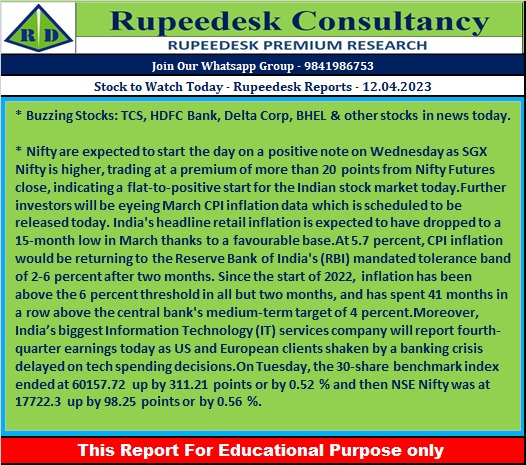

Stock to Watch Today - Rupeedesk Reports - 12.04.2023

Buzzing Stocks: TCS, HDFC Bank, Delta Corp, BHEL & other stocks in news today.

Tata Consultancy Services: The country's largest IT services exporter will be in focus ahead of March FY23 quarter earnings on April 12. Anand Rathi Wealth, and Dharani Sugars & Chemicals will also announce quarterly earnings on the same day.

HDFC Bank: The country's largest private sector lender has proposed to raise funds worth Rs 50,000 crore via bonds over the next 12 months through private placement. The board will consider the said proposal on April 15.

Delta Corp: The casino gaming company has reported a 6.4% year-on-year growth in Q4FY23 profit at Rs 51.17 crore impacted by weak operating performance. Consolidated revenue grew by 4% YoY to Rs 227.16 crore for the quarter. On the operating front, EBITDA (earnings before interest, tax, depreciation and amortisation) fell by 12.8% YoY to Rs 60.18 crore with margin declining 510 bps to 26.5% for the quarter.

Titagarh Wagons: Bharat Heavy Electricals and Titagarh Wagons consortium has received an order for Vande Bharat trainsets in the mega tender of Indian Railways. The company will manufacture and supply 80 sleeper class Vande Bharat trainsets and comprehensive maintenance of the same for 35 years. The order is for supply of 80 trainsets at the rate of Rs 120 crore per trainset.

Paras Defence and Space Technologies: Subsidiary Paras Anti-drone Technologies has entered into 'Memorandum of Understanding' (MoU) with Spacekawa Explorations (Kawa Space) for indigenous developments and deployment of space intelligence, surveillance and reconnaissance (ISR) payloads. Paras Anti-drone and Kawa Space will develop and advance technologies for space applications that can address the challenges of a rapidly changing world.

Sula Vineyards: The country's largest wine producer says its own brands sales volumes crossed 1 million cases, with Elite & Premium wines surging past the 5 lakh case mark for the first time. The company has recorded its highest-ever annual revenues both for its own brands as well as the wine tourism business. The company witnessed a strong 15% growth YoY for its own brands in Q4FY23 at Rs 104.3 crore, and wine tourism grew by 18% YoY to Rs 12.4 crore, while own brands revenue in FY23 increased by 26% to Rs 482.5 crore and wine tourism business registered a 30% jump at Rs 45 crore in FY23 compared to FY22.

Marathon Nextgen Realty: The company sold 1.53 lakh square feet of area in Q4FY23, down 31% over 2.24 lakh square feet of area sold in same period last year. The sales value for the quarter stood at Rs 226.4 crore, down 20%. In FY23, it sold 5.21 lakh square feet of area, down 12% compared to FY22, but sales value in the same period rose 12% to Rs 753 crore. On a full year basis, the net debt was reduced by Rs 325 crore from Rs 1,189 crore in FY22 to Rs 864 crores in FY23.

KP Energy: The company has successfully commissioned a 52.5 MW (Phase-I) ISTS-connected wind power project comprising 25 numbers of WTGs (wind turbine generators) of 2.1MW each at Sidhpur site in Devbhoomi Dwarka. The remaining phases of the project are expected to be completed successfully by July 2023.

Life Insurance Corporation of India: The Corporation has appointed Ratnakar Patnaik as Chief Investment Officer with effect from April 10, in place of P R Mishra who has transferred and posted to another assignment. P C Paikray is appointed as Chief Risk Officer of the Corporation, in place of Tablesh Pandey who has taken charge as Managing Director of the Corporation.

Delhivery: Internet Fund III Pte Ltd, the venture capital fund managed by US-based investment management company Tiger Global Management, sold 1.17 crore equity shares or 1.61% stake in the logistics company via open market transactions at an average price of Rs 330 per share, amounting Rs 387.87 crore.

Adani Enterprises: The Adani Group company has incorporated a wholly-owned subsidiary Pelma Collieries. Pelma will carry on business to develop, erection, operate of coal washery including coal handling systems.

Venus Pipes & Tubes: Ace investor Ashish Rameshchandra Kacholia has bought 4 lakh equity shares or 1.97% stake in the company via open market transactions at an average price of Rs 750 per share. However, Nuvama Wealth Finance sold 1.38 lakh shares in Venus Pipes at an average price of Rs 750.02 per share.

Sagar Cements: PGIM India Mutual Fund has offloaded 60.39 lakh equity shares in the cement company via open market transactions at an average price of Rs 183.1 per share, amounting to Rs 110.58 crore. ICICI Prudential Mutual Fund was the buyer.

Sanofi India: NPPA (National Pharmaceutical Pricing Authority) has issued the list to fix the ceiling price for the cost to patients of company’s insulin glargine brand Lantus and accordingly the said product will be subject to a price reduction of approximately 21% on a weighted average basis considering the different SKU’s being marketed by the company. While there will be an impact on sales, the company does not expect a material impact on the profitability. The drop in price is also likely to result in some volume traction in Lantus especially in the second half of the year.c

Spandana Sphoorty Financial: The board of directors will meet on April 14 to consider the fund raising by way of issuance of non-convertible debentures on private placement basis.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment