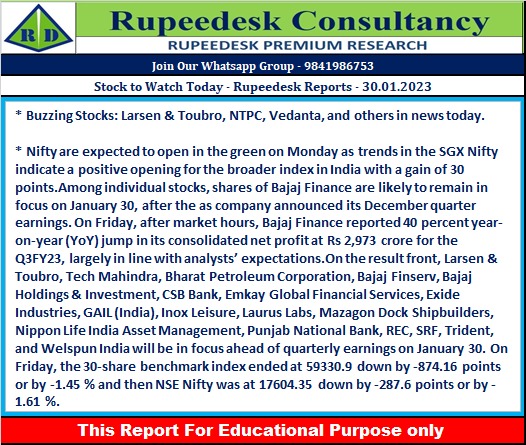

Stock to Watch Today - Rupeedesk Reports - 30.01.2023

Buzzing Stocks: Larsen & Toubro, NTPC, Vedanta, and others in news today.

Results on January 30: Larsen & Toubro will be in focus ahead of the quarterly earnings today. Among others, Tech Mahindra, Bharat Petroleum Corporation, Bajaj Finserv, Bajaj Holdings & Investment, CSB Bank, Emkay Global Financial Services, Exide Industries, GAIL (India), Inox Leisure, Laurus Labs, Mazagon Dock Shipbuilders, Nippon Life India Asset Management, Punjab National Bank, REC, SRF, Trident, and Welspun India will declare their quarterly earnings on January 30.

Bajaj Finance: The finance company has clocked a 40% year-on-year growth in consolidated net profit at Rs 2,973 crore for December FY23 quarter with loan losses and provisions falling 20% YoY to Rs 841 crore for the quarter. Net interest income for Q3FY23 increased by 24% YoY to Rs 7,435 crore and assets under management (AUM) grew by 27% YoY to Rs 2.3 lakh crore as of December FY23. New loans booked during Q3FY23 were highest ever at 7.84 million, up 5% YoY. Customer franchise stood at 66.05 million as of December FY23 as compared, a growth of 19% YoY. The company recorded highest ever quarterly increase in its customer franchise of 3.14 million during the quarter.

Vedanta: The billionaire Anil Agarwal-owned company has reported a 42.3% year-on-year fall in consolidated profit at Rs 3,091 crore for quarter ended December FY23, hit by weak operating performance and muted topline growth. It has higher input cost, power & fuel expenses, and finance cost for the quarter YoY. Revenue from operations for Q3FY23 at Rs 34,102 crore grew by 0.01% compared to year-ago period. The company has approved plans for the Group to source 91 MW hybrid renewable power aluminium, copper, and oil & gas operations; and 600 MW solar power for aluminium operations. It aims to achieve substantial consumption of renewable energy for smelting and associated operations, and meeting power requirements of capacity expansion.

NTPC: The country's largest power generation company has recorded a 5.4% year-on-year growth in standalone profit at Rs 4,476 crore impacted by lower operating margin performance. Revenue grew by 37% YoY to Rs 41,411 crore compared to year-ago period. At the operating level, EBITDA jumped 36% to Rs 13,239 crore, but margin fell by 15 bps to 31.97% YoY, for the quarter. The gross generation grew by 3.93% to 78.64 billion units and installed capacity rose by 3,127 MW to 70,884 MW compared to same period last year.

Kajaria Ceramics: The ceramic and vitrified tiles manufacturer has registered a 41% year-on-year growth in consolidated profit at Rs 73.66 crore for quarter ended December FY23, as operating numbers were down. Consolidated revenue grew by 2.1% YoY to Rs 1,091.1 crore for the quarter. On operating front, EBITDA was down by 27.6% to Rs 133 crore and margin fell by 5 percentage points to 12.2% for the quarter compared to same period last year.

Bharat Electronics: The state-owned aerospace and defence company has recorded a 2.6% year-on-year growth in standalone profit at Rs 599 crore for quarter ended December FY23, dented by weak operating margin. Revenue from operations at Rs 4,131 crore for the quarter increased by 12% over a year-ago period. At the operating level, EBITDA rose nearly 4% YoY to Rs 853.5 crore, but margin fell by 160 bps YoY to 20.66% for the quarter. In addition, the board members have appointed Damodar S Bhattad, Director (Finance) as Chief Financial Officer of the company.

Aditya Birla Sun Life AMC: The asset management company has reported a 11% decline in consolidated profit at Rs 166.3 crore for quarter ended December FY23 despite higher other income and lower tax cost, impacted by fall in topline growth. Revenue from operations fell 6% to Rs 314 crore compared to year-ago period.

Tata Elxsi: The design and technology services provider has registered a 29% year-on-year growth in profit at Rs 195 crore for quarter ended December FY23, backed by topline and other income. Revenue from operations for the quarter at Rs 818 crore grew by 29% over a year-ago period.

Tube Investments of India: Tube Investments of India subsidiary acquires remaining 30% stake in Cellestial E-Mobility. Subsidiary TI Clean Mobility has entered into Share Purchase Agreement for acquisition of remaining 30.04% equity shares held by the founders of Cellestial E-Mobility for Rs 50.90 crore. The proposed investment is part of TI Clean Mobility's plan to consolidate its holding in the electric tractors business.

Godfrey Phillips India: The tobacco manufacturer has reported a 60% year-on-year increase in consolidated profit at Rs 187 crore for quarter ended December FY23, led by healthy operating income growth of 64% and margin expansion. Revenue from operations grew by 28% YoY to Rs 1,112 crore the quarter.

Aarti Drugs: The pharma company has registered a 37% year-on-year decline in consolidated profit at Rs 36.67 crore for quarter ended December FY23, hit by weak operating performance and tepid topline growth. Consolidated revenue for the quarter at Rs 664 crore increased by 4.6% compared to corresponding period last fiscal.

Adani Enterprises: The Rs 20,000-crore follow-on public offer of the flagship company of Adani Group will remain open for subscription on January 30, the second day of bidding. The issue, so far, subscribed 1%. The issue price band at Rs 3,112-Rs 3,276 per share.

Dixon Technologies: The company signed a term sheet with Mega Alliance (Part of Tinno Group) to form joint venture for designing & manufacturing of mobile communication equipment and related solutions in India. Dixon will hold 51% and Mega Alliance 49% stake in the prospective JV company.

Hinduja Global Solutions: The IT services management company has received board approval for the share buyback worth upto Rs 1,020 crore. It has fixed a buyback price at Rs 1,700 per share, which is 31% higher over the closing price of Rs 1,299 on January 27.

CMS Info Systems: The banking logistics and technology services provider has clocked a 26% YoY growth in profit at Rs 76 crore for quarter ended December FY23 with EBITDA rising 29% YoY to Rs 135 crore and revenue climbing 21% to Rs 488 crore. The company has seen operating profit margin expansion of 171 bps YoY at 27.7% for the quarter.

Fineotex Chemical: The textile chemicals and auxiliaries’ company has clocked a 18% year-on-year growth in consolidated profit at Rs 22.5 crore for quarter ended December FY23, supported by healthy operating growth of 14%. Revenue from operations grew by 4% YoY to Rs 109.2 crore for the quarter.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment