Stock to Watch Today - Rupeedesk Reports - 18.09.2023

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

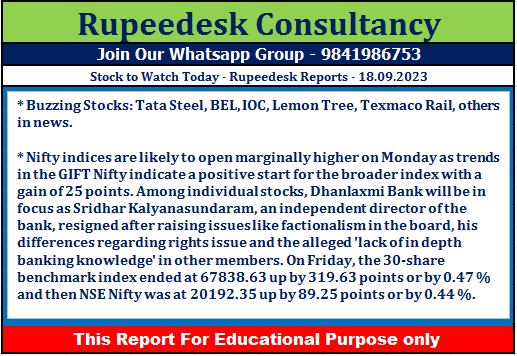

Buzzing Stocks: Tata Steel, BEL, IOC, Lemon Tree, Texmaco Rail, others in news.

Tata Steel: The Tata Group company and the UK government announced a joint agreement to invest 1.25 billion pound in electric arc furnace steelmaking at the Port Talbot site. This included a grant from the UK Government of up to 500 million pound. The Port Talbot project will reduce direct emissions by 50 million tonnes over 10 years. Further, the project would also involve Tata Steel’s balance sheet being restructured with potential elimination of the current cash losses in the UK operations and non-cash impairment of legacy investments.

Wipro: The technology services and consulting major has opened a new office in Jefferson city, Missouri. The office will serve as a base to more than 500 employees and will partner with the state’s Jobs for America’s Graduates (JAG) programme to attract local talent.

Jupiter Life Line Hospitals: The Mumbai-based healthcare services provider will list its equity shares on the BSE and NSE on September 18. The issue price has been fixed at Rs 735 per share.

Hindustan Aeronautics: The Defence Acquisition Council has accorded approval for Acceptance of Necessity (AON) for procurement of 12 Su-30MKI Aircraft from Hindustan Aeronautics, with associated equipment and avionics upgradation of Dornier Aircraft.

Bharat Electronics: The state-owned defence company has received an order of Rs 2,118.57 crore from Cochin Shipyard for supply of various equipment consisting of sensors, weapon equipment, fire control systems and communication equipment for six numbers of Next Generation Missile Vessels (NGMV), class of anti-surface warfare corvettes for Indian Navy. Further, it also received additional orders worth Rs 886 crore for upgradation of AFNET SATCOM N/W & Akash missiles with RF Seeker, and inertial navigation system and other equipments with accessories and spares. With this it has received orders worth Rs 14,384 Crore till now in FY24.

Indian Oil Corporation: The company has received the board nod for additional investment of Rs 903.52 crore in Hindustan Urvarak and Rasayan (HURL). HURL is a joint venture of Indian Oil incorporated for setting up of fertilizer plants at Gorakhpur, Sindri and Barauni.

Lemon Tree Hotels: The hotel chain has opened Peninsula Suites in Bengaluru. This is the sixth property in the city under the Lemon Tree umbrella. The property is managed by subsidiary Carnation Hotels, and the hotel management arm of Lemon Tree Hotels.

Texmaco Rail & Engineering: The rail solutions provider has received approval from the board of directors for raising of funds up to Rs 1,000 crore from issuance of equity shares through qualified institutions placement (QIP). Further, it also got the approval for raising of funds up to Rs 50 crore through preferential issue to promoters.

Tata Elxsi: The product engineering and innovation-led design services provider announced a global partnership with INVIDI Technologies. This partnership will enable operators to deliver targeted advertising solutions and create new revenue streams.

Brigade Enterprises: Subsidiary Brigade Tetrarch has entered into a sale deed for acquiring 5 acres 35.25 guntas of land parcel in Bangalore for Rs 123.5 crore, from Bangalore Ceramics. It will be developing a residential project on this land parcel with an overall development of nearly one million square feet with an overall revenue potential of around Rs 800 crore.

Zomato: Zomato Slovakia s.r.o, the step down subsidiary of the food delivery giant in Slovak Republic has initiated the process of liquidation on September 14. Further, Zomato Slovakia does not have any active business operations. It may be further noted that Zomato Slovakia is not a material subsidiary of the Company, and the dissolution of Zomato Slovakia will not affect the turnover/revenue of the company.

Restaurant Brands Asia: Tata Mutual Fund, Plutus Wealth Management LLP, TD Emerging Markets Fund, Amal N Parikh, Quant Mutual Fund, ICICI Prudential Life Insurance Company, Goldman Sachs Funds-Goldman Sachs Asia Equity Portfolio, and Franklin Singapore 3 Banken Asia Stock-Mix have cumulatively bought 23.92 percent stake or 11.83 crore equity shares worth Rs 1,349 crore, via open market transactions, in the quick-service restaurants chain. However, promoter entity QSR Asia Pte Ltd was the seller in the deal, offloading 12.54 crore shares, equivalent to 25.36 percent of paid-up equity, at average price of Rs 119.1 per share. As of June 2023, QSR Asia 40.8 percent shares in the company.

Five-Star Business Finance: Foreign company SCHF PV Mauritius sold 30.19 lakh shares or 1.03 percent stake in the non-banking finance company at an average price of Rs 700.15 per share, amounting to Rs 211.35 crore. It held 1.2 percent shares in the company as of June 2023. However, foreign portfolio investor Smallcap World Fund Inc was the buyer for entire Five-Star shares in this deal, in addition to its current holding of 1.64 percent or 47.78 lakh shares as of June 2023.

Panacea Biotec: Dr Cyrus Poonawalla's Serum Institute of India sold 4 lakh shares in pharma company Panacea Biotec at an average price of Rs 140.65 per share. Earlier in the current quarter, Serum had sold 5 lakh shares in the company, while its shareholding at the end of June 2023 was 6.97 percent or 42.7 lakh shares.

Satin Creditcare Network: EVLI Emerging Frontier Fund, an open-ended fund incorporated in Finland, has bought 5.14 lakh shares or 0.51 percent stake in microfinance company Satin Creditcare Network at an average price of Rs 237.45 per share.

ONGC and Oil India: The Union government has increased the windfall tax on domestic production of crude oil to Rs 10,000 per tonne from Rs 6,700 per tonne. The increase will come into effect from September 16. The government has cut the special additional excise duty (SAED) on aviation turbine fuel (ATF) to 3.50 rupees per litre from 4 rupees per litre. International benchmark Brent crude futures jumped to $93.93 a barrel on last Friday, up over 30 percent from June lows.

Aditya Vision: Promoters sold 5.39 percent shareholding in the electronic retail chain, with Sunita Sinha offloading 5 lakh shares at an average price of Rs 2,203.02 per share and Nishant Prabhakar 1.48 lakh shares at an average price of Rs 2,200.85 per share. However, HDFC Mutual Fund was the buyer for some of those shares, purchasing 5 lakh shares at an average price of Rs 2,199.74 per share.

Adani Total Gas: The Adani Group company has bagged work order in the range of Rs 130-150 crore from Ahmedabad Municipal Corporation. The work order includes design, build, finance and operate 500 tonnes per day (TPD) capacity bio-CNG (CBG) plant on PPP model at Pirana / Gyaspur in Ahmedabad, and Ahmedabad Municipal Corporation will provide land for setting up the CBG plant and 500 TPD of waste at the doorstep of the plant.

Indian Railway Catering and Tourism Corporation: The state-owned company has made live a pilot project with Amazon for e-Market place, recharges & bill payment for a period of six months. This would involve the integration of Amazon e-commerce products on IRCTC’s websites and mobile applications. This initiative aims to offer IRCTC users access to Amazon's eMarketplace services, in addition to bill payments and recharge services.

RattanIndia Power: Brijesh Narendra Gupta resigned as Managing Director of the company with effect from September 15. Brijesh resigned due to his personal reasons.

Samvardhana Motherson International: The auto ancillary company has incorporated an indirect wholly owned subsidiary Motherson Electroplating US LLC (ME-US) in Delaware-USA. ME-US will own and operate the business and assets recently acquired by SMP Automotive Systems Alabama Inc. from Bolta US Ltd.

PVR Inox: The multiplex chain has opened 5 screen multiplex at Himalaya Mall in Ahmedabad. With this launch, company now operates the largest multiplex network with 1,713 screens across 362 properties in 115 cities (India and Sri Lanka).

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment