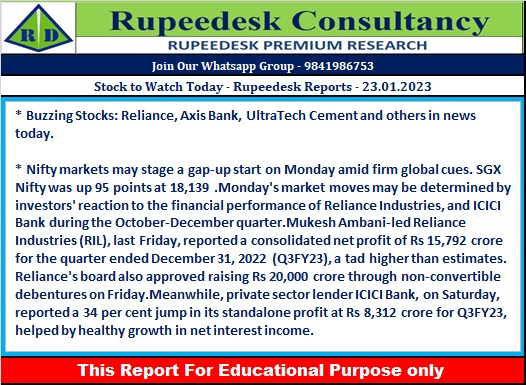

Stock to Watch Today - Rupeedesk Reports - 23.01.2023

Buzzing Stocks: Reliance, Axis Bank, UltraTech Cement and others in news today.

Results on January 23: Axis Bank, IDBI Bank, Canara Bank, Container Corporation of India, Amber Enterprises India, Craftsman Automation, Butterfly Gandhimathi Appliances, Gland Pharma, Gravita India, HFCL, Jammu & Kashmir Bank, Jindal Stainless, Poonawalla Fincorp, Route Mobile, Shoppers Stop, Syngene International, Tata Communications, Tamilnad Mercantile Bank, and Zensar Technologies will be in focus ahead of quarterly earnings on January 23.

Reliance Industries: The oil-telecom-to-retail major has delivered strong operating performance for the quarter ended December FY23 with contribution from all segments, with consolidated profit (excluding the impact of exceptional item) rising marginally by 0.6% YoY to Rs 17,806 crore for Q3FY23; and EBITDA growing 13.5% YoY to Rs 38,460 crore for the quarter backed by strong growth in subscriber base and 17.5% increase in ARPU (average revenue per user) in digital services segment. Gross revenue at Rs 2.4 lakh crore in Q3 increased by 14.8% YoY supported by continuing growth momentum in consumer businesses.

ICICI Bank: The country's second largest private sector lender recorded 34.2% year-on-year increase in standalone profit at Rs 8,312 crore for quarter ended December FY23 on healthy growth in NII and operating profit, with improvement in asset quality. Net interest income surged 34.6% to Rs 16,465 crore compared to year-ago period with net interest margin expanding 69 bps YoY to 4.65% for the quarter. Profit and NII were ahead of analysts' estimates. Credit growth was 19.7% and deposits increased by 10.3% compared to year-ago period.

Kotak Mahindra Bank: The private sector lender has clocked 31% year-on-year growth in standalone profit at Rs 2,792 crore for quarter ended December FY23 despite higher provisions, backed by healthy operating profit, other income and NII growth, with improvement in asset quality performance. Net interest income for the quarter jumped 30.4% to Rs 5,653 crore with 85 bps YoY expansion in net interest margin at 5.47%. Deposits for the quarter grew by 13% and advances increased by 23% compared to year-ago period.

UltraTech Cement: The Aditya Birla Group-owned cement company has reported a 38% year-on-year decline in consolidated profit at Rs 1,058.2 crore for quarter ended December FY23, impacted by weak operating margin. It has seen an increase in raw material cost, power & fuel cost and freight & forwarding expenses YoY. Consolidated revenue from operations increased 19.5% to Rs 15,521 crore for the quarter YoY.

IDFC First Bank: The bank has clocked a 115% year-on-year growth in standalone profit at Rs 604.6 crore for December FY23 quarter despite higher provisions, supported by strong other income, operating profit and NII with asset quality improvement. Net interest income for the quarter at Rs 3,285.3 crore grew by 27.3% compared to corresponding period last fiscal.

Yes Bank: The private sector lender has registered a 80.7% year-on-year decline in standalone profit at Rs 51.5 crore for quarter ended December FY23 impacted by ageing related provisions, but supported by higher other income and operating profit with improvement in asset quality. Net interest income grew by 11.7% to Rs 1,970.6 crore for the quarter YoY, with net interest margin rising 10 bps YoY (down 10 bps QoQ) to 2.5%. Advances for the quarter grew by 10% and deposits growth stood at 16% compared to corresponding period last fiscal.

Trent: The Tata Group company has executed an equal joint venture with MAS Amity Pte Ltd. The company with equal joint venture will set up an entity in India for jointly developing a business of intimate wear and other apparel related products.

State Bank of India: The country's largest lender has entered into an agreement to purchase of 40% stake in Commercial Indo Bank LLC (CIBL), Moscow held by Canara Bank. The transaction is expected to be completed by March 2023 and the acquisition cost is $14.67 million.

RBL Bank: The bank has clocked a 34% year-on-year increase in profit at Rs 209 crore for quarter ended December FY23, on fall in provisions with improvement in asset quality. Net interest income at Rs 1,148 crore for the quarter rose by 13.6% compared to year-ago period, with net interest margin expanding 40 bps YoY to 4.74%. Advances for the quarter at Rs 66,684 crore increased by 15%, and deposits grew by 11% with CASA deposits rising 18%.

Tanla Platforms: The cloud communications company has recorded a 26.3% year-on-year decline in profit at Rs 116.5 crore for December FY23 quarter, dented by lower top line and weak operating performance. Revenue for the quarter at Rs 869.6 crore fell by 1.7% and EBITDA tanked 25% to Rs 151.4 crore with margin down 550 bps compared to year-ago period.

Indian Energy Exchange: India's power trading platform has registered a 4% year-on-year fall in consolidated profit at Rs 77.2 crore for quarter ended December FY23, dented by double-digit decline in revenue and operating income. Consolidated revenue from operations at Rs 100.3 crore dropped 14.7% compared to year-ago period.

JSW Energy: The power company has reported a 42% year-on-year decline in consolidated profit at Rs 187 crore for quarter ended December FY23 impacted by higher fuel cost. Consolidated revenue from operations grew by 18% YoY to Rs 2,248 crore for the quarter due to higher realisation. Overall net generation at 4.3 billion units declined by 5% YoY due to lower merchant market sales in the quarter. EBITDA at Rs 727 crore during the quarter fell by 18% YoY primarily due to lower short term sales YoY, partly offset by contribution from Vijayanagar Solar and higher other income in the quarter.

Petronet LNG: The liquified natural gas importer has recorded 58.6% quarter-on-quarter growth in profit at Rs 1,180.5 crore for quarter ended December FY23 on strong operating performance, beating analysts' estimates. Revenue from operations fell by 1.3% QoQ to Rs 15,776 crore, but EBITDA grew by 43% sequentially to Rs 1,675 crore for the quarter.

Bandhan Bank: The private sector lender has registered a massive 66% year-on-year decline in profit at Rs 290.6 crore for December FY23 quarter, dented by higher provisions and lower growth in net interest income. Net interest income fell 2% YoY to Rs 2,080.4 crore for the quarter, with 130 bps drop in net interest margin at 6.5%. Loan book grew by 11.1% and deposits rose by 21% YoY.

LTIMindtree: The IT services company has recorded a 16% sequential fall in profit at Rs 1,001 crore for quarter ended December FY23, with EBITDA at Rs 1,374.8 crore declining 16 percent QoQ and margin dropping nearly 4 percentage points QoQ to 15.95%. Revenue grew by 4.8% sequentially to Rs 8,620 crore, with dollar revenue growth at 2.4% and constant currency revenue growth at 1.9% for the quarter.

JSW Steel: The steel company has reported a 89.5% year-on-year decline in profit at Rs 474 crore for quarter ended December FY23, impacted by higher raw material cost and power & fuel expenses. Revenue grew by 2.8% YoY to Rs 39,134 crore for the quarter.

Punjab & Sind Bank: The bank has recorded a 24% year-on-year growth in profit at Rs 373.2 crore for December FY23 quarter, supported by provisions write-back, with improvement asset quality. Net interest income grew by 6.2% YoY to Rs 805 crore for Q3FY23, with gross advances growth of 16.54% and deposit growth of 9.1%.

Strides Pharma Science: The World Health Organization has completed an inspection of Puducherry facility of the company during January 16-20, 2023. The Puducherry facility caters to the US, other regulated markets, and institutional businesses; and can produce finished dosage formulation products across multiple dosage formats.

Saregama India: The company has clocked a 20% year-on-year growth in consolidated profit at Rs 52.3 crore for quarter ended December FY23, led by other income and top line. Consolidated revenue from operations grew by 23.4% to Rs 185.5 crore for the quarter. EBITDA at Rs 62.6 crore for the quarter grew by 15% over a year-ago period.

Shakti Pumps: The submersible pumps manufacturer has reported a 24% year-on-year decline in profit at Rs 11.2 crore for December FY23 quarter, impacted by weak operating performance and lower other income. Revenue from operations grew by 17% YoY to Rs 314.2 crore for the quarter.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment