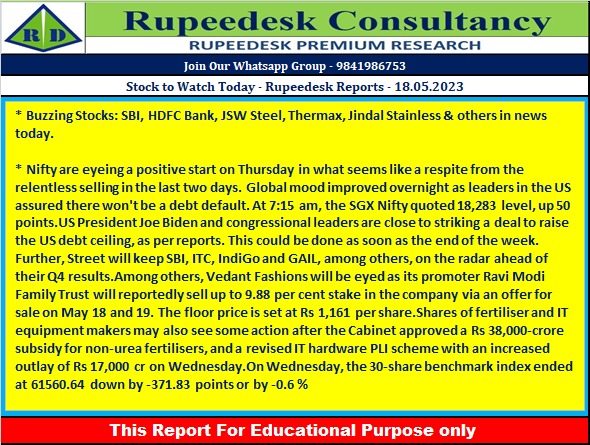

Stock to Watch Today - Rupeedesk Reports - 18.05.2023

Buzzing Stocks: SBI, HDFC Bank, JSW Steel, Thermax, Jindal Stainless & others in news today.

Results on May 18: State Bank of India, ITC, GAIL (India), InterGlobe Aviation, Arvind, Bata India, Clean Science and Technology, Container Corporation of India, Gland Pharma, Gujarat Narmada Valley Fertilizers & Chemicals, Gulf Oil Lubricants India, Krishna Institute of Medical Sciences, PTC India Financial Services, PI Industries, PNB Housing Finance, RITES, Shalby, Tata Elxsi, Ujjivan Financial Services, United Spirits, and Zydus Lifesciences will be in focus ahead of quarterly earnings on May 18.

HDFC Bank: The Reserve Bank of India (RBI) has granted its approval to SBI Funds Management for acquiring up to 9.99% stake in HDFC Bank. The RBI has advised SBI Funds Management to acquire the major shareholding in the bank within a period of six months i.e. by November 15, 2023. Further, SBI Funds Management must ensure that the aggregate holding in the bank remains below 10% of paid-up share capital or voting rights of the bank at all times.

JSW Steel: The steel producer has been declared as a preferred bidder for composite licence of an unexplored iron ore mine, which is Surjagad 4 iron ore block in Gadchiroli district, in Maharashtra. The auctions were held by the Maharashtra Government on May 12. The highest final offer price by the company to become a “preferred bidder” is 131.05% of average monthly prices of iron ore of different grades and quality published by Indian Bureau of Mines in Maharashtra from time to time.

Thermax: The energy and environment solutions company has reported a 52.3% year-on-year growth in consolidated profit at Rs 156.2 crore for March FY23 quarter, backed by healthy operating performance. Revenue from operations for the quarter grew by 16% to Rs 2,310.82 crore compared to corresponding period last fiscal. The board has announced a final dividend of Rs 10 per share.

Jindal Stainless: The stainless steel company has recorded a 12.8% year-on-year fall in consolidated profit at Rs 765.8 crore for quarter ended March FY23, impacted by tepid topline growth and weak operating numbers. Revenue for the quarter at Rs 9,765 crore increased by 0.4% over a year-ago period.

Glaxosmithkline Pharmaceuticals: The pharma company has registered consolidated profit (from continuing operations) at Rs 133.43 crore for March FY23 quarter, against loss of Rs 54.66 crore in corresponding period last fiscal. Revenue from operations for the quarter fell by 2.7% year-on-year to Rs 787.5 crore as a robust underlying volume growth was offset by the impact of National List of Essential Medicines (NLEM) 2022. The board has recommended a final dividend of Rs 32 per share for FY23.

REC: The power projects finance company has recorded a 33.2% year-on-year growth in consolidated profit at Rs 3,065.4 crore for quarter ended March FY23, supported by reversal of impairment on financial instruments. Revenue from operations grew by 6.3% to Rs 10,243 crore compared to year-ago period. The state-owned company has approved appointment of Hemant Kumar, CGM (Finance) as Chief Compliance Officer for three years with effect from May 6.

Indiabulls Real Estate: The real estate firm said the board has approved the appointment of Manish Kumar Sinha as the Chief Financial Officer with effect from May 17. Saurabh Garg has resigned as CFO of the company due to personal reasons.

Lemon Tree Hotels: The hotel chain operator has signed a License Agreement for 82-room property in Lucknow, Uttar Pradesh under the company's brand 'Lemon Tree Premier'. The property is expected to be operational by August 2026. Subsidiary Carnation Hotels will be operating this property.

Vedant Fashions: Promoter Ravi Modi Family Trust plans to sell up to 1.69 crore equity shares of Vedant Fashions or 7% stake, with an option to additionally sell 69.87 lakh shares or 2.88% stake. The offer for sale issue will open on May 18 for non-retail investors, and May 19 for retail investors. The floor price for the offer will be Rs 1,161 per share.

ICICI Prudential Life Insurance Company: The company has appointed Dhiren Salian as the Chief Financial Officer, with effect from May 18. Satyan Jambunathan will cease to be the Chief Financial Officer of the company with effect from same date.

Surya Roshni: The company has received order of Rs 43.69 crore from Indraprastha Gas (IGL) for supply 3LPE coated carbon steel pipes for city gas distribution (CGD) projects in NCT of Delhi, Uttar Pradesh, Haryana and Rajasthan, along with other new orders received in May from Indian Oil Corporation (IOCL) and Maharashtra Natural Gas (MNGL). Total order amounted to Rs 62.23 crore.

Mankind Pharma: Income Tax Department has conducted search at some of the offices and plants of the company and its subsidiaries. The company said it has fully cooperated with the officials of IT Dept during the proceedings and responded to the clarifications and details sought by them. The business operations of the company continue as usual and have not been impacted due to the search.

Railtel Corporation of India: The company has reported consolidated profit at Rs 76.04 crore for March FY23 quarter, rising 40% YoY despite weak operating margin, driven by higher topline, other income and exceptional income. Revenue from operations grew by 51.1% year-on-year to Rs 703.6 crore in Q4FY23.

NHPC: Gujarat Urja Vikas Nigam (GUVNL) had issued a Letter of Intent to NHPC for 200 MW capacity solar power project within 600 MW GSECL's Solar Park at Khavda (GSECL Stage-1). The estimated financial implication for the said solar power project would be Rs 1,007.60 crore.

Sanghi Industries: The cement manufacturer has posted loss of Rs 104.6 crore for quarter ended March FY23, against profit of Rs 6.3 crore in same period last year. Dismal topline, and operating performance dented bottomline. Revenue from operations declined by 36.5% to Rs 226 crore compared to Q4FY22.

Godrej Agrovet: Godrej Agrovet is launching finance offering for oil palm farmers in partnership the State Bank of India. A product jointly developed by the company and SBI will enable farmers to avail loan for setting up micro irrigation facility, set up fencing arrangement to protect from cattle grazing and improvement of tube well at their oil palm farms.

KPI Green Energy: The company has received approval of Chief Electrical Inspector (CEIG) for 9.40MW wind-solar hybrid power project. It has accomplished the charging of 9.40MW wind-solar hybrid power project comprising 5.40MW wind and 4MWdc solar capacity for client Greenlab Diamonds LLP, Surat under ‘captive power producer (CPP) business segment. These projects are in the advance stage of commissioning.

MM Forgings: The iron and steel forgings manufacturer has recorded a 4-fold increase in consolidated profit at Rs 30.63 crore for quarter ended March FY23, driven by lower tax cost and higher operating numbers. Revenue from operations for the quarter at Rs 387.4 crore grew by 20.2% over a year-ago period. The board has announced an interim dividend of Rs 6 per share.

Honeywell Automation India: The automation and software solutions provider has reported a 54.2% year-on-year growth in profit at Rs 112 crore for March FY23 quarter backed by strong topline and operating numbers. Revenue from operations for the quarter at Rs 849.7 crore increased by 27.2% over a year-ago period. The board announced final dividend of Rs 95 per share.

MTAR Technologies: The precision engineering company has registered a 56.9% year-on-year growth in profit at Rs 31.1 crore for quarter ended March FY23 as topline and operating numbers remained strong. Revenue from operations grew by 99.2% to Rs 196.4 crore compared to corresponding period last fiscal. The board has reappointed P Srinivas Reddy as Managing Director of the company for five years with effect from September 1 this year.

Whirlpool of India: The home appliances manufacturer has reported a 24.6% year-on-year decline in profit at Rs 63.7 crore for quarter ended March FY23 mainly on lower sales due to subdued market conditions and calibrated price correction actions which were partially offset by the cost productivity actions and reduction in commodity cost. Revenue falls 2% to Rs 1,672.7 crore compared to same period last year. The board has announced final dividend of Rs 5 per share for FY23.

Restaurant Brands Asia: The company has posted loss of Rs 73.3 crore for March FY23 quarter, widening from Rs 67 crore in same period last year. Revenue from operations grew by over 28% YoY to Rs 514 crore compared to similar period last fiscal.

JK Tyre & Industries: The tyre maker has recorded consolidated profit at Rs 108.4 crore for the quarter ended March FY23, growing 170% over corresponding period last fiscal, driven by healthy operating numbers. Revenue from operations increased by 9.7% to Rs 3,632.5 crore compared to same period last fiscal.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment