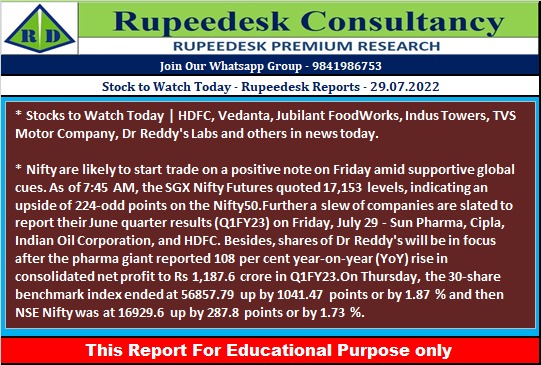

Stock to Watch Today - Rupeedesk Reports - 29.07.2022

Stocks to Watch Today | HDFC, Vedanta, Dr Reddy's Labs and others in news today

Results on July 29: HDFC to be in focus ahead of June quarter earnings scheduled to be announced today. HDFC, NTPC, Sun Pharma, Cipla, Indian Oil Corporation, Ashok Leyland, DLF, Emami, Exide Industries, Nazara Technologies, Piramal Enterprises, CARE Ratings, CarTrade Tech, Cholamandalam Investment, CreditAccess Grameen, Deepak Fertilisers, Easy Trip Planners, 3i Infotech, Great Eastern Shipping, GMR Infrastructure, Godrej Agrovet, Heritage Foods, JK Paper, Mahindra Logistics, Metro Brands, Rain Industries, Route Mobile, Strides Pharma Science, Star Health and Allied Insurance Company, Torrent Pharmaceuticals, VST Industries, and Zydus Wellness will declare their June quarter earnings on July 29.

Results on July 30: Bank of Baroda to be in focus as the lender is expected to announced its June quarter earnings tomorrow. Bank of Baroda, DCB Bank, Godfrey Phillips India, IDFC First Bank, Indian Bank, Multi Commodity Exchange of India, Mahindra Holidays & Resorts India, and Venus Remedies will declare their results for the quarter ended in June on July 30.

Dr Reddy's Laboratories: The pharma company recorded a 108 percent year-on-year growth in consolidated profit at Rs 1,187.60 crore for the quarter ended June 2022, backed by healthy operating performance and higher other income. Revenue grew 6 percent YoY to Rs 5,215.40 crore in Q1FY23 due to tepid growth in North America and Europe but India growth was strong at 26 percent YoY.

Jubilant FoodWorks: The company acquired 40 percent stake in Roadcast Tech Solutions Private Limited that offers a logistics platform for management of last-mile delivery operations. The acquisition cost is Rs 14.98 crore for 40 percent stake.

Indus Towers: Bimal Dayal has resigned as managing director and chief executive of the company. He has decided to pursue opportunities outside Indus Towers.

TVS Motor Company: The two-and-three-wheeler maker reported consolidated profit at Rs 296.75 crore for the quarter ended June 2022, as against a loss of Rs 14.72 crore in same period last year, supported by top line and operating performance. The Q1FY22 performance was affected by second Covid wave. Revenue grew 56 percent on-year to Rs 7,315.70 crore in Q1FY23. The board has approved the issuing of non–convertible debentures (NCDs) aggregating up to Rs 125 crore on a private placement basis.

SBI Life Insurance Company: The life insurance company recorded a 17.78 percent year-on-year growth in profit at Rs 262.85 crore for the quarter ended June 2022. Net premium income grew significantly by 32.76 percent YoY to Rs 11,036 crore compared to corresponding period of last fiscal, but the income from investments came in at negative Rs 6,405.66 crore for the June FY23 quarter against income of Rs 7,409.91 crore YoY.

Vedanta: The company recorded a 6 percent year-on-year increase in consolidated profit at Rs 5,593 crore for the quarter ended June 2022, impacted by higher input cost and power and fuel costs. Revenue grew by 35 percent YoY to Rs 39,355 crore during the same period.

RITES: The transport infrastructure consultancy and engineering firm recorded an 85.8 percent YoY increase in profit at Rs 145 crore for the quarter ended June 2022 and revenue grew 68.8 percent to Rs 637 crore during the same period. RITES declared interim dividend of Rs 4 per share.

Sapphire Foods India: Nippon Life India Trustee bought 21.23 lakh equity shares or 3.34 percent stake in the company via open market transactions during January 7-July 26. With this, its shareholding in Sapphire increased to 5.03 percent, up from 1.69 percent earlier.

Motilal Oswal Financial Services: The company recorded a 85.85 percent year-on-year fall in consolidated profit at Rs 31.26 crore for the June FY23 quarter, against Rs 221 crore in same period last year, impacted by lower top line. Revenue fell by 16 percent YoY to Rs 753 crore during the same period as there was loss of Rs 158 crore on fair value change against gain of Rs 106 crore YoY. Even employee cost also increased by 26.3 percent to Rs 232.2 crore YoY, though 80 percent YoY drop in impairment on financial instruments to Rs 8.55 crore supported bottomline.

Laxmi Organic Industries: The company reported a 36.6 percent year-on-year decline in consolidated profit at Rs 64.88 crore in quarter ended June 2022, impacted by tepid growth in top line and 30 percent fall in operating profit. Revenue grew by 2.75 percent YoY to Rs 756.61 crore for June FY23 quarter, while there was a 103.4 percent increase in other expenses and 10.5 percent rise in raw material cost for the quarter.

GMM Pfaudler: The company clocked a consolidated profit at Rs 61.47 crore in quarter ended June 2022, against loss of Rs 18.4 crore in same period last year, supported by higher topline, other income and operating income. Revenue grew by 34 percent YoY to Rs 739.24 crore in Q1FY23 on the back of strong execution. The company has signed agreement to acquire 100 percent stake in Hydro Air Research Italia Srl, based in Italy, for Rs 38.24 crore. The transaction is funded through internal accruals and expected to be completed in August 2022.

Oriental Hotels: The company reported profit at Rs 11.09 crore in the quarter ended June 2022, against loss of Rs 16.83 crore in Q1FY22. In year-ago quarter, profit was affected by second Covid wave. Revenue grew by 256% YoY to Rs 90.57 crore in Q1FY23 and EBITDA was positive at Rs 26.83 crore in June FY23 quarter against EBITDA loss of Rs 11.77 crore in June FY22 quarter.

Ajanta Pharma: The pharma company posted profit after tax of Rs 175 crore in the quarter ended June 2022 against Rs 174 crore in same period last year due to tepid growth in operating profit. Revenue from operations grew by 27% to Rs 951 crore compared to year-ago period and EBITDA increased 0.9 percent YoY to Rs 222 crore in same period.

IIFL Securities: The company reported a 37 percent YoY decline in profit after tax at Rs 43 crore on lower other income and tepid operating performance. Total income at Rs 295 crore grew by 10 percent and assets under management and custody at Rs 1,11,201 crore grew by 103 percent YoY in Q1FY23.

Nippon Life India Asset Management: The company recorded a 37 percent YoY decline in consolidated profit at Rs 114 crore for the quarter ended June 2022 impacted by negative other income and weak operating performance. Revenue grew by 4.6 percent YoY to Rs 316.10 crore during the same period.

Sona BLW Precision Forgings: The auto ancillary company reported a 5 percent YoY growth in profit at Rs 76 crore and 18% growth in top line at Rs 589 crore. The net order book increased to Rs 20,500 crore in Q1FY23, from Rs 18,600 crore as of March 2022.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment