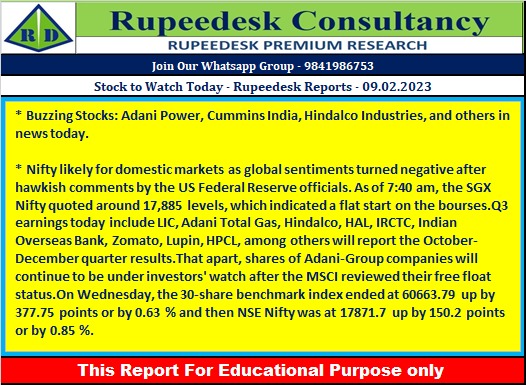

Stock to Watch Today - Rupeedesk Reports - 09.02.2023

Buzzing Stocks: Adani Power, Cummins India, Hindalco Industries, and others in news today.

Results on February 9: Hindalco Industries, Hindustan Petroleum Corporation, Life Insurance Corporation of India, Lupin, Zomato, Adani Total Gas, Aurobindo Pharma, Bajaj Consumer Care, Bombay Dyeing & Manufacturing Company, Devyani International, Force Motors, General Insurance Corporation of India, Greaves Cotton, Hindustan Aeronautics, Indian Railway Catering and Tourism Corporation, Jet Airways, Kalpataru Power Transmission, MRF, Natco Pharma, Page Industries, Pfizer, Sapphire Foods India, Suzlon Energy, United Breweries, Ujjivan Financial Services, and Voltas will be in focus ahead of quarterly earnings on February 9.

Adani Power: The Adani Group company has recorded consolidated profit at Rs 8.77 crore for quarter ended December FY23, down 96 percent compared to year-ago period impacted by significantly higher fuel cost, though profit was supported by higher other income. Consolidated revenue for the quarter at Rs 7,764.4 crore increased by 45 percent over a year-ago period mainly due to greater regulatory claims, increased operating capacity, and improved tariff realization. At the operating level, EBITDA fell by 17 percent YoY to Rs 1,470 crore with margin down over 1,400 bps YoY for the quarter.

Gujarat Pipavav Port: The port services company has clocked a 89 percent year-on-year increase in consolidated profit at Rs 84.4 crore for three-month period ended December FY23 despite higher input cost, driven by healthy topline as well as operating income. Revenue from operations for the quarter grew by 49 percent YoY to Rs 250.6 crore, while EBITDA at Rs 142 crore increased by 63.4 percent, with margin expansion of 512 bps compared to year-ago period.

RBL Bank: The Reserve Bank of India has approved the re-appointment of Rajeev Ahuja as Executive Director of RBL Bank for three years effective from February 21 this year. Rajeev Ahuja will be designated as key managerial personnel of the bank.

Larsen & Toubro: Ministry of Defence has signed a contract with Larsen & Toubro for the procurement of 41 indigenous modular bridges, worth over Rs 2,585 crore, for the Corps of Engineers of Indian Army. A modular bridge is fabricated in modules that can be installed quickly in the field.

Techno Electric & Engineering Company: The company has sold/disposed off 37.50 MW of 111.90 MW of its wind power assets in Tamil Nadu for Rs 158.93 crore. It has entered into MoUs for the sale of another 71.40 MW. TECHNO had installed 111.90 MW wind power assets in the year 2011.

Uno Minda: The auto ancillary company has received approval from board members for buying 22.6 percent stake in Minda Kosel Aluminum Wheel (MKA) from its JV partner Kosei International Trade and Investment Company, for Rs 116 crore. With this, MKA will become wholly owned subsidiary of the company.

Indian Bank: The public sector bank has revised its repo benchmark rate on all loans by 25 bps to 6.50 percent with effect from February 9. The bank has taken this decision after increase in repo rate of 25 bps by Monetary Policy Committee of RBI.

Trent: The retail company has reported nearly 20 percent year-on-year growth in consolidated profit at Rs 167 crore for three-month period ended December FY23. It registered the highest ever quarterly revenues at Rs 2,303.4 crore, up 54 percent YoY. At the operating level, EBITDA grew by 18.5 percent YoY to Rs 323.2 crore but margin fell by 415 bps YoY to 14.03 percent for the quarter given the higher expenses. Numbers are not comparable YoY as Q3FY22 had accounting for rent waivers and reversals relating to inventory provisioning.

Oberoi Realty: The Mumbai-based real estate company has registered a 50.3 percent year-on-year growth in consolidated profit at Rs 702.6 crore for quarter ended December FY23 on healthy topline and operating performance. Consolidated revenue surged 96 percent YoY to Rs 1,630 crore for the quarter. On the operating front, EBITDA jumped 184 percent YoY to Rs 940.4 crore with margin expansion of 1,786 bps compared to year-ago period.

Cummins India: The diesel and natural gas engines manufacturer has recorded better than expected earnings on all fronts for Q3FY23 as profit grew by 49 percent YoY to Rs 360.14 crore and revenue increased by 25.7 percent to Rs 2,181 crore for the quarter. At the operating level, EBITDA jumped 52.4 percent YoY to Rs 412.2 crore with margin expansion of 331 bps compared to year-ago period. The company announced an interim dividend of Rs 12 per share for FY23.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment