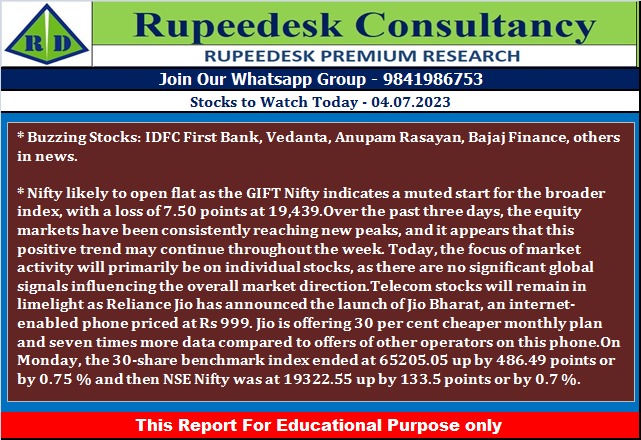

Stock to Watch Today - Rupeedesk Reports - 04.07.2023

Buzzing Stocks: IDFC First Bank, Vedanta, Anupam Rasayan, Bajaj Finance, others in news.

HMA Agro Industries: The company will debut on the BSE and NSE on July 4 after closing the public issue on June 23 with 1.62 times subscription. The final issue price has been fixed at Rs 585 per share.

Lupin: The pharma company has received approval from the United States Food and Drug Administration (US FDA) for its abbreviated new drug application for Cyanocobalamin nasal spray. Cyanocobalamin is a generic equivalent of Nascobal nasal spray, which is available in the strength of 500 mcg per spray, of Par Pharmaceutical Inc. This product will be manufactured at Lupin’s Somerset facility in the US. Cyanocobalamin nasal spray had estimated annual sales of $69 million in the US, as per IQVIA MAT Mar 2023.

Chalet Hotels: The hotel chain operator has received approval from the board of directors for raising of funds up to Rs 500 crore from non-convertible debentures or any other debt instrument, in one or more tranches, for refinancing high cost debt. The board also approved fund raising up to Rs 100 crore through borrowing from promoters for meeting expenses for the residential project in Bengaluru.

Genus Power Infrastructures: The electricity metering solutions provider has received a letter of award (LOA) of Rs 2,207.53 crore for the appointment of advanced metering infrastructure service provider (AMISP), including design of AMI system with supply, installation and commissioning of 27.69 lakh smart prepaid meters, feeder meter, DT meter level energy accounting and FMS of these 27.69 Lakhs smart meters. The company foresees a strong influx of orders in the upcoming quarters of FY24.

Oil India: The state-owned oil and gas exploration company said its board of directors has approved the revision of project capital cost from Rs 6,555 crore to Rs 7,231 crore for implementation of petrochemical project of Numaligarh refinery.

Bajaj Finance: The new loans booked during Q1 FY24 grew by 34% to 9.94 million compared to 7.42 million in Q1FY23. Deposits book stood at approximately Rs 49,900 crore as of June 2023, increasing 46% over Rs 34,102 crore as of June 2022. Assets under management increased by 32% to Rs 2.7 lakh crore in Q1FY24 against same period last year. Consolidated net liquidity surplus stood at Rs 12,700 crore as of June 2023.

Avenue Supermarts: The hypermarkets chain D-Marts operator has clocked a 18.1% year-on-year growth in standalone revenue at Rs 11,584.44 crore for the quarter ended June FY24, up from Rs 9,806.9 crore in same period last year. The total number of stores as of June 2023 stood at 327.

Vedanta: The cast metal aluminium production increased by 2% YoY and 1% QoQ to 579kt (kilo tonnes) due to efficiency in the operations. Highest-ever mined metal production in Q1FY24 at 257kt rose by 2% YoY due to higher ore production, primarily at Rampura Agucha and Kayad mines, supported by improved mined metal grades and better mill recovery. Overall power sales grew by 19% to 4,266 million units in quarter ended June FY24.

IDFC First Bank: The bank said the board members have approved the amalgamation of IDFC with the bank. The share exchange ratio for the amalgamation will be 155 equity shares of IDFC First Bank for every 100 equity shares of IDFC. As a result of the proposed merger, the standalone book value per share of the bank would increase by 4.9% as per financials FY23.

Anupam Rasayan: The custom synthesis & speciality chemicals manufacturer has signed Memorandum of Understanding (MoU) with 3xper Innoventure, a subsidiary of Tube Investments of India, for supply of targeted and identified new age pharma molecules. The identified products for active pharmaceutical ingredients (API) will be developed under the CRAMS and CDMO models.

V-Mart Retail: The hypermarket chain operator has recorded a 16% year-on-year growth in revenue from operations at Rs 678 crore for quarter ended June FY24 including income from LimeRoad. The income from LimeRoad digital marketplace of Rs 17 crore represents the commission income charged from sellers on the net merchandising value of Rs 44 crore. The company opened 9 new stores and closed one store in Q1FY24, taking total stores count to 431.

Aurobindo Pharma: The company's entity has entered into an arrangement with Viatris Inc. for $48 million for transfer of certain marketing and manufacturing related authorisations from Viatris Inc. The arrangement also contemplates participation in the supply system in relation to certain marketing and manufacturing related authorisations and sharing of the net economic benefits by Viatris Inc. to group entity of the company.

Tube Investments of India: The auto ancillary company has forayed into electric small commercial vehicle business as its subsidiary Tl Clean Mobility (TICMPL) has entered into an agreement with Anand Jayachandran for pursuing electric small commercial vehicle business (e-SCV) through a subsidiary to be incorporated by TICMPL. TICMPL will be investing Rs 160 crore and Anand Jayachandran will be investing Rs 40 crore in the form of equity. Further, TICMPL has entered into definitive agreements for acquisition of 50% in Jayem Automotives through a combination of purchase of equity shares from promoters Anand Jayachandran and B Jayachandran, for Rs 206 crore.

Eris Lifesciences: Subsidiary Eris Oaknet Healthcare has transferred to Eris Lifesciences all the dermatology trademarks that had been previously acquired from Glenmark Pharmaceuticals. The consideration for this intra group transfer is Rs 339.68 crore.

Torrent Power: The power utility company has started working on a green hydrogen pilot project for blending with natural gas in city gas distribution (CGD) network. The pilot project is based on alkaline electrolyzer and expected to complete in approximately 8 months. The project will blend approximately 2.5% GH2 into CGD network. GH2 is produced using electrolysis of water powered by Renewable sources. Blending GH2 with the existing natural gas supply allows for a gradual transition towards a cleaner and more sustainable energy mix.

Sula Vineyards: The leading wine producer has appointed Karan Vasani as chief operating officer after Chaitanya Rathi resigned as COO to explore opportunities outside of the company.

Hindustan Zinc: The Vedanta Group company has announced mined metal production in Q1FY24 at 257kt (kilo tonnes), growing 2% over a year-ago period, backed by higher ore production. Integrated saleable metal (refined zinc + lead) production remained flat at 260 kt YoY, and saleable silver production was 5.8 million ounces, up 1% YoY and down 2% QoQ, in line with lead metal production and higher WIP depletion. Wind power generation fell 13% YoY to 130 millon units in quarter ended June FY24.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment