Stock to Watch Today - Rupeedesk Reports - 14.09.2023

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

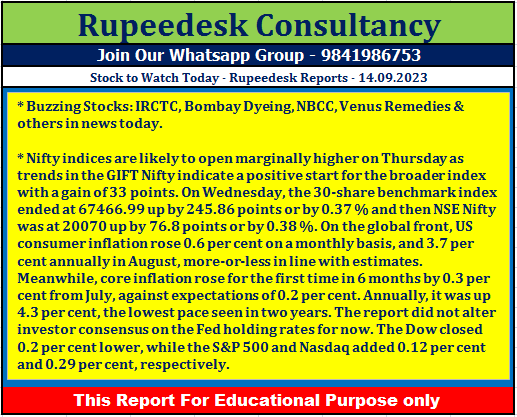

Buzzing Stocks: IRCTC, Bombay Dyeing, NBCC, Venus Remedies & others in news today.

IRCTC: The company has signed a Memorandum of Understanding (MOU) with Maharashtra State Road Transport Corporation (MSTRC) to enable MSRTC's online bus booking services via IRCTC's bus booking portal/website. The detailed roles & responsibilities of IRCTC & MSRTC will be finalized for executing the above project in coordination by both parties.

Bombay Dyeing and Manufacturing Company: The company approved the proposal to sell the land parcel of about 22 acres in Worli, Mumbai to Goisu Realty Private Limited (a subsidiary of Sumitomo Realty & Development Company Limited) in 2 phases, for a total consideration of about Rs 5,200 crore. BDMC will receive about Rs 4,675 crore in Phase-I and the rest in Phase-II.

Venus Remedies: The company announced its recent registration with the Department of Scientific and Industrial Research (DSIR), an Indian government body. This will help the company to avail customs duty exemptions.

Wipro: The company announced the launch of its Cyber Defense Center (CDC) in Dusseldorf, Germany. Wipro’s CDCs are positioned around the globe to provide localised support and fulfil customers’ cybersecurity and compliance requirements.

NBCC (India): The company has signed a quadripartite MoU with the Ministry of Steel (MoS) Govt. of India, Rashtriya Ispat Nigam Limited (RINL) and National Land Monetization Corp. Ltd. (NLMC) for monetization of the non-core assets of RINL at Vishakhapatnam. As per MoU, NBCC would act as technical cum transaction advisor and assist Ministry of Steel (MoS), RINL and NLMC in the monetisation of Non-core assets of RINL available at Vishakhapatnam.

United Spirits: The beverage company said similar to previous financial years, it has received VAT & CST assessment orders for FY21. As per the orders, the tax authority has denied the input tax credit taken by the company on ENA (extra neutral alcohol) purchased on the ground that ENA is subject to GST and raised VAT demand of Rs 98,48,321 (including penalty of Rs 12,000) and CST demand of Rs 5,99,36,965 (including penalty of Rs 2,000). The company will be taking appropriate steps in due course to contest the matter.

Shree Cement: CARE Ratings has reaffirmed the proposed Non-Convertible Debentures (NCDs) rating of Rs 700 crore CARE AAA; Stable (Read as Triple A, Outlook: Stable).

Filatex Fashions: The company approved the allotment of 157 crore shares at Rs 14.08 per share raising Rs 2,211 crore from as many as 197 investors including promoters, institutions and individual investors. Key investors are Prabhat Sethia (Promoter) and Madhusudan Securities.

Vinati Organics: The company has subscribed an additional 1,11,60,000 fully paid-up equity shares of the face value of Rs 10/- each at par, amounting to Rs 11,16,00,000/- by way of subscription towards the rights issue of Veeral Organics Pvt. Ltd. a wholly owned subsidiary.

NIIT: NIIT Canada, a wholly owned subsidiary of NIIT Learning Systems, announced the successful implementation of its Xsel Learning platform in collaboration with CENTURY 21 Heritage Group. The company said that the launch of Xsel marks a significant advancement in real estate education pedagogy and technology, bringing revolutionary digital learning solutions to the CENTURY 21 Heritage Group.

Lloyds Steels Industries: Lloyds Engineering Works, formerly known as Lloyds Steels Industries has entered into agreement with Bhabha Atomic Research Centre (BARC) for transfer of technology. The license will aid the company in executing orders related to desalination. Also, this license is valid for five years from the date of commencement of the agreement.

Bajaj Healthcare: The company has received the Establishment Inspection Report (EIR) from the USFDA for the pre-approval inspection (PAI) at manufacturing site at Savli, Vadodara, Gujarat, with zero 483 observations. The pre-approval inspection was carried out by the USFDA in November 2022 at the said API manufacturing facility.

Kirloskar Ferrous Industries: The resolution plan submitted by Kirloskar Ferrous Industries, for Oliver Engineering (the corporate debtor), has been approved by the National Company Law Tribunal, New Delhi Bench, and the said order has been received by the company on September 13, 2023. The said plan was approved by the Committee of Creditors of the corporate debtor. Oliver Engineering is engaged in the business of ferrous casting and machining and has a manufacturing facility in Punjab.

KPI Green Energy: The company has commissioned 7.80MW wind-solar hybrid power project comprising 4.20MW wind and 3.60MWdc solar capacity for the client Mono Steel India, Surat under captive power producer (CPP) business segment.

Digispice Technologies: Binu Varghese has been appointed as Vice President – Legal, in the company, with effect from September 13.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment