Stock to Watch Today - Rupeedesk Reports : 04.03.2022

Stock to Watch Today - Rupeedesk Reports

Data Source : Govt , Private News Channels and Websites Etc

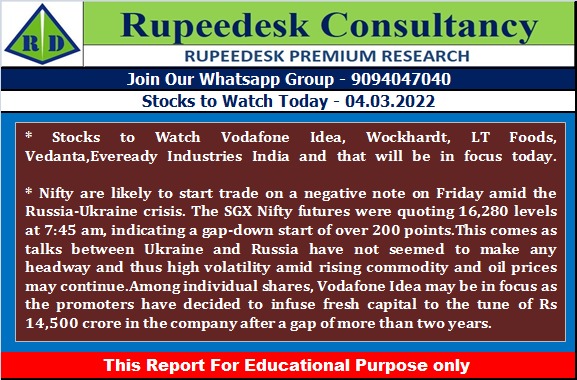

Buzzing Stocks | Vodafone Idea, Wockhardt, LT Foods, Vedanta, others in news today

Vodafone Idea | The board of directors of the telecom operator has approved fund raising of Rs 4,500 crore on a preferential basis, through its promoters. It has decided to issue more than 338.3 crore equity shares at an issue price of Rs 13.30 per share to Euro Pacific Securities, Prime Metals, and Oriana Investments Pte Ltd. The company has also received board's approval for additional fund raising of Rs 10,000 crore via private placement or qualified institutions placement.

Wockhardt | The rights issue of Rs 748 crore will open for subscription by shareholders on March 15 and the issue closing date will be March 22. The company will issue three rights equity shares for every 10 equity shares held by shareholders as on record date of March 9.

LT Foods | The consumer food company said its subsidiary LT Foods Americans Inc acquired 51 percent stake in Golden Star Trading Inc along with its brand Golden Star. It also has a call option to further buy the remaining 49 percent stake at the end of three years.

Vedanta | France-based financial services company Societe Generale sold 2,24,50,200 equity shares in the billionaire Anil Agarwal-owned company via open market transactions. These shares were sold at an average price of Rs 391.74 apiece.

Eveready Industries India | After the open offer by Burman group, Aditya Khaitan and Amritanshu Khaitan have resigned as Non-Executive Director and Chairman, and as Managing Director of the company. The resignation will enable the company to benefit from new leadership and direction.

Stove Kraft | Sequoia Capital-owned SCI Growth Investments II sold 24,69,853 equity shares in Kitchen appliances manufacturer via open market transactions at an average price of Rs 645.35 per share. However, Bengal Finance and Investment acquired 9,30,232 equity shares, Nippon India Mutual Fund bought 3,10,078 equity shares and PGIM India Mutual Fund purchased 6,97,674 shares at an average price of Rs 645 per share.

Gabriel India | HDFC Asset Management Company through its schemes acquired an additional 2.13 percent stake via open market transactions on March 2. With this, its shareholding in the company stands at 9.17 percent now, against 7.04 percent earlier.

Themis Medicare | The company has received approval for its immunomodulatory antiviral drug Viralex from Drug Controller General of India. The drug will be used for treatment of COVID-19.

IndiaMART InterMESH | The company has entered into an agreement to make an investment in Zimyo Consulting against 10 percent of the share capital.

Mahindra & Mahindra Financial Services | The firm has disbursed approximately Rs 2,733 crore of loans in February 2022, registering a 44 percent YoY growth. The year-to-date total disbursement was Rs 23,632 crore, a growth of 42 percent over the same period last year. The collection efficiency remained stable at 98 percent for the month of February YoY. Asset quality has seen improvement due to a positive trend in collections. The company is confident of meeting its commitment to bring the net Stage 3 below 4 percent by year-end.

Free Intraday Tips : Join Our Whatsapp No : 9841986753

Free Commodity Tips : Join our Whatsapp No : 9094047040

RUPEEDESK PREMIUM RESEARCH

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, ICEX, NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt , Private News Channels and Websites Etcd

No comments:

Post a Comment