SENSEX OPTIONS TIPS - 01.06.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Wednesday, May 31, 2023

SENSEX OPTIONS TIPS - 01.06.2023

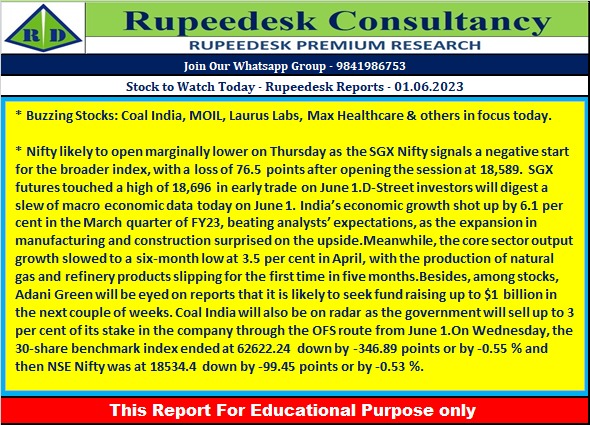

Stock to Watch Today - Rupeedesk Reports - 01.06.2023

Stock to Watch Today - Rupeedesk Reports - 01.06.2023

Buzzing Stocks: Coal India, MOIL, Laurus Labs, Max Healthcare & others in focus today

Coal India: The Government of India, the promoter, will be selling its 9.24 crore equity shares or 1.5% stake in the country's largest coal mining company on June 1 and June 2. It also has an option to additionally sell another 9.24 crore shares in the company in case the oversubscription option is exercised. The offer for sale issue will open on June 1 for non-retail investors and retail investors can participate in the offer on June 2. The floor price of the offer has been fixed at Rs 225 per share, which is at a 6.7% discount to Wednesday's closing price of Rs 241.

Laurus Labs: The pharma company has signed definitive agreements to acquire additional stake of 7.24% in Immunoadoptive Cell Therapy (lmmunoACT), an advanced cell and gene therapy company, for Rs 80 crore. Post the deal, Laurus Labs’ stake in ImmunoACT will increase to 33.86%. This fresh infusion of capital will enable ImmunoACT to fast track the additional supply of the lead candidate HCAR-19along with the further expansion of the multi-location GMP facilities for manufacturing Chimeric Antigen Receptor T cells (CAR-T cells) treatment to support the growing need for scalable manufacturing. Additionally, some promoters and senior management of Laurus Labs would also acquire 0.54% stake in ImmunoACT for Rs 4 crore at the same price.

MOIL: The miniratna state-owned manganese ore mining company has increased prices for some of manganese ore grades (BGF452, CHF473 and GMF569) by 10%, with effect from June 1. The company has maintained the prices of ferro grade, SMGR, fines and chemical grades, and also electrolytic manganese dioxide price for June.

HDFC Life Insurance Company: Promoter entity Abrdn (Mauritius Holdings) 2006 Limited has exited the life insurance company by selling entire 3.56 crore shares or 1.66% stake, to various investors, at an average price of Rs 570.60 per share. The stake sale was worth Rs 2,036.7 crore. With the stake sale, abrdn will hold nil equity shares in the company.

Sona BLW Precision Forgings: Societe Generale has bought additional 81.97 lakh shares in the auto ancillary company at an average price of Rs 503 per share, amounting to Rs 412.34 crore shares, and Government of Singapore purchased additional 36.43 crore shares in the company at an average price of Rs 540.44 per share. However, promoter entity Aureus Investment sold 1.9 crore shares or 3.24% stake in Sona BLW at an average price of Rs 503.73 per share, and BNP Paribas Arbitrage sold 96.84 lakh shares in the company at an average price of Rs 541.61 per share, amounting to Rs 524.5 crore. BNP Paribas Arbitrage held 73.91 lakh shares or 1.26% stake in Sona BLW, Societe Generale has 60.85 lakh shares or 1.04% stake, and Government of Singapore held 3.13 crore shares or 5.35% stake in the company as of March 2023.

Max Healthcare Institute: Government of Singapore has bought additional 66.6 lakh shares in the company via open market transactions at an average price of Rs 549.53 per share, amounting to Rs 366 crore. However, BNP Paribas Arbitrage have net sold 90.33 lakh shares in the company at an average price of Rs 546.56 per share, amounting to Rs 492.6 crore, and UBS Principal Capital Asia sold 75.43 lakh shares in Max Healthcare at an average price of Rs 548.03 per share, amounting to Rs 413.42 crore.

Goldstone Technologies: GTL is partnering with Quantron AG, a German e-mobility major, to establish a joint venture to address the high potential fleet management market. The fleet management market is valued at around $70 billion or Rs 5.8 lakh crore by 2032. By focusing on zero-emission transport, the JV aims to offer OEM-agnostic mobility as a service (MaaS) solutions, addressing efficiency and digitalization challenges.

Gati: Pirojshaw Aspi Sarkari has resigned as Chief Executive Officer of logistics company Gati, with effect from May 31. The company has appointed Pirojshaw Aspi Sarkari as MD & CEO of its subsidiary Gati-Kintetsu Express (GKEPL), with immediate effect, in the place of Adarsh Sudhakar Hegde who stepped down from the said position of Chairman & Managing Director with immediate effect. Shashi Kiran Shetty, the Chairman & Managing Director of Gati, has been appointed as Non-Executive Chairman of GKEPL.

Rainbow Children's Medicare: R Gowrisankar has resigned as Chief Financial Officer (CFO) of the healthcare company due to personal reasons with effect from May 31. The company has appointed Vikas Maheshwari as CFO of the company with effect from June 1.

South Indian Bank: The bank said its board of directors approved the panel of candidates for the position of the Managing Director & Chief Executive Officer (MD & CEO) of the bank. The bank will be submitting its application to Reserve Bank of India with the names of the candidates, seeking approval for the appointment of the new MD & CEO.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Mcx Commodity Intraday Trend Rupeedesk Reports - 31.05.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 31.05.2023

Bajaj-Auto Stock Report - 31.05.2023

Bajaj-Auto Stock Report - 31.05.2023

Dixon Stock Report - 31.05.2023

Dixon Stock Report - 31.05.2023

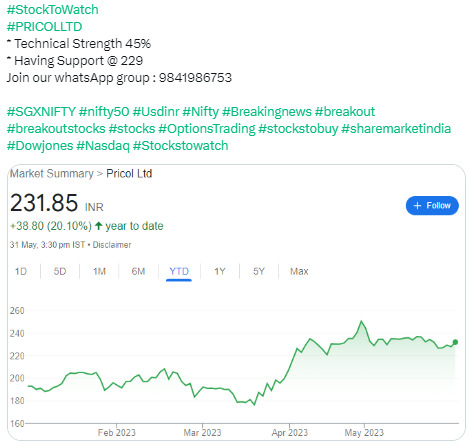

Stock to Watch Pricolltd - 31.05.2023

Stock to Watch Pricolltd - 31.05.2023

Stock to Focus Apollohosp - 31.05.2023

Stock to Focus Apollohosp - 31.05.2023

SENSEX OPTIONS TIPS - 31.05.2023

SENSEX OPTIONS TIPS - 31.05.2023

04.51 PM STRIKE 62600.00 PE : Buy Sensex(02 Jun) Put Option SA 196 SL 163 Target 230 / 238/ 266

Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Currency Market Intraday Trend Rupeedesk Reports - 31.05.2023

Currency Market Intraday Trend Rupeedesk Reports - 31.05.2023

Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Tuesday, May 30, 2023

US & Asian Markets - 31.05.2023

US & Asian Markets - 31.05.2023

Crudeoil - Dollar - Gold Updates - 31.05.2023

Crudeoil - Dollar - Gold Updates - 31.05.2023

TOP 10 Stocks In Focus - 31.05.2023

TOP 10 Stocks In Focus - 31.05.2023

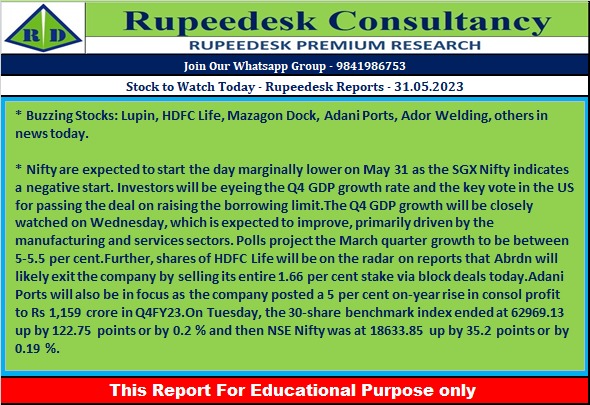

Stock to Watch Today - Rupeedesk Reports - 31.05.2023

Stock to Watch Today - Rupeedesk Reports - 31.05.2023

Buzzing Stocks: Lupin, HDFC Life, Mazagon Dock, Adani Ports, Ador Welding, others in news today.

Lupin: The pharma major announced a strategic collaboration with Enzene Biosciences to launch Cetuximab in India, the first biosimilar developed for Cetuximab. Cetuximab has received approval from the Drug Controller General of India (DCGI) for treating head and neck cancer, particularly Squamous Cell Carcinoma of the head and neck (SCCHN). Cetuximab is available as a 100mg vial.

HDFC Life Insurance Company: Abrdn (Mauritius Holdings) 2006 Limited is likely to exit the life insurance company by selling entire 1.66% equity via block deals, reports CNBC-TV18 quoting sources. The stake sale is likely to take place in the price range of Rs 563.20-585.15 per share.

Coal India: The country's largest coal mining company said the board has approved revision of non-coking coal prices with effect from May 31. The price increase is 8% over the existing notified prices for high grade coal of grade G2 to G10, which will be applicable to all subsidiaries of Coal India. Due to this revision, company will earn incremental revenue of Rs 2,703 crore for the balance period of financial year 2023-24.

Adani Ports and Special Economic Zone: The leading ports and logistics company has recorded consolidated profit at Rs 1,159 crore for March FY23 quarter, supported by healthy operating performance and topline, but impacted by lower other income, and exceptional loss of Rs 1,273 crore. Revenue from operations in Q4FY23 stood at Rs 5,797 crore increasing 40% over corresponding period last fiscal. The board has recommended a dividend Rs 5 per share for FY23.

Torrent Pharmaceuticals: The pharma company has reported consolidated profit at Rs 287 crore for quarter ended March FY23, supported by healthy topline and operating numbers. It had a loss of Rs 118 crore in Q4FY22 due to one-time loss of Rs 485 crore. Revenue from operations for fourth quarter stood at Rs 2,491 crore, growing 17% over corresponding period last fiscal, with India business rising 22% to Rs 1,257 crore, but US revenue fell by 1% to Rs 280 crore YoY. The board has given approval for fund raising up to Rs 5,000 crore via issuance of equity shares, and recommended a final dividend of Rs 8 per share.

Mazagon Dock Shipbuilders: The state-owned shipbuilding company has registered a stellar 105.1% year-on-year growth in consolidated profit at Rs 326.2 crore for fourth quarter of FY23 despite significant rise in input cost, driven by healthy topline and operating numbers. Revenue for the quarter came in at Rs 2,079 crore, growing 49% over corresponding period last fiscal. The company announced an interim dividend of Rs 6.86 per share for FY23.

Graphite India: The graphite electrodes manufacturer has posted consolidated profit at Rs 29 crore for fourth quarter of FY23, falling 69.5% compared to year-ago period, as it has subdued performance on topline as well as operating fronts. Lower other income also impacted profitability. Revenue from operations for January-March period stood at Rs 815 crore, declining 3.4% compared to corresponding period last financial year. The company has announced a dividend of Rs 8.50 per share.

Insecticides (India): The agrochemical company has posted consolidated loss of Rs 29.3 crore for March FY23 quarter impacted by higher input cost, against profit of Rs 22.3 crore in year-ago period. Revenue from operations for fourth quarter of FY23 stood at Rs 302 crore, growing 8.6% over a year-ago period.

Astrazeneca Pharma India: The pharma firm has recorded profit at Rs 17.3 crore for March quarter FY23, declining sharply by 38.3% compared to year-ago period despite stellar topline and operating numbers, impacted by one-time expenses of Rs 40.23 crore related to separation cost and voluntary retirement scheme. Revenue from operations for fourth quarter of FY23 stood at Rs 284.7 crore increasing 22.7% over same period last year. The company announced dividend of Rs 16 per share for FY23.

GOCL Corporation: The industrial explosives, mining products, speciality oils and chemicals, and pharma formulations manufacturer has registered a 90.4% year-on-year decline in consolidated profit at Rs 13.8 crore for March FY23 quarter despite stellar topline growth, impacted by weak operating performance due to higher input cost. Also the base in Q4FY22 was much higher due to one-time gain of Rs 127.61 crore. Revenue from operations for the quarter stood at Rs 241.8 crore, rising 88% YoY. The board has approved a dividend of Rs 5 per share for FY23 and a special dividend of Rs 5 per share, and raising of capital up to $100 million via debt or equity.

Royal Orchid Hotels: The hotel chain has recorded a massive 60.1% year-on-year decline in consolidated profit at Rs 12.7 crore for fourth quarter of FY23 due to high base, but operating numbers and topline remained strong. The Q4FY22 profit was supported by one-time gain of Rs 26.75 crore related to profit on sale of subsidiary and remeasurement gain on loss of control of in a subsidiary. Revenue for the quarter stood at Rs 72.5 crore, increasing 83.5% over corresponding period last fiscal.

Jindal Worldwide: The textile company has registered a 23.1% year-on-year decline in consolidated profit at Rs 26.5 crore for quarter ended March FY23 despite higher operating margin, impacted by lower topline. Revenue from operations for fourth quarter of FY23 stood at Rs 549.5 crore, declining 24.6% compared to same quarter last year.

Lumax Auto Technologies: The automotive components manufacturer has registered a 11.4% year-on-year fall in consolidated profit at Rs 18.6 crore for March FY23 quarter impacted by higher exceptional loss, but topline and operating numbers were strong. Revenue from operations for the quarter came in at Rs 493.3 crore, growing 18.3% over year-ago period. The company announced a final dividend of Rs 4.50 per share for FY23.

Tega Industries: Tega, the manufacturer of consumable products for mineral beneficiations and mining equipment, has reported a massive 58% year-on-year growth in consolidated profit at Rs 77.3 crore for fourth quarter of FY23, driven by strong topline as well as operating performance. Revenue for the quarter at Rs 396.4 crore increased by 36.66% over corresponding period last fiscal, with consumables segment showing a 24% growth at Rs 360 crore. Equipments business revenue stood at Rs 36.76 crore in Q4FY23, against nil in Q4FY22.

Sona BLW Precision Forgings: Promoter entity Aureus Investment is likely to sell upto 3.25% equity worth Rs 950 crore at Rs 500 per share in Sona BLW Precision Forgings, reports CNBC-TV18 quoting sources. Aureus Investment held 33% stake in Sona BLW at end of March 2023 quarter.

Indian Metals & Ferro Alloys: The ferro alloys producer has reported consolidated profit at Rs 64 crore for March FY23 quarter, falling 55% compared to corresponding period last fiscal. Weak topline and operating numbers impacted profitability. Revenue dropped 15.8% year-on-year to Rs 637 crore in fourth quarter of FY23.

Ador Welding: The industrial manufacturing company has recorded a 71% year-on-year growth in profit at Rs 22.55 crore for quarter ended March FY23, driven by strong operating numbers. Revenue for fourth quarter stood at Rs 235.5 crore, growing 18% over a year-ago period. The board has announced dividend of Rs 17.50 per share for FY23 and approved re-appointment of Aditya T Malkani as the Managing Director of the company for three years, with effect from September 14.

Kalpataru Power Transmission: Three promoters have offloaded Rs 467.83 crore worth shares in the power transmission and infrastructure EPC company via open market transactions. Kalptaru Constructions sold 10 lakh shares in the company at an average price of Rs 485.13 per share, Parag Mofatraj Munot offloaded 73.24 lakh shares at a price of Rs 485.75 per share, and Kalpataru Viniyog LLP sold 13.1 lakh shares at an average price of Rs 485.06 per share. However, ICICI Prudential Mutual Fund through its ICICI Prudential Equity & Debt Fund bought additional 14.95 lakh shares in Kalpataru at an average price of Rs 485 per share as ICICI Prudential Value Discovery Fund held 7.96% stake or 1.29 crore shares in company as of March 2023.

Krishna Institute of Medical Sciences: Foreign investor General Atlantic Singapore KH Pte Ltd has sold 23.2 lakh shares or 2.89% stake in KIMS via open market transaction at an average price of Rs 1,600 per share, which amounted to Rs 371.3 crore. As of March 2023, General Atlantic had held 8.61% stake or 68.89 lakh shares in KIMS.

Prestige Estates Projects: The south-based real estate firm has reported 50.1% year-on-year fall in consolidated profit at Rs 468.4 crore for March FY23 quarter despite healthy operating numbers, impacted by high base as the year-ago quarter enjoyed high exceptional gain. Revenue from operations for the quarter stood at Rs 2,631.8 crore, increasing 9.6% over a year-ago period.

Lemon Tree Hotels: The hotel chain has posted consolidated profit at Rs 43.97 crore for fourth quarter of FY23, against loss of Rs 24.6 crore in corresponding period last fiscal, driven by robust operating performance and topline. Revenue from operations for the quarter at Rs 252.7 crore increased by 111.4% over a year-ago period.

Suzlon Energy: The renewable energy solutions provider has recorded consolidated profit at Rs 279.9 crore for fourth quarter of FY23, against loss of Rs 204.3 crore in year-ago period. The highest exceptional gain and healthy operating margin supported bottomline. Revenue grew by 31.5% year-on-year to Rs 1,694 crore in Q4FY23.

Welspun Corp: The flagship company of the Welspun Group has registered a 0.1% decline in consolidated profit at Rs 235.93 crore for quarter ended March FY23 despite healthy topline and operating performance, as base in Q4FY22 was high due to higher other income. Revenue from operations stood at Rs 4,070 crore for the quarter, growing 102.4% over a year-ago period.

Patanjali Foods: The FMCG company has recorded fourth quarter profit at Rs 263.7 crore, rising 12.5% over a year-ago period despite weak operating numbers, driven by higher other income, and lower finance cost. Revenue from operations stood at Rs 7,873 crore, increasing 18.1% over same period last year. The board recommended a dividend of Rs 6 per share.

Mankind Pharma: The fourth largest pharmaceutical firm has recorded a 52% year-on-year growth in profit at Rs 294 crore for March FY23 quarter, driven by healthy operating numbers. Revenue for fourth quarter came in at Rs 2,053 crore, growing 19% YoY.

Indiabulls Real Estate: The real estate company has posted huge loss of Rs 375.9 crore for March FY23 quarter, widening sharply from Rs 59.8 crore in year-ago period. Revenue from operations fell by 57% to Rs 108.1 crore compared to corresponding period last fiscal.

Uflex: The packaging and solutions company has registered a 99.7% year-on-year decline in consolidated profit at Rs 0.88 crore for quarter ended March FY23, impacted by lower topline, other income, weak operating numbers, and higher exceptional loss. Revenue for the quarter stood at Rs 3,380.1 crore, falling 12.6% compared to year-ago period.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Mcx Commodity Intraday Trend Rupeedesk Reports - 30.05.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 30.05.2023

Currency Market Intraday Trend Rupeedesk Reports - 30.05.2023

Currency Market Intraday Trend Rupeedesk Reports - 30.05.2023

Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Sunpharma Stock Report - 30.05.2023

Sunpharma Stock Report - 30.05.2023

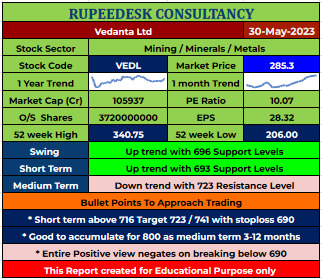

VEDL Stock Report - 30.05.2023

VEDL Stock Report - 30.05.2023