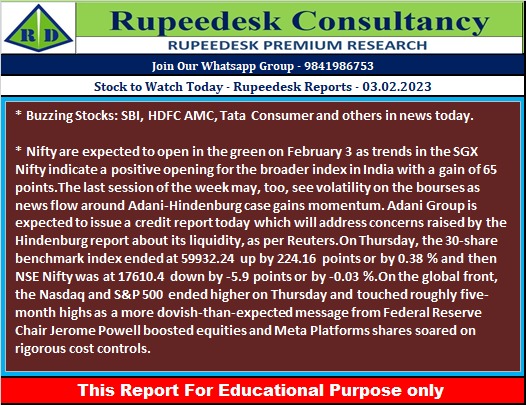

Stock to Watch Today - Rupeedesk Reports - 03.02.2023

Buzzing Stocks: SBI, HDFC AMC, Tata Consumer and others in news today.

Results on February 3: State Bank of India, Divis Labs, Bank of Baroda, Tata Power, InterGlobe Aviation, One 97 Communications (Paytm), Marico, Mahindra & Mahindra Financial Services, Zydus Lifesciences, Manappuram Finance, Aarti Industries, Borosil, Clariant Chemicals, Elgi Equipments, Emami, Engineers India, India Cements, Intellect Design Arena, JK Tyre & Industries, Jubilant Pharmova, Kansai Nerolac Paints, Nava, Praj Industries, Quess Corp, Shipping Corporation of India, Sun TV Network, and Tube Investments of India would be in focus ahead of quarterly earnings on February 3.

ITC: The cigarette-hotel-to-FMCG major is going to announce its December FY24 quarter earnings on February 3. The stock has hit a record high of Rs 385 on February 2, continuing uptrend for third straight session.

Results on February 4: MCX India, Affle (India), Apex Frozen Foods, Atul Auto, Birla Corporation, Dalmia Bharat, Finolex Industries, India Pesticides, Relaxo Footwears, Rossari Biotech, Skipper, and Voltamp Transformers will be in focus ahead of December FY23 quarter earnings on February 4.

HDFC Asset Management Company: The Sebi has given an approval and permitted abrdn Investment Management to reduce its shareholding in HDFC AMC to less than 10%. In December 2022, HDFC AMC had received letter from abrdn Investment Management, one of the promoters holding 10.21% in the company, intending to sell their entire stake in the company. abrdn Investment Management is the co-sponsor of HDFC Mutual Fund.

Tata Consumer Products: The FMCG company has recorded a 26% year-on-year growth in consolidated profit at Rs 364.4 crore for quarter ended December FY23 despite weak operating margin, led by tax write-back, exceptional income and higher other income. Revenue for the quarter grew by 8.3% YoY to Rs 3,475 crore with India business growth of 8% and international business rising 4%, however, EBITDA fell 1.7% to Rs 454 crore and margin declined by 130 bps to 13.1% for the quarter.

Adani Enterprises: The National Stock Exchange (NSE) has put Adani Enterprises, Adani Port, Ambuja Cement under additional surveillance measure (ASM) framework starting February 3, especially after massive stock rout in most of Adani group stocks. This will mean the intraday trading will also require 100% upfront margin.

IndusInd Bank: The Hinduja Group is looking to increase its stake in IndusInd Bank to 26% from the existing 16.51%, reports CNBC-TV18 quoting sources. IndusInd International Holdings, promoter of IndusInd Bank, is preparing the application for the process and will further submit the same to the Reserve Bank of India (RBI), sources said.

Mazagon Dock Shipbuilders: Sanjeev Singhal, with effect from February 1, 2023, has been given additional charge of Chairman & Managing Director of Mazagon Dock Shipbuilders. Singhal joined Mazagon Dock as Director (Finance) on January 8, 2020.

Inox Green Energy Services: The wind power operation and maintenance service provider entered into a definitive investment agreement with I-Fox Windtechnik India, an independent O&M wind service provider, to acquire 51% stake in I-Fox at Rs 35,947.71 per share. I-Fox has a fleet of 230+MW majorly operating in South India. With this acquisition, company entered into multi-brand OEM wind turbine O&M business.

Likhitha Infrastructure: The company has received an order worth Rs 129.63 crore from GAIL (India). The scope of work included pipeline laying and composite works for PART-B (Nagpur Jharsuguda) of MNYJPL project. The contract has to be executed within 14 months from the date of letter of intent.

Berger Paints India: The paint company has recorded a 20.5% year-on-year decline in consolidated profit at Rs 200.94 crore for quarter ended December FY23 impacted by weak operating margin performance. Revenue for the quarter at Rs 2,694 crore grew by 5.6%, but EBITDA fell by 11% to Rs 350 crore compared to year-ago period.

Apollo Tyres: The tyre manufacturer has reported a 31% year-on-year growth in consolidated profit at Rs 292.1 crore for December FY23 quarter despite spike in input & finance costs. Revenue for the quarter at Rs 6,423 crore increased by 12.5% and EBITDA jumped 23% to Rs 913.4 crore with margin expansion of 120 bps compared to year-ago period. Jaimini Bhagwati is appointed as Independent Director on the board.

Eclerx Services: The IT services management company has recorded a 23.2% year-on-year growth in consolidated profit at Rs 131.3 crore for quarter ended December FY23 despite fall in operating profit margin that hit by higher employee expenses, led by other income and topline. Revenue for the quarter grew by 23% YoY to Rs 687 crore compared to year-ago period.

NMDC: The state-owned iron ore company has fixed lump ore price (65.5%, 6-40mm) at Rs 4,400 per tonne, and fines price (64%, -10mm) at Rs 3,910 per tonne.

Mahindra Lifespace Developers: The company has registered a 37.2% year-on-year growth in consolidated profit at Rs 34.1 crore for December FY23 quarter with EBITDA loss narrowing significantly to Rs 11.4 crore and exceptional gain of Rs 27.08 crore. Revenue surged 668% YoY to Rs 186.9 crore for the quarter.

GMM Pfaudler: The technologies, systems and services provider has reported a 41.3% year-on-year decline in profit at Rs 18.67 crore for quarter ended December FY23 hit by negative other income and exceptional loss. Revenue for the quarter at Rs 792.3 crore grew by 23.4% and EBITDA surged 44% to Rs 118.4 crore compared to year-ago period with margin expansion of around 2 percentage points.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment