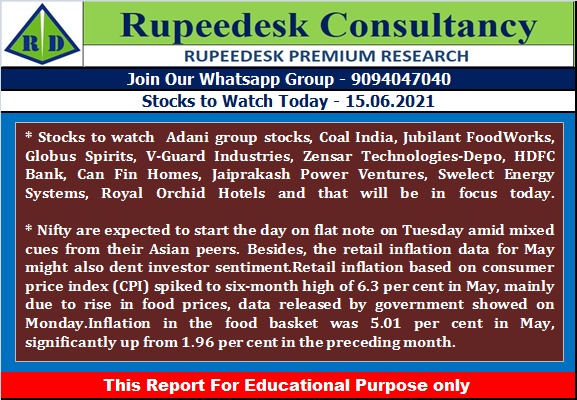

Buzzing Stocks: Adani group stocks, Coal India, Jubilant FoodWorks and others in news today

Results on June 15 | Jubilant FoodWorks, Power Finance Corporation, LIC Housing Finance, Easy Trip Planners, Entertainment Network (India), Flexituff Ventures International, India Home Loan, JMD Ventures, BLS International Services, Centum Electronics, Lemon Tree Hotels, Manaksia, Salzer Electronics, Spencers Retail, and Whirlpool of India will release quarterly earnings on June 15.

Adani Group stocks: The accounts of three foreign funds that are big stakeholders of Adani group companies are not frozen, a top official of the National Securities Depository Ltd (NSDL) informed the port-to-energy conglomerate. To be sure, the NSDL website still shows that the accounts of the three so-called foreign portfolio investors (FPIs) are frozen. But this punitive action pertains to older cases, NSDL officials told Moneycontrol, asking not to be named.

Coal India | The company reported lower consolidated profit at Rs 4,588.96 crore in Q4FY21 against Rs 4,625.7 crore in Q4FY20, revenue fell to Rs 26,700.14 crore from Rs 27,568.23 crore YoY.

Globus Spirits | Templeton Strategic Emerging Markets Fund IV LDC sold another 2.66 lakh equity shares in Globus Spirits at Rs 393.23 per share on the NSE, the bulk deals data showed.

V-Guard Industries | SBI Mutual Fund acquired 50 lakh equity shares in V-Guard Industries at Rs 265 per share, whereas promoter Chittilappilly Thomas Kochuouseph was the seller offloading same number of shares at a same price on the NSE, the bulk deals data showed.

Zensar Technologies-Depo | Marina Holdco (FPI) sold 2,57,50,000 equity shares in the company at Rs 295.16 per share on the NSE. However, DSP Mutual Fund acquired 67,56,757 lakh equity shares in the company at Rs 294.74, Goldman Sachs India Fund bought 25,75,839 equity shares at Rs 294.98 per share, and Nippon India Mutual Fund bought 41.5 lakh equity shares at Rs 294.95 per share on the NSE, the bulk deals data showed.

HDFC Bank: The bank is likely to consider interim dividend for FY21 on June 18.

Can Fin Homes | National Housing Bank imposed a penalty of Rs 29,13,234 plus applicable GST at 18 percent, on the company.

Jaiprakash Power Ventures | The company reported consolidated profit at Rs 215.32 crore in Q4FY21 against loss of Rs 70.91 crore in Q4FY20, revenue increased to Rs 956.87 crore from Rs 698.47 crore YoY.

Swelect Energy Systems | The company reported consolidated loss at Rs 4.46 crore in Q4FY21 against loss of Rs 14.87 crore in Q4FY20, revenue increased to Rs 78.55 crore from Rs 63.06 crore YoY.

Royal Orchid Hotels | ICRA re-affirmed credit rating on the company at BBB, but the outlook downgraded to Negative from Stable.

Va Tech Wabag | Porinju Veliyath-owned Equity Intelligence India Pvt Ltd & EQ India Fund sold over 7.64 lakh equity shares or 1.23 percent stake in Va Tech Wabag via open market transaction on June 10, reducing shareholding to 0.64 percent from 1.87 percent earlier.

NHPC | NHPC signed a Memorandum of Understanding (MoU) with Bihar State Hydro-Electric Power Corporation (BSHPCL) for execution of Dagmara HE Project (130.1 MW) in Bihar on ownership basis.

Satin Creditcare Network | The company reported higher standalone profit at Rs 42.76 crore in Q4FY21 against Rs 12.48 crore in Q4FY20, revenue fell to Rs 372.58 crore from Rs 375 crore YoY.

Uttam Sugar Mills | The company reported lower profit at Rs 27.83 crore in Q4FY21 against Rs 34.93 crore in Q4FY20, revenue fell to Rs 553.36 crore from Rs 556.72 crore YoY.

JSW Ispat Special Products | Promoter AION Investments Private II Limited to sell up to 9,94,61,544 equity shares (21.18 percent of total paid up equity) in JSW Ispat on June 15-16, via offer for sale.

Mirc Electronics | The company reported profit at Rs 1.49 crore in Q4FY21 against loss of Rs 6.66 crore in Q4FY20, revenue jumped to Rs 228.83 crore from Rs 166.18 crore YoY.

Rallis India | The company appointed Subhra Gourisaria as the Chief Financial Officer, on the superannuation of Ashish Mehta, CFO.

Sagar Cements | Board meeting of the company will be held on July 1, to consider a proposal to sub-divide (split) the face value of the equity shares of the company from Rs 10 each into an appropriate amount.

Ramky Infrastructure | The company reported consolidated profit at Rs 85.5 crore in Q4FY21 against loss of Rs 175.87 crore in Q4FY20, revenue fell to Rs 268.99 crore from Rs 316.5 crore YoY.

No comments:

Post a Comment