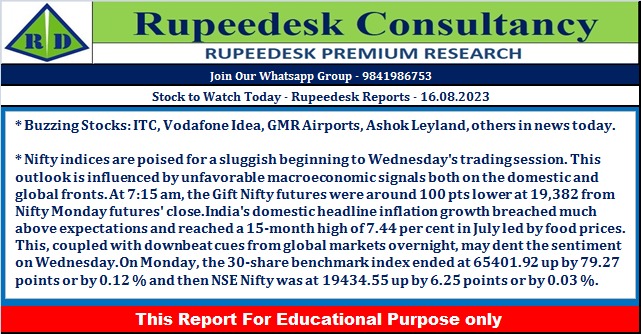

Stock to Watch Today - Rupeedesk Reports - 16.08.2023

Buzzing Stocks: ITC, Vodafone Idea, GMR Airports, Ashok Leyland, others in news today.

SBFC Finance: The non-banking finance company will make its debut on the bourses on August 16. The offer price has been fixed at Rs 57 per share.

ITC: The FMCG company has recorded standalone profit of Rs 4,902.74 crore for quarter ended June FY24, rising sharply by 17.6% over a year-ago period driven by healthy operating margin and higher other income. Revenue (net of excise duty) during the quarter fell by 8.5% YoY to Rs 15,828.2 crore impacted by lower agri, and paper & packaging businesses. On the operating front, EBITDA grew by 10.7% to Rs 6,250 crore with margin expansion of 680 bps at 39.5% compared to year-ago period. ITC has received board approval for the hotel business demerger and shareholders will get 1 share of hotel company for every 10 shares held.

Reliance Industries: Reliance Jio Infocomm has completed its minimum roll-out obligations in each of the 22 licensed service areas (LSA), across each of the spectrum bands, ahead of time. Jio customers are now using 26 GHz mmWave-based business-connectivity across all 22 telecom circles.

Infosys: Converged video, broadband and communications company Liberty Global and IT services firm Infosys have expanded their collaboration to evolve and scale Liberty Global's cutting-edge digital entertainment and connectivity platforms. The parties have entered into an initial 5-year agreement, with an option to extend to 8 years and beyond. Infosys will provide services to Liberty Global estimated at 1.5 billion euro (around $1.6 billion) over the initial 5-year term and at 2.3 billion euro (around $2.5 billion) if the contract is extended to 8 years.

HCL Technologies: Cricket Australia (CA) has selected the IT services company for its next phase of digital transformation. CA has been a customer of HCL Technologies for digital transformation since 2019.

Mahindra and Mahindra: Mahindra Tractors has launched its lightweight tractor platform Mahindra Oja in Cape Town, South Africa. Oja platform, which will be the first light weight tractor from The Mahindra Group, can help double its tractor export volumes over the next three years. After kickstarting its journey in India, the lightweight Oja range will be launched in North America, ASEAN, Brazil, Australia, South Africa, Europe and the SAARC region. Mahindra will also make its debut in the ASEAN region, starting with Thailand in 2024.

Adani Enterprises: Subsidiary AMG Media Networks has received board approval for the acquisition of remaining 51% stake in Quintillion Business Media. Post acquisition of 51% stake, Quintillion Business Media will become a wholly-owned subsidiary of AMG Media Networks. AMG had acquired 49% stake in Quintillion Business Media in March 2023.

Vodafone Idea: The telecom operator has reported loss of Rs 7,840 crore for quarter ended June FY24, widening from loss of Rs 6,418.9 crore in previous quarter. Revenue from operations grew by 1.2% sequentially to Rs 10,655.5 crore during the same period supported by improving subscriber mix and 4G subscriber additions. EBITDA fell by 1.3% QoQ to Rs 4,157 crore with margin declining 100 bps at 39% in Q1FY24. ARPU for the quarter stood at Rs 139 in Q1FY24, rising 2.96% over Rs 135 in Q4FY23.

Hero MotoCorp: The country's largest two-wheeler maker has received family settlement agreement from the promoters. As per the agreement, Sunil Munjal will exit from the management and control of the company, including any position held as joint managing director. The understanding also reached between Family Group and Sunil Kant Munjal on usage of trademark 'HERO'. The management and control of listed entity vested with the Family Group and Sunil Kant Munjal resigned as Joint Managing Director in the listed entity. Family group comprises Santosh Munjal, Renu Munjal, Suman Kant Munjal and Pawan Munjal.

Ashok Leyland: The Indian flagship company of the Hinduja Group has received board approval for the acquisition of 100% of OHM Global Mobility (OHM India) from OHM International Mobility for Rs 1 lakh. As the company is yet to become operational the consideration was nominal. With this move, OHM becomes a 100% subsidiary of Ashok Leyland. Ashok Leyland will be investing up to Rs 300 crore as equity into OHM India to operationalize the company.

Pennar Industries: The engineering products and solutions company has bagged orders worth Rs 702 crore across its various business verticals. The orders are expected to be executed within the next two quarters.

SRF: The search of factory premises of the company in Bhiwadi, Rajasthan was conducted by the GST Department. The concerned officials had perused certain documents and asked for certain additional documents pertaining to claim of GST credit. Company has paid Rs 4 crore towards SGST under protest.

Coffee Day Enterprises: The coffee house chain Cafe Coffee Day operator has recorded profit at Rs 21 crore for quarter ended June FY24, against loss of Rs 17 crore in corresponding period of previous fiscal, with better topline and operating numbers. Revenue from operations grew by 18% on-year to Rs 247 crore during the quarter, and EBITDA increased by 97% to Rs 63 crore in the same period.

Zee Entertainment Enterprises: SEBI has revised the directions it had given in the matter of Zee Entertainment's former directors Subash Chandra and Punit Goenka, and has asked its investigating officials to complete the enquiry in eight months. And the market regulator asked both noticees not to hold any Board or Key Managerial Personnel (KMP) position in ZEEL, its subsidiary companies or any company resultant from a merger with these companies.

InterGlobe Aviation: The Gangwal family led by Rakesh Gangwal looks to raise $450 million or around Rs 3,735 crore via a block trade, in the ongoing stake reduction exercise of the co-founder of IndiGo Airlines, multiple industry sources told Moneycontrol. The offer floor price is Rs 2,400 per share, representing a 5.8% discount to Monday's close price of Rs 2,549 per share.

JSW Energy: US-based GQG Partners Emerging Markets Equity Fund, backed by Rajiv Jain's GQG Partners, has bought 1.19 crore equity shares or 0.72% stake in the power producer, via open market transactions at an average price of Rs 345 per share. However, Authum Investment & Infrastructure was the seller in this deal, offloading 1.6 crore equity shares or 0.97% stake at same price. As of June 2023, Authum Investment held 2.01% stake in the company.

Senco Gold: The Kolkata-based jewellery company has registered a 22.7% on-year growth in consolidated profit at Rs 27.7 crore for the quarter ended June FY24, with revenue from operations rising 29.6% YoY to Rs 1,305.4 crore during the same period. On the operating front, EBITDA grew by 22.1% YoY to Rs 67.2 crore, but margin dropped 31 bps to 5.15% compared to year-ago period.

GMR Airports Infrastructure: The company has narrowed its consolidated loss to Rs 29.8 crore for quarter ended June FY24, compared to loss of Rs 137 crore in same period last year, aided by healthy topline and operating performance. Consolidated revenue from operations grew by 40.2% on-year to Rs 2,017.6 crore during the quarter.

Ujjivan Financial Services: Foreign investor Newquest Asia Investments II sold 30 lakh equity shares or 2.46% stake in financial services company, via open market transactions at an average price of Rs 495.19 per share, which amounted to Rs 148.55 crore. As of June 2023, Newquest held 5.17% stake in Ujjivan. However, BNP Paribas Arbitrage and ace investor Sunil Singhania-owned Abakkus Emerging Opportunities Fund-1 were buyers for some of those shares, purchasing 6.79 lakh shares at an average price of Rs 495.15 per share, and 11.5 lakh shares at an average price of Rs 495 per share, respectively.

Indiabulls Housing Finance: The housing finance company has recorded consolidated profit at Rs 296.2 crore for first quarter of FY24, rising 3.3% over corresponding period of previous fiscal. However, net interest income fell by 5.8% to Rs 546.5 crore during the same period.

Hindustan Copper: The state-owned mining and copper ore processing company has reported profit at Rs 47.3 crore for quarter ended June FY24, falling 17.1% compared to corresponding period of previous fiscal, impacted by disappointing operating performance. Revenue from operations for the quarter grew by 6.5% on-year to Rs 370.9 crore.

Bajaj Healthcare: The pharmaceutical company has posted net loss of Rs 48.2 crore for the first quarter of FY24, against profit of Rs 12 crore in year-ago period. Revenue from operations fell sharply by 20.8% to Rs 129.7 crore during the same period.

Dhabriya Polywood: Promoter Digvijay Dhabriya has sold 7 lakh shares or 6.47% stake in the PVC & UPVC profiles manufacturer via open market transactions at an average price of Rs 280.9 per share. Promoters held 74.22% stake in the company as of June 2023. However, ace investor Ashish Rameshchandra Kacholia was one of the buyers for shares sold by promoter, purchasing 5.46 lakh shares or 5.04% stake in the company. Finavenue Growth Fund bought 55,000 shares, Prateek Jain 85,000 shares and Gaurav Jain 60,000 shares in Dhabriya Polywood.

HP Adhesives: Europe-based financial services group Societe Generale has bought 2 lakh shares or 1.09% shareholding in the adhesive manufacturing company at an average price of Rs 511 per share.

Simplex Infrastructures: HDFC Mutual Fund sold another 13.82 lakh shares or 2.42% stake in Simplex Infrastructures at an average price of Rs 55.2 per share. However, Santosh Industries purchased 15.25 lakh shares in Simplex at an average price of Rs 55.15 per share, and ICM Finance bought 4 lakh shares at an average price of Rs 55.2 per share.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment