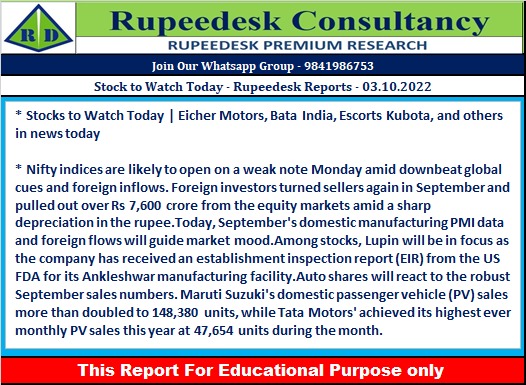

Stock to Watch Today - Rupeedesk Reports - 03.10.2022

Stocks to Watch Today | Eicher Motors, Bata India, Escorts Kubota, and others in news today

APL Apollo Tubes: The steel tube maker registered the highest quarterly sales volume of 6.02 lakh tonnes in Q2FY23, up 41 percent YoY and growing 42 percent sequentially. The sales volume for first half of FY23 was 10.25 lakh tonnes compared to 8 lakh tonnes in same period last year. In the second half of FY23, the sales volume would get further boost from commissioning and ramp-up of new Raipur plant, the company believes.

Eicher Motors: VE Commercial Vehicles, an unlisted material subsidiary of the company, sold 6,631 vehicles in September 2022, which grew by 9.2% compared to 6,070 units sold in year-ago month, while in the first half of FY23, it registered a massive 67.6% YoY growth in sales at 35,085 vehicles.

Bata India: Kanchan Chehal is proposed to take up a Global role with Bata Group, hence he ceased to the whole-time director but would continue to serve the board at Bata India as a non-executive director. In addition, Vidhya Srinivasan has resigned as Director – Finance and Chief Financial Officer of the company to pursue opportunities outside, effective November 12, 2022. For the interim period, Shaibal Sinha, the non-executive non-independent director, has been assigned the responsibility to oversee the finance & accounts functions of the company.

Escorts Kubota: Escorts Kubota said its agri machinery segment sold 12,232 tractors in September 2022, registering a growth of 38.7% as against 8,816 tractors sold in same month last year. Domestic tractor sales increased 42.7% to 11,384 units, and export sales grew 0.8% to 848 tractors compared to year-ago month.

Zydus Lifesciences: Zydus Lifesciences has received approval from the United States Food and Drug Administration to market Sildenafil, the high blood pressure drug (pulmonary hypertension). It works by relaxing and widening the blood vessels in lungs which allows the blood to flow more easily. The drug will be manufactured at the group’s formulation manufacturing facility at Baddi, Himachal Pradesh. The drug had annual sales of $65 million in the United States according to IQVIA data of August 2022.

SML Isuzu: The company sold 752 vehicles in September 2022, up 5 percent compared to 716 vehicles sold in corresponding month last year, while in the current financial year, it sold 6,285 vehicles, a massive growth of 136% compared to 2,659 units in year-ago period.

Coal India: The company said its coal production in September 2022 increased by 12.3% to 45.7 million tonnes, and offtake rose by 1.1% to 48.9 million tonnes compared to same period last month. These are provisional numbers.

NIIT: The company expects its CLG (corporate learning group) business to get back to QoQ growth starting Q3FY23 and achieve high single digit YoY growth in FY23. On the other hand, the SNC (skills & careers business) business remains on track and is expected to grow over 50% on a YoY basis in FY23. During the quarter ended September 2022, NIIT continued to win new customers in line with expectations along with maintaining a 100% contract renewals record. In addition, the company has decided to make an investment of $2 million in KNOLSKAPE Solutions, Pte Ltd, Singapore.

Indiabulls Housing Finance: The company has increased its lending rates by 50 bps effective from October 1. The decision came after the RBI raised repo rate by 50 basis points.

Poonawalla Fincorp: Care Ratings has upgraded the long-term rating of Poonawalla Fincorp and its subsidiary, Poonawalla Housing Finance (PHFL) to 'AAA' with Stable outlook. This rating is applicable for bank loan facilities, non-convertible debentures, market linked debentures and subordinated debt.

Future Supply Chain Solutions: Mayur Toshniwal has resigned as a director of the company with effect from September 30, 2022. With his resignation, Mayur has also ceased to be Managing Director of the company.

Muthoot Capital Services: The company has completed a securitization transaction of Rs 121.56 crore on September 30. This is the fourth securitization transaction carried out by the company during the FY23. The entire pool is from the non - priority sector and has been taken after considering the RBI guidelines.

Spandana Sphoorty Financial: Crisil has removed the credit rating on company from 'watch with developing implications' and reaffirmed rating as 'A' with stable outlook for bank loan facilities worth Rs 3,500 crore.

Royal Orchid Hotels: Promoter Keshav Baljee sold 3,45,065 equity shares or 1.25% stake in the company via open market transactions at an average price of Rs 274.7 per share.

Gokaldas Exports: Abu Dhabi Investment Authority acquired 15 lakh equity shares in the company at an average price of Rs 349.75 per share, however, Clear Wealth Consultancy Services LLP sold 15 lakh shares at same price.

Veritas (India): Promoter Niti Nitinkumar Didwania offloaded 8.5 lakh shares or 3.17% stake in the company via open market transactions at an average price of Rs 118.5 per share, however, Swan Energy was the buyer of those shares at same price. In September, Niti Nitinkumar Didwania sold total 9.73% stake against its 57.49% stake as of June 2022, and Swan Energy acquired those shares.

63 Moons Technologies: The company will provide software support services to Multi Commodity Exchange of India (MCX) for three months effective from October 1. Its ongoing software support and maintenance agreement ended on September 30.

Astec Lifesciences: Saurav Bhala has resigned as the 'chief financial officer' of the company to pursue a career opportunity outside the company.

IL&FS Transportation Networks: The company has appointed Milind Gandhi as its Chief Financial Officer & key managerial personnel effective October 1, 2022. Mohit Bhasin is ceased to be CFO and KMP of the company effective September 30.

Dilip Buildcon: The company has received provisional completion certificate for rehabilitation and up-gradation from 2 lane to 4 lane for Varanasi - Dagamagpur section of National Highway-7 on EPC mode in Uttar Pradesh. With this, the authority declared the project fit for entry into commercial operation on September 29.

Likhitha Infrastructure: The company has received orders worth Rs 177 crore from various oil & gas distribution companies during the quarter ended September 2022. The total outstanding order book of the company as on September 2022 is Rs 1,125 crore.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment