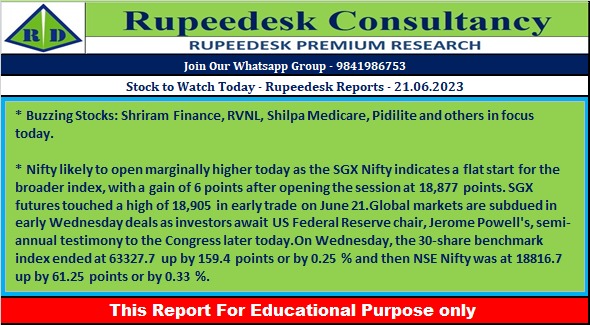

Stock to Watch Today - Rupeedesk Reports - 21.06.2023

Buzzing Stocks: Shriram Finance, RVNL, Shilpa Medicare, Pidilite and others in focus today.

Shriram Finance: Piramal Enterprises is likely to sell the entire 8.34% stake or 3.12 crore shares in Shriram Finance through block deals, reports CNBC-TV18, quoting sources. The floor price is likely at Rs 1,483 per share, a 5% discount to closing price on June 20. Morgan Stanley is the broker for this deal.

HDFC Life Insurance Company: The Competition Commission of India (CCI) has approved proposed combination involving acquisition of additional shareholding of HDFC Life Insurance Company by Housing Development Finance Corporation (HDFC). The proposed combination involves the acquisition by HDFC of certain additional shares of HDFC Life through one or more market purchases via exchanges such that HDFC and the merged entity, i.e. HDFC Bank (after the effective date of the proposed merger of HDFC into HDFC Bank) will hold more than 50% stake in HDFC Life in accordance with Indian banking laws. As of March 2023, HDFC holds 48.65% stake in HDFC Life.

HDFC Asset Management Company: SBI Mutual Fund, Zulia Investments Pte Limited, Smallcap World Fund Inc, and Societe Generale have bought, in total, 99.1 lakh equity shares or 4.64% stake in the asset management company via open market transactions at an average price of Rs 1,873 per share. However, Abrdn Investment Management has exited the company by selling entire 2.18 crore shares or 10.2% stake at same price, which amounted to Rs 4,079.07 crore.

Aptech: Anil Pant, Managing Director & CEO informed the company on June 19 that on account of sudden deterioration of his health, he would be proceeding on indefinite leave with effect from June 20. As an interim measure, the board has constituted an interim committee of certain Members of the board and the senior management of the company to ensure smooth functioning and continuity of operations of the company. The nomination and remuneration committee and the board of directors of the company are taking necessary steps to select Interim CEO.

Shilpa Medicare: The pharma company said the board members will meet on June 23 to consider a proposal of fund raising via Rights issue of equity shares.

Pidilite Industries: The construction and specialty chemicals manufacturer launched its manufacturing facilities under its two joint ventures, Pidilite Litokol (PLPL) and Tenax Pidilite (TPPL), in Amod, Gujarat. Litokol SPA Italy and Tenax SPA Italy have transferred technology to Pidilite as part of the joint venture. This development will strengthen Pidilite's presence in the tile and stone care range.

Rail Vikas Nigam: The company in its clarification note to exchanges said the news with respect to breaking of joint venture between RVNL & Transmashholding (TMH) is factually incorrect. The MoU between both the parties is still valid as none of the parties have terminated the same. The bank Guarantee will be deposited well within the permissible time limits as per the tender condition. Further deliberations on the terms of MoU are underway.

Gujarat Mineral Development Corporation: Hasmukh Adhia, the Principal Advisor to Chief Minister of Gujarat, has been appointed as the Director and Chairman of GMDC with immediate effect. Hasmukh Adhia is a Gujarat Cadre officer of Indian Administrative Services belonging to 1981 batch.

Avenue Supermarts: Dheeraj Kampani has resigned as vice president (Buying and Merchandising) of the company. His last working day with the company would be June 30.

Fino Payments Bank: Rakesh Bhartia has withdrawn his nomination as part-time Chairman of the bank due to his personal reasons and other official commitments. He will continue to hold the position as an Independent Director of the bank. In November 2022, the bank had approved appointment of Rakesh Bhartia as part-time Chairman.

Archean Chemical Industries: Europe-based financial services group Societe Generale has bought 6.42 lakh equity shares in the chemical manufacturing company via open market transactions at an average price of Rs 510 per share. However, Norges Bank on account of the Government Pension Fund Global sold 9.5 lakh shares or 0.77% stake in the company at an average price of Rs 510.87 per share.

Krishna Institute of Medical Sciences: SBI Mutual Fund has bought 40.68 lakh shares or 5.08% stake in KIMS via open market transactions at an average price of Rs 1,710 per share, amounting to Rs 695.7 crore. However, foreign investor General Atlantic Singapore Kh Pte Ltd was the seller in this deal.

Thyrocare Technologies: Foreign portfolio investor Arisaig Asia Consumer Fund has offloaded 26.72 lakh equity shares or 5.05% stake in the diagnostic and preventive care laboratories chain at an average price of Rs 488.18 per share, which amounted to Rs 130.47 crore. However, ICICI Prudential Mutual Fund bought 22.53 lakh equity shares or 4.25% stake in Thyrocare at an average price of Rs 488 per share, amounting to Rs 109.95 crore.

Jamna Auto Industries: Foreign portfolio investor Smallcap World Fund Inc has sold 59.05 lakh shares or 1.48% stake in the company via open market transactions at an average price of Rs 96.15 per share, which amounted to Rs 56.78 crore. As of March 2023, Smallcap World Fund had held 1.28 crore shares or 3.22% stake in the company.

Timken India: Promoter Timken Singapore Pte Limited has offloaded 76 lakh equity shares or 10.1% stake in the ball and roller bearing manufacturing company via open market transactions at an average price of Rs 3,107.75 per share, which amounted to Rs 2,361.89 crore. However, Kuwait Investment Authority has bought 5.07 lakh shares or 0.67% stake in the company at an average price of Rs 3,100.30 per share.

IDFC First Bank: The bank said its board members have approved appointment of Madhivanan Balakrishnan, Chief Operating Officer, as the Whole-time Director (additional director), designated as Executive Director and Chief Operating Officer of the bank, with effect from June 20, for three years.

Satin Creditcare Network: The company has received board approval for issuance of non-convertible debentures, worth upto Rs 54 crore on a private placement basis.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment