Stock to Watch Today - Rupeedesk Reports - 22.03.2022

Stock to Watch Today - Rupeedesk Reports

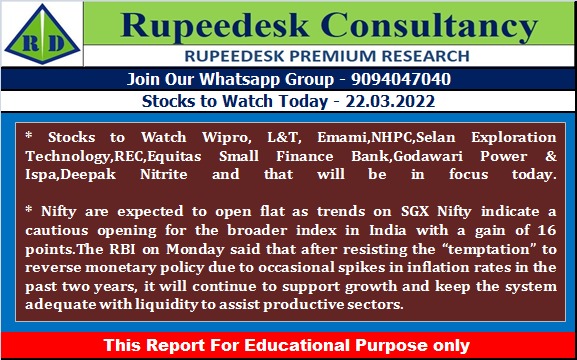

Buzzing Stocks | Wipro, L&T, Emami, others in news today.

Wipro: Wipro board to meet on March 25. The board will consider the declaration of interim dividend for the financial year ending 2021-22.

Larsen & Toubro: L&T board to meet on March 24 for fund raising. The board will seek approval for raising funds, including through issue of debt securities, as part of the company's refinancing program.

NHPC: LIC sold 2.03% stake in NHPC via open market transactions. With this, LIC's stake in the power generation company stands at 7.23 percent, down from 9.26 percent earlier.

Selan Exploration Technology: Selan Exploration files application with petroleum ministry. The company has filed an application with Ministry of Petroleum and Natural Gas (MoPNG) and Directorate General of Hydrocarbons (DOH) for prior consent for the indirect assignment of the participating interest for the identified contract area in the company's blocks i.e. Bakrol, Lahar and Karjisan.

REC: REC board approves borrowing programme. The company approved the market borrowing programme of Rs 85,000 crore under different debt segments for the financial year 2022-23.

Equitas Small Finance Bank: Equitas SFB board approves merger. The board has approved a Scheme of Amalgamation between Equitas Holdings and Equitas Small Finance Bank.

Godawari Power & Ispat: Godawari Power in pact with Hira Infra Tek. The company has signed a Share Purchase Agreement with Hira infra-Tek (HITL) to acquire 44,54,621 equity shares of Hira Ferro Alloys (HFAL) from HITL at a price of Rs 224 per share. With this, its stake in HFAL will be increased from 56.45 percent to 75.66 percent.

Emami: Emami closes buyback plan. The company closed its buyback plan. It has bought back a total of 33,63,740 equity shares and invested Rs 161.21 crore, which represents 99.52 percent of the maximum buyback size.

Deepak Nitrite: ICRA upgrades Deepak Nitrite rating. ICRA has upgraded long term rating from 'AA-' to 'AA', and re-affirmed short term rating at 'A1+' for Rs 756.27 crore bank facilities of Deepak Phenolics, a wholly owned subsidiary of the company. The outlook on the long-term rating has been revised to Positive from Stable.

Hemisphere Properties India: Government sanctions loan to Hemisphere Properties. Government of India sanctioned loan Rs 10 crore to the company.

Kohinoor Foods: Kohinoor Foods board to meet on March 24. The board on March 24 will consider the sale of the factory unit of the company at Murthal, Sonepat (Haryana), by way of slump sale.

Dhampur Sugar Mills: Dhampur Sugar Mills declares dividend. The board has declared an interim dividend of Rs 6.00 per equity share for the financial year 2021-22.

SeQuent Scientific: White Oak Capital buys stake in SeQuent Scientific. White Oak Capital Management Consultants LLP acquired 2.16 lakh equity shares in the company via open market transactions on March 16. With this, its shareholding in the company stands at 5.01 percent, up from 4.92 percent earlier.

Shankara Building Products & APL Apollo Tubes: APL Apollo Tubes arm buys stake in Shankara Building Products. APL Apollo Tubes announced a minority equity investment by its subsidiary APL Apollo Mart in Shankara Building Products. The investment will be through a combination of purchase of secondary promoter shares and proposed preferential allotment of convertible warrants. Total investment by APL Apollo Mart in Shankara Building Products will be upto Rs 180.5 crore including immediate investment of Rs 101.8 crore.

G R Infraprojects: GR Infraprojects gets road projects from NHAI. The company has emerged as L-1 bidder for road project - 4-Laning of Ujjain-Badnawar section - in Madhya Pradesh on HAM. The tender was invited by the National Highways Authority of India.

Mac Charles (India): Mac Charles India sells 29987 shares in Airport Golf View. The company has sold its 29,987 equity shares held in its material subsidiary Airport Golf View Hotels and Suites Private Limited to Crackers India Infrastructure, for Rs 29.13 crore.

Gulshan Polyols: Gulshan Polyols launches QIP. The company launched qualified institutions placement issue on March 21. The floor price has been fixed at Rs 343.66 per share for the issue.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment