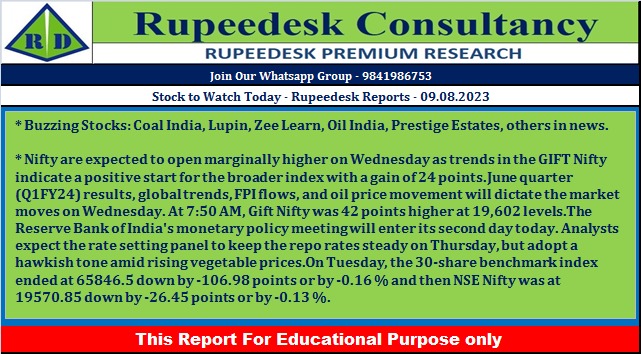

Stock to Watch Today - Rupeedesk Reports - 09.08.2023

Buzzing Stocks: Coal India, Lupin, Zee Learn, Oil India, Prestige Estates, others in news.

Results on August 9: Tata Power Company, Zee Entertainment Enterprises, Abbott India, Bajaj Consumer Care, Bata India, Berger Paints India, Bharat Forge, CARE Ratings, Dreamfolks Services, eClerx Services, Granules India, Indian Railway Catering and Tourism Corporation, Kalyan Jewellers India, Max Financial Services, Natco Pharma, PI Industries, Sandhar Technologies, Schneider Electric Infrastructure, Shankara Building Products, Sula Vineyards, Sunteck Realty, Trent, Vijaya Diagnostic Centre, and Zuari Agro Chemicals will be in focus ahead of declaring their quarterly earnings today.

Coal India: The state-owned coal miner has recorded better-than-expected earnings for Q1FY24, though its consolidated profit fell 10.1% on-year to Rs 7,941.4 crore, impacted by weak operating numbers, but supported by higher other income. Revenue from operations grew 2.5% year-on-year to Rs 35,983 crore in the June quarter, with production of raw coal increasing 9.8% YoY to 175.47 million tonnes and offtake of raw coal rising 5.3% to 186.95 million tonnes. EBITDA fell 14.2% YoY to Rs 10,514 crore with margin declined 570 bps to 29.2% in Q1FY24.

Oil India: The state-run oil and gas exploration company has registered a standalone profit of Rs 1,613.4 crore for the quarter ended June FY24, falling 9.78% from the corresponding period last fiscal, impacted by lower topline and weak operating numbers. Revenue from operations for the quarter (net of excise duty) came in at Rs 4,531.2 crore, declining 16% YoY, while EBITDA dropped 0.8% YoY to Rs 2,329 crore with margin down 790 bps at 51.4% for June FY24 quarter.

Inox Wind Energy: The wind energy generator has sold more than 1.46 crore equity shares of its subsidiary Inox Wind, through a block deal, to institutional investors. The stake sale was worth Rs 304.68 crore. Further, the INOXGFL Group said it successfully raised Rs 500 crore through sale of equity shares of Inox Wind through block deals on the stock exchanges. The funds raised are proposed to be infused into Inox Wind and proposed to be utilized for repayment of Inox Wind’s existing debt.

Lupin: The pharma major said New Jersey-based subsidiary Novel Laboratories Inc, has received approval from the US Food and Drug Administration (US FDA) for its abbreviated new drug application for fluocinolone acetonide oil, a generic equivalent of DermaSmoothe/FS, of Hill Dermaceuticals Inc. Fluocinolone acetonide oil had estimated annual sales of $10 million in the US as per IQVIA MAT June 2023. Fluocinolone acetonide oil is a body oil used to treat eczema, a skin condition.

Zee Learn: The education solutions provider has signed a settlement agreement with JC Flowers Asset Reconstruction to settle its obligations with respect to loans borrowed by certain trusts and entities. Till the time the loans are settled in terms thereof and the legal proceedings initiated in connection therewith are either settled/withdrawn, the matters covered under the legal proceedings remain sub judice.

SBI Life Insurance Company: Insurance Regulatory and Development Authority of India has given its approval for the appointment of Amit Jhingran as Managing Director and CEO of the insurance company.

Siemens: The company has reported consolidated profit at Rs 455.5 crore for quarter ended June FY23 (Q3FY23) , rising 51.5% over year-ago period, driven by higher other income and operating numbers. Revenue from operations grew by 14.4% YoY to Rs 4,873.2 crore, while its new orders stood at Rs 5,288 crore, a 5.9% increase over the same period last year.

Prestige Estates Projects: The south-based real estate developer has reported consolidated profit at Rs 267 crore for quarter ended June FY24, rising 30.3% compared to year-ago period despite lower revenue and high base, supported by higher other income and strong operating margin. Revenue declined 13.3% year-on-year to Rs 1,681 crore and other income increased by 289% YoY to Rs 285.4 crore, while it had an exceptional income of Rs 149.7 crore in Q1FY23.

Aarti Industries: The speciality chemicals manufacturer has reported a 48.5% year-on-year decline in consolidated profit at Rs 70 crore for the quarter ended June FY24, impacted by dismal topline and operating performance. Revenue from operations for the quarter at Rs 1,414 crore fell by 12.2% compared to corresponding quarter of previous fiscal.

Data Patterns India: The defence and aerospace electronics solutions provider has recorded consolidated profit at Rs 25.83 crore for the quarter ended June FY24, rising 81.4% over a year-ago period, driven by higher other income and topline numbers. Revenue during the quarter grew by 31.2% year-on-year to Rs 89.7 crore, while other income stood at Rs 11.61 crore for the quarter against Rs 1.7 crore in same period last fiscal.

Bikaji Foods International: Lighthouse India Fund III, owned by Mumbai-based private equity investor, has sold 35 lakh equity shares or 1.4% stake in the ethnic snacks company via open market transactions at an average price of Rs 480 per share. However, Tata AIA Life Insurance Company has bought 15.62 lakh equity shares or 0.6% stake in the company at same price.

Inox Wind: Promoters Inox Wind Energy and Devansh Trademart LLP sold 1.46 crore equity shares and 93.48 lakh shares in the wind energy company, respectively, via open market transactions at an average price of Rs 208 per share. However, ICICI Prudential Mutual Fund has bought 50.48 lakh shares, and Nippon India Mutual Fund purchased 96 lakh shares in the company at same price, which totalled to 4.49% of total paid-up equity of Inox Wind.

Minda Corporation: Alternate investment fund PHI Capital Trust has exited the automotive components manufacturer by selling entire 1.18 crore shares or 4.96% stake, which amounted to Rs 332.1 crore. PHI sold 1.03 crore shares at an average price of Rs 280 per share, and 15.38 lakh shares at an average price of Rs 280.68 per share. However, Europe-based financial services group Societe Generale has bought 13.07 lakh shares and ICICI Prudential Mutual Fund purchased 58 lakh shares in Minda at an average price of Rs 280 per share.

Piramal Pharma: ICICI Prudential Mutual Fund through its four schemes ICICI Prudential Value Discovery Fund, ICICI Prudential Innovation Fund, ICICI Prudential Pharma Healthcare and Diaganostics PHD Fund, and ICICI Prudential Equity & Debt Fund purchased 2.58 lakh shares or 2.16% stake in the pharma company at an average price of Rs 14.6 per share. However, CA Alchemy Investments, an affiliated entity of CAP V Mauritius Ltd, an investment fund managed and advised by affiliated entities of The Carlyle Group Inc, was the seller, offloading 2.59 crore shares or 2.17% stake in the subsidiary of Piramal Enterprises at same price.

Ideaforge Technology: The drone manufacturing company has registered consolidated profit at Rs 18.86 crore for quarter ended June FY24, falling sharply by 54.3% compared to year-ago period, dented by weak operating numbers and lower topline. Revenue from operations declined 2.2% to Rs 97 crore during the same period.

EIH: The hospitality company has recorded healthy earnings performance for quarter ended June FY24, with profit climbing 65.2% YoY to Rs 103.76 crore on strong operating numbers as well as topline. Consolidated revenue from operations stood at Rs 498.1 crore for the quarter, rising 26.3% over a year-ago period.

Utkarsh Small Finance Bank: The banking & financial services company has registered profit at Rs 107.5 crore for June FY24 quarter, rising 20.1% over corresponding period previous fiscal on fall in provisions & contingencies. Net interest income during the quarter at Rs 422 crore increased by 20.8% over same period last year.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment