KKR.

Life Insurance Corporation of India: The Corporation has received an order from the Bihar- Additional Commissioner State Tax (Appeal), wherein the authority has raised a demand of goods and service tax along with interest and penalty of Rs 290.49 crore. The Corporation will file an appeal before the GST Appellate Tribunal, against the said order within prescribed timelines.

Delta Corp: The casino chain has received an intimation from the Directorate General of GST Intelligence, Hyderabad, for payment of an alleged tax liability of Rs 11,139.61 crore along with interest and penalty from July 2017 to March 2022. Further, if the company fails to do so, the show cause notice will be issued to the company. The amount claimed in the DG Notice is based on the gross bet value of all games played at the casinos during the relevant period.

Deep Industries: The air & gas compression services company has received Letter of Award from Oil and Natural Gas Corporation for charter hiring of HP compressors at GCP Geleki, Assam for three years. The total estimated value of the said award is Rs 108 crore.

Strides Pharma Science: Subsidiary Strides Pharma Global Pte Limited, Singapore has received approval from the US FDA for Icosapent Ethyl capsules. Icosapent Ethyl Capsule is used used in conjunction with other medicines like statins to reduce the risk of heart attack, stroke and heart issues. The product is bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Vascepa of Amarin. The Icosapent Ethyl capsule has a market size of $1.3 billion.

Samhi Hotels: Morgan Stanley Investments Mauritius, and Morgan Stanley Mauritius Company exited the privately held Samhi Hotels by selling their entire personal shareholding of 22.70 lakh shares each at Rs 134.4 per share and Rs 136.46 per share, respectively. Morgan Stanley Asia (Singapore) Pte sold 19.26 lakh shares at an average price of Rs 139.37 per share. Cumulatively they sold 2.97% shareholding against 3.45% stake held before the listing day. However, BofA Securities Europe SA has bought additional 45.85 lakh shares or 2.1% stake in the company at an average price of Rs 139.37 per share, amounting to Rs 63.9 crore. SI investments Broking purchased 15 lakh shares at an average price of Rs 136.04 per share.

Hinduja Global Solutions: Foreign portfolio investor Aviator Global Investment Fund has bought 2.8 lakh shares or 0.6% stake in the IT services management company via open market transactions at an average price of Rs 1,005 per share, in addition to 2.93% shareholding held as of June 2023. However, Legends (Cayman) was the seller in the deal.

Zaggle Prepaid Ocean Services: ACM Global Fund VCC has bought 8 lakh shares in the business spend management services company via open market transactions at an average price of Rs 164.83 per share, and Valuequest Investment Advisors purchased 33.03 lakh shares at an average price of Rs 165.96 per share, which is equivalent to 3.36% stake. However, Goldman Sachs Investments Mauritius I sold 6.1 lakh shares at an average price of Rs 165.39 per share.

Cholamandalam Financial Holdings: Promoter entity Ambadi Enterprises exited the company by selling its personal shareholding of 10.58 lakh shares via open market transactions at an average price of Rs 1,151.02 per share. However, Nomura India Investment Fund Mother Fund bought 14.51 lakh shares in the company at an average price of Rs 1,145.3 per share, amounting to Rs 166.18 crore.

Chavda Infra: The construction company will debut on the NSE Emerge on September 25. Its shares will be available for trading in the trade-for-trade segment. The issue price is Rs 65 per share.

Holmarc Opto-Mechatronics: The scientific and engineering instruments manufacturer will list its equity shares on the NSE Emerge on September 25. Its shares will be available for trading in the trade-for-trade segment. The issue price is Rs 40 per share.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment