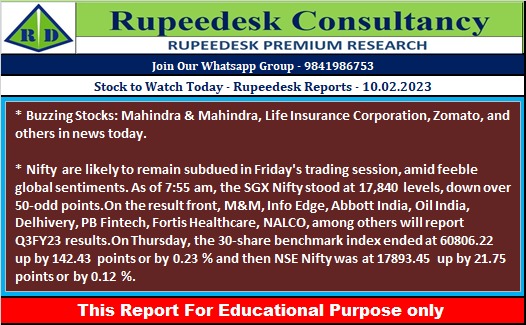

Stock to Watch Today - Rupeedesk Reports - 10.02.2023

Buzzing Stocks: Mahindra & Mahindra, Life Insurance Corporation, Zomato, and others in news today.

Results on February 10: Mahindra and Mahindra, ABB India, PB Fintech, Abbott India, Alkem Laboratories, Ashoka Buildcon, Astrazeneca Pharma, BEML, BHEL, Dilip Buildcon, Delhivery, EIH, Glenmark Pharmaceuticals, JK Lakshmi Cement, KFin Technologies, Lemon Tree Hotels, Metropolis Healthcare, NALCO, Info Edge India, and Oil India will be in focus ahead of quarterly earnings on February 10.

Life Insurance Corporation of India: The life insurer has reported standalone profit of Rs 8,334.2 crore for quarter ended December FY23, growing multifold compared to profit of Rs 235 crore in same quarter last year on the back of strong growth. Net premium income for the quarter at Rs 1.11 lakh crore increased by 14.5% over a year-ago period and first year premium or new business premium increased by 11 percent YoY to Rs 9,725 crore for the quarter.

Zomato: The food delivery giant has posted consolidated loss of Rs 346.6 crore for the December FY23 quarter, widening from loss of Rs 63.2 crore in year-ago period given the significantly higher expenses (up 51%). Consolidated revenue grew by 75.2% YoY to Rs 1,948.2 crore for the quarter, while at the operating level, EBITDA loss of Rs 366.2 crore for the quarter narrowed compared to EBITDA loss of Rs 488.8 crore in corresponding period last fiscal.

Aurobindo Pharma: The pharma company has recorded a 18.7% year-on-year fall in consolidated profit at Rs 491 crore for quarter ended December FY23, dented by weak operating margin performance. Consolidated revenue for the quarter at Rs 6,407 crore increased by 6.7% over a year-ago period with US formulations business growing 9.3%, Europe formulation segment showing 0.4% increase and growth markets business rising 25.7% YoY. On the operating front, EBITDA fell 6% YoY to Rs 954.4 crore for the quarter with margin declining 204 bps YoY to 14.89% due to higher spend on R&D.

Hindustan Petroleum Corporation: The oil marketing company has turned profitable with Q3FY23 net at Rs 172.4 crore against loss of Rs 2,172 crore in previous quarter, with better operating performance. Standalone revenue grew by 1% to Rs 1.09 lakh crore compared to previous year. On the operating front, its EBITDA came in at Rs 1,671.7 crore for quarter ended December FY23, against loss of Rs 1,497.9 crore in September FY23 quarter.

MTAR Technologies: The precision engineering solutions company has recorded standalone profit at Rs 31.4 crore for quarter ended December FY23, growing 136.2% over a year-ago period. Revenue from operations more than doubled to Rs 160.2 crore in Q3FY23, against Rs 78.1 crore in same period last year. EBITDA at Rs 45 crore for the quarter grew by 97.4% over corresponding period last fiscal, but margin fell by 110 bps YoY to 28.09% on significant increase in input cost.

ITC: Subsidiary ITC Infotech India has incorporated a wholly-owned subsidiary in France under the name of ITC Infotech France SAS. Consequently, ITC France has become a step-down wholly owned subsidiary of ITC.

Pfizer: The pharma company has reported a 4.7% year-on-year growth in profit at Rs 150.66 crore for three-month period ended December FY23, driven by good operating performance, but revenue from operations fell 8% YoY to Rs 621.75 crore for the quarter. On the operating front, EBITDA increased 4.2% YoY to Rs 203.45 crore and margin expanded by 385 bps YoY to 32.72% during the quarter. The company appointed Meenakshi Nevatia as the Managing Director and Additional Director for five years.

United Breweries: The beer and non-alcoholic beverages maker has posted loss of Rs 2.1 crore for December FY23 quarter, against profit of Rs 90.56 crore in same period last year, impacted by weak operating performance and exceptional loss of Rs 33.12 crore. Revenue for the quarter at Rs 1,611 crore grew by 1.9% over a year-ago period. On the operating front, EBITDA fell 54% YoY to Rs 76.65 crore and margin plunged 623 bps to 4.75% in the same period. Numbers missed analysts' expectations.

Voltas: The air conditioning and engineering services provider posted consolidated loss of Rs 110.38 crore for quarter ended December FY23, against profit of Rs 96 crore in same period last year, as there was an exceptional loss of Rs 137.39 crore related to provision arising out of cancellation of contract and encashment of bank guarantee. Revenue for the quarter grew by 12% YoY to Rs 2,005.61 crore with growth in unitary cooling products as well as electro-mechanical projects & services segments. EBITDA at Rs 76.37 crore for the quarter declined by 51% YoY with margin contraction of 490 bps YoY.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment