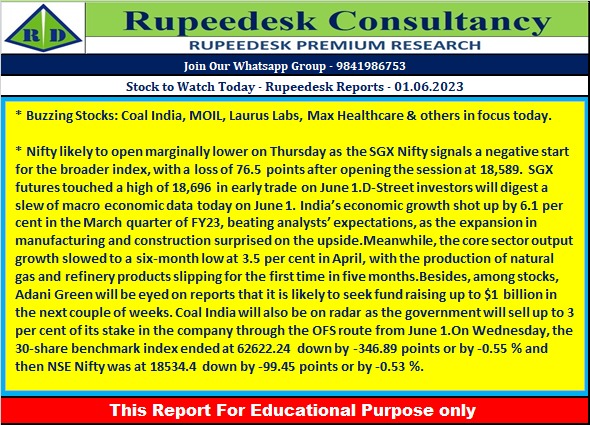

Stock to Watch Today - Rupeedesk Reports - 01.06.2023

Buzzing Stocks: Coal India, MOIL, Laurus Labs, Max Healthcare & others in focus today

Coal India: The Government of India, the promoter, will be selling its 9.24 crore equity shares or 1.5% stake in the country's largest coal mining company on June 1 and June 2. It also has an option to additionally sell another 9.24 crore shares in the company in case the oversubscription option is exercised. The offer for sale issue will open on June 1 for non-retail investors and retail investors can participate in the offer on June 2. The floor price of the offer has been fixed at Rs 225 per share, which is at a 6.7% discount to Wednesday's closing price of Rs 241.

Laurus Labs: The pharma company has signed definitive agreements to acquire additional stake of 7.24% in Immunoadoptive Cell Therapy (lmmunoACT), an advanced cell and gene therapy company, for Rs 80 crore. Post the deal, Laurus Labs’ stake in ImmunoACT will increase to 33.86%. This fresh infusion of capital will enable ImmunoACT to fast track the additional supply of the lead candidate HCAR-19along with the further expansion of the multi-location GMP facilities for manufacturing Chimeric Antigen Receptor T cells (CAR-T cells) treatment to support the growing need for scalable manufacturing. Additionally, some promoters and senior management of Laurus Labs would also acquire 0.54% stake in ImmunoACT for Rs 4 crore at the same price.

MOIL: The miniratna state-owned manganese ore mining company has increased prices for some of manganese ore grades (BGF452, CHF473 and GMF569) by 10%, with effect from June 1. The company has maintained the prices of ferro grade, SMGR, fines and chemical grades, and also electrolytic manganese dioxide price for June.

HDFC Life Insurance Company: Promoter entity Abrdn (Mauritius Holdings) 2006 Limited has exited the life insurance company by selling entire 3.56 crore shares or 1.66% stake, to various investors, at an average price of Rs 570.60 per share. The stake sale was worth Rs 2,036.7 crore. With the stake sale, abrdn will hold nil equity shares in the company.

Sona BLW Precision Forgings: Societe Generale has bought additional 81.97 lakh shares in the auto ancillary company at an average price of Rs 503 per share, amounting to Rs 412.34 crore shares, and Government of Singapore purchased additional 36.43 crore shares in the company at an average price of Rs 540.44 per share. However, promoter entity Aureus Investment sold 1.9 crore shares or 3.24% stake in Sona BLW at an average price of Rs 503.73 per share, and BNP Paribas Arbitrage sold 96.84 lakh shares in the company at an average price of Rs 541.61 per share, amounting to Rs 524.5 crore. BNP Paribas Arbitrage held 73.91 lakh shares or 1.26% stake in Sona BLW, Societe Generale has 60.85 lakh shares or 1.04% stake, and Government of Singapore held 3.13 crore shares or 5.35% stake in the company as of March 2023.

Max Healthcare Institute: Government of Singapore has bought additional 66.6 lakh shares in the company via open market transactions at an average price of Rs 549.53 per share, amounting to Rs 366 crore. However, BNP Paribas Arbitrage have net sold 90.33 lakh shares in the company at an average price of Rs 546.56 per share, amounting to Rs 492.6 crore, and UBS Principal Capital Asia sold 75.43 lakh shares in Max Healthcare at an average price of Rs 548.03 per share, amounting to Rs 413.42 crore.

Goldstone Technologies: GTL is partnering with Quantron AG, a German e-mobility major, to establish a joint venture to address the high potential fleet management market. The fleet management market is valued at around $70 billion or Rs 5.8 lakh crore by 2032. By focusing on zero-emission transport, the JV aims to offer OEM-agnostic mobility as a service (MaaS) solutions, addressing efficiency and digitalization challenges.

Gati: Pirojshaw Aspi Sarkari has resigned as Chief Executive Officer of logistics company Gati, with effect from May 31. The company has appointed Pirojshaw Aspi Sarkari as MD & CEO of its subsidiary Gati-Kintetsu Express (GKEPL), with immediate effect, in the place of Adarsh Sudhakar Hegde who stepped down from the said position of Chairman & Managing Director with immediate effect. Shashi Kiran Shetty, the Chairman & Managing Director of Gati, has been appointed as Non-Executive Chairman of GKEPL.

Rainbow Children's Medicare: R Gowrisankar has resigned as Chief Financial Officer (CFO) of the healthcare company due to personal reasons with effect from May 31. The company has appointed Vikas Maheshwari as CFO of the company with effect from June 1.

South Indian Bank: The bank said its board of directors approved the panel of candidates for the position of the Managing Director & Chief Executive Officer (MD & CEO) of the bank. The bank will be submitting its application to Reserve Bank of India with the names of the candidates, seeking approval for the appointment of the new MD & CEO.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment