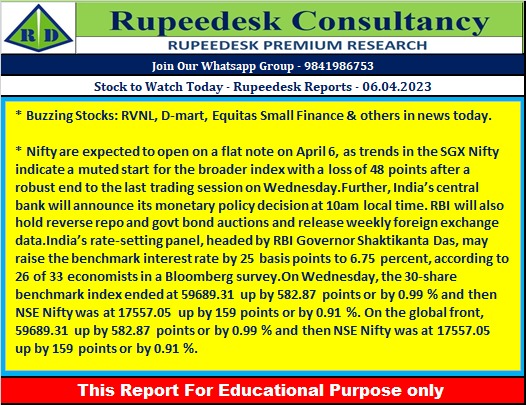

Stock to Watch Today - Rupeedesk Reports - 06.04.2023

Buzzing Stocks: RVNL, D-mart, Equitas Small Finance & others in news today.

Hero MotoCorp: The world's largest two-wheeler maker has launched a voluntary retirement scheme (VRS) for its staff. It expects this to improve efficiency within the company through a lean and more productive organization.

FSN E-Commerce Ventures: The beauty & personal care (BPC) segment has sustained strong demand, partly aided by the ‘Pink Love’ sale introduced by the Nykaa during Q4FY23. BPC business has seen higher year-on-year growth rates in Q4 FY23 compared to the YoY growth rates seen in Q3 FY23. The operating parameters for the BPC business - average order values and conversion rates - have been robust which has aided growth in revenue. For FY23 at the consolidated level, the company expects to sustain a percentage growth rate in line with 9MFY23. For Q4FY23, Nykaa expects percentage revenue growth rates in its fashion business to come through in the late teens on the back of focussing on business efficiency and unit economics.

Cholamandalam Investment and Finance Company: The company has recorded robust 65 percent growth in disbursements for Q4FY23 coming in approximately at Rs 21,020 crore against Rs 12,718 crore in the same period last year. In FY23, disbursements increased by 87 percent to Rs 66,532 crore compared to the previous year. Collection efficiency on billing stood at 130 percent in Q4FY23. The company continued to hold a strong liquidity position with Rs 5,222 crore as cash balance as of March 2023, with a total liquidity position of Rs 6,750 crore (including undrawn sanctioned lines).

Infosys: The leading IT services provider has extended its collaboration with LexisNexis, a data and analytics company, to provide end-to-end information services across their range of content, enterprise, and product applications. As part of the collaboration, Infosys will also provide strategic consultancy for LexisNexis' downstream, discretionary, and strategic spends.

Equitas Small Finance Bank: The small finance bank has registered a 36 percent year-on-year growth in gross advances at Rs 28,061 crore for the quarter that ended March FY23, and the sequential growth was 13 percent, as per provisional data. Disbursements for the quarter at Rs 5,917 crore increased by 80 percent YoY & 23 percent QoQ. Total deposits during the quarter at Rs 25,381 crore grew by 34 percent YoY and 8 percent QoQ. CASA ratio in Q4FY23 came in at 42 percent, against 52 percent in the same period last year.

Rail Vikas Nigam: RVNL has emerged as the lowest bidder (L1) for a project worth Rs 121 crore from North Central Railway. As a part of the project, the company will make provision of E1 based automatic signaling with continuous track circuiting and will do other associated works including suitable indoor alteration in the electronic interlocking/RRI/PI stations enroute in the Jhansi-Gwalior section of the Jhansi division of North Central Railway.

Dalmia Bharat Sugar and Industries: The board of directors has given approval to the company for setting up of grain-based distillery at the Nigohi unit with a capacity of 250 KLPD with a capital expenditure of Rs 400 crore. This distillery is expected to be commissioned by September 2024. Post commissioning, the total distillery capacity would be 1100 KLPD (cane based 600 KLPD and grain-based 500 KLPD). Also, the board approved capacity expansion at the Ramgarh sugar unit from 6,600 TCD to 7,000 TCD at capex of Rs 14 crore. Post-commissioning of the project, the total crushing capacity of the company would be 38,250 TCD.

Tatva Chintan Pharma Chem: The company said it has commenced its commercial production from the new facility at Dahej manufacturing plant in Gujarat.

Religare Enterprises: Religare Enterprises has entered into a share purchase agreement with its subsidiary Religare Finvest (RFL), and Religare Housing Development Finance Corporation (RHDFCL), for the acquisition of the entire equity stake of RHDFCL held by RFL. RHDFCL is a subsidiary of RFL and RFL currently holds 87.5 percent stake in RHDFCL. Post-acquisition, RHDFCL will become a direct subsidiary of Religare Enterprises. Meanwhile, Religare Enterprises acquired MIC, an IRDAI registered insurance web aggregator as for the said transaction, it has entered into a Share Purchase Agreement with IGEAR Holdings (IHPL), and The Indian Express (TIEPL).

Singer India: Rajeev Bajaj will step down as Managing Director of Singer India to pursue other interests. Bajaj will continue with the company till April 30, 2023, to provide transition and support to his successor. The company has appointed Rakesh Khanna as Executive Vice Chairman & Managing Director with effect from April 5.

Ujjivan Small Finance Bank: The small finance bank has clocked 33% YoY growth in Q4FY23 advances at Rs 24,114 crore, with disbursement above Rs 6,000 crore for the quarter and Rs 20,000 crore for the year FY23. Disbursement for the quarter grew 23% YoY driven by robust growth in microbanking, housing and FIG (financial institutions group). Deposits in Q4FY23 grew by 39% YoY to Rs 25,481 crore driven by strong retail and CASA growth.

Avenue Supermarts: The hypermarkets chain operator has recorded standalone revenue from operations at Rs 10,337.12 crore for the quarter ended March FY23, growing 20 percent over Rs 8,606 crore revenue in Q4FY22. The total number of stores as of March 2023 stood at 324.

LIC Housing Finance: The board of directors has appointed Siddhartha Mohanty as an additional director and non-executive chairman, and Jagannath Mukkavilli as an additional director (non-executive).

Tata Steel: India production volume grew by 5.1% to 5.15 million tonnes in Q4FY23 and delivery volume increased by 0.6% to 5.15 million tonnes compared to year-ago period. Europe's production volume remained flat at 2.31 million tonnes for Q4FY23 against Q4FY22, and delivery Volume fell significantly by 11.3% to 2.13 MT.

Greaves Cotton: Kewal Handa has resigned as Independent Director of the company with effect from April 5 due to his professional commitments. Kewal has confirmed that there are no other material reasons for his resignation.

Prakash Industries: The company has prepaid entire term loan to Indostar Capital Finance of around Rs 33 crore ahead of its maturity. The company is committed to reduce the pledge of promoter's shares.

RHI Magnesita India: The QIP Committee has closed company's Qualified Institutional Placement issue and approved the allocation of 1.57 crore equity shares to eligible qualified institutional buyers at an issue price of Rs 572.70 per share which is at a discount of 5% to the floor price of Rs 602.82 per share.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment