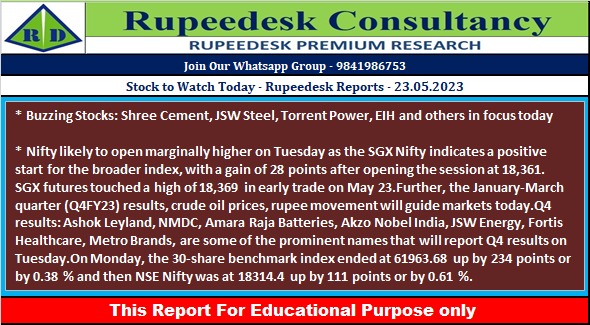

Stock to Watch Today - Rupeedesk Reports - 23.05.2023

Buzzing Stocks: Shree Cement, JSW Steel, Torrent Power, EIH and others in focus today

Results on May 23: JSW Energy, Akzo Nobel India, Amara Raja Batteries, Ashok Leyland, Bajaj Electricals, Biocon, CMS Info Systems, Dishman Carbogen Amcis, Dixon Technologies (India), Dreamfolks Services, Fortis Healthcare, Linde India, Metro Brands, NMDC, Sudarshan Chemical Industries, Thyrocare Technologies, TTK Healthcare, and Unichem Laboratories will be in focus ahead of declaring their quarterly earnings today.

JSW Steel: The steel maker teamed up with Japan-based JFE Steel to set up a cold-rolled grain-oriented electrical steel (CRGO) manufacturing joint venture in India. The 50:50 joint venture company will be able to manufacture the entire range of CRGO products at its proposed facilities at Vijayanagar in Karnataka. Further, the company has reappointed Sajjan Jindal as Chairman and Managing Director, Jayant Acharya as Joint Managing Director and CEO, Gajraj Singh Rathore as Chief Operating Officer, and Rajeev Pai as Chief Financial Officer. The resolution plan submitted by its subsidiary JSW Steel Coated Products for National Steel & Agro Industries has been approved by NCLT.

Shree Cement: The cement major has recorded a 15.3% year-on-year decline in standalone profit at Rs 546.2 crore for March FY23 quarter, impacted by sharp increase in power and fuel cost. The standalone revenue for the quarter grew by 16.7% to Rs 4,785 crore over the last year. Both profit and revenue were above analysts' estimates, but operating numbers missed expectations. The company announced second interim dividend of Rs 55 per share for FY23.

Bharat Petroleum Corporation: The state-owned oil retailer has reported a standalone profit at Rs 6,477.7 crore for quarter ended March FY23, growing 230.6% over previous quarter, driven by healthy operating numbers. Revenue from operations (net of excise duty) fell by 0.88% sequentially to Rs 1.18 lakh crore in Q4FY23. The board recommended final dividend of Rs 4 per share.

Indiabulls Housing Finance: The housing finance company has reported a 14.4% year-on-year decline in consolidated profit at Rs 262.6 crore for quarter ended March FY23, impacted by higher impairment on financial instruments. Net interest income grew by 13.5% to Rs 733.6 crore compared to same quarter last fiscal.

EIH: The luxury hotel chain has recorded a 469% year-on-year growth in consolidated profit at Rs 84.4 crore for quarter ended March FY23. Revenue from operations grew by 112% to Rs 637 crore compared to same period last year. Board announced a final dividend of Rs 1.10 per share for FY23.

PB Fintech: The Policybazaar and Paisabazaar operator has reduced its PAT loss significantly to Rs 8.9 crore for quarter ended March FY23, from Rs 219.6 crore in same period last year. The operating revenue grew by 61% to Rs 869 crore compared to corresponding period last fiscal. The insurance premium at Rs 3,586 crore for March FY23 quarter increased 65% and credit disbursal at Rs 3,357 crore grew by 53% over a year-ago period.

HEG: The graphite electrode manufacturer has registered a 23% year-on-year decline in consolidated profit at Rs 99.72 crore for March FY23 quarter, impacted by lower topline and operating numbers. Revenue from operations for the quarter at Rs 616.88 crore fell by 8.3% compared to corresponding period last fiscal. The company announced a final dividend of Rs 42.50 per share. HEG board has approved further investment of up to Rs 90 crore in one or more tranches, in its subsidiary TACC.

Kokuyo Camlin: Ace investor Porinju Veliyath-owned Equity Intelligence India has bought more than half a percent stake or 5.4 lakh shares in the stationery manufacturing company via open market transactions, at an average price of Rs 105.79 per share.

Astra Microwave Products: Astra Rafael Comsys, the joint venture company, has bagged Rs 158 crore worth of order from defence public sector undertaking (DPSU) for supply of software defined radio (SDR).

Torrent Power: The stock will be in focus as the Board of Directors of the company will meet on May 29 to consider raising of funds via issuance of non-convertible debentures upto Rs 3,000 crore through private placement basis. The board will also consider financial results for the quarter and year ended March 2023, and recommendation of final dividend, if any, for FY23.

Max Healthcare Institute: GQG Partners Emerging Markets Equity Fund, owned by US-based GQG Partners LLC, purchased 75.5 lakh shares or 0.77% shareholding in Max Healthcare Institute at an average price of Rs 549.7 per share, amounting to Rs 415 crore.

Matrimony.com: Investment management firm Carnelian Asset Advisors purchased 1.35 lakh shares or 0.6% stake in matchmaking and marriage related services provider Matrimony.com at an average price of Rs 560 per share.

Gland Pharma: Morgan Stanley Investment Funds Emerging Markets Equity Fund sold 9.6 lakh equity shares in Gland Pharma at an average price of Rs 930.69 per share, amounting to Rs 89.37 crore.

Dhanlaxmi Bank: The private sector lender has reported profit at Rs 38.2 crore for quarter ended March FY23, growing 63% over a year-ago period due to tax write-back against tax expenses in the same period. Fall in provisions and contingencies YoY also supported bottomline. Net interest income grew by 19.4% to Rs 115.15 crore compared to corresponding quarter of previous fiscal.

SJVN: The hydroelectric power generation company has recorded consolidated profit at Rs 17.21 crore for March FY23 quarter, rising 130% over same period last fiscal, driven by strong topline and operating numbers. Revenue from operations increased by 56% to Rs 503.77 crore compared to year-ago period.

Finolex Industries: The PVC pipes and fittings manufacturer has reported consolidated profit at Rs 166.5 crore for quarter ended March FY23, falling 66.4% compared to corresponding quarter of last fiscal due to high base. The March FY22 quarter profit was boosted by exceptional gain of Rs 376 crore on transfer of leasehold rights on land. Revenue from operations dropped 28.4% to Rs 1,141 crore compared to same quarter last year.

Gujarat Alkalies & Chemicals: The chemical manufacturing company has recorded a 67.8% year-on-year decline in consolidated profit at Rs 71 crore for quarter ended March FY23, impacted by weak topline, and operating numbers. Revenue from operations fell 0.3% to Rs 1,138.1 crore compared to same quarter last year. The board recommended a dividend of Rs 23.55 per share.

Fusion Micro Finance: The company's profit after tax increased by 767.93% YoY to Rs 114.52 crore for quarter ended March FY23 as impairment of financial instruments declined 48.36% YoY to Rs 69.2 crore in the same period. Net interest income grew by 62.4% YoY to Rs 273.75 crore in Q4FY23.

Spencer’s Retail: The retail store company has increased its consolidated loss to Rs 61.23 crore for March FY23 quarter, from Rs 42.5 crore in same period last fiscal due to tepid revenue growth and lower other income. Revenue from operations for the quarter at Rs 543.4 crore grew by 0.3% over year-ago period.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment