Buzzing Stocks: Coforge, Zee Entertainment, JK Tyre and others that will be in focus today

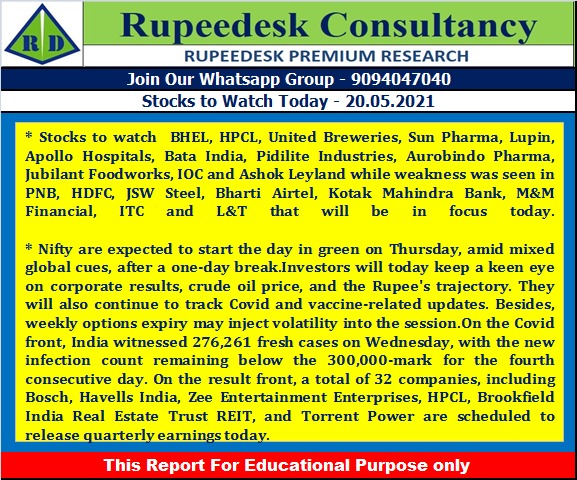

Results on May 20: Bosch, Havells India, Zee Entertainment Enterprises, HPCL, Brookfield India Real Estate Trust REIT, Torrent Power, Emkay Global Financial Services, EPL, Expleo Solutions, IndInfravit Trust, JK Lakshmi Cement, KNR Constructions, Libord Securities, Libord Finance, Mangalam Drugs & Organics, Meghmani Organics, New Delhi Television, Plastiblends India, Presha Metallurgical, Music Broadcast, Relaxo Footwears, Response Informatics, Sterling Webnet, The Investment Trust Of India, Acrysil, Amradeep Industries, Cosmo Films, Disa India, Electrosteel Castings, Ultramarine & Pigments, Usha Martin, and Virat Industries will release quarterly earnings on May 20.

Coforge: Promoter Hulst B V sold 31 lakh equity shares at Rs 3,250.58 per share on the BSE, the bulk deals data showed.

Indian Oil Corporation: The company reported a profit of Rs 8,781.3 crore in Q4FY21 against Rs 4,916.59 crore in Q3FY21, revenue increased to Rs 1,63,605.67 crore from Rs 1,46,598.83 crore YoY.

Sintex Industries: The company intimated exchanges that there is severe damage at the factory plant at Jafarabad, Gujarat due to cyclone Tauktae on May 17-18. The expected quantum of loss or damage due to cyclone Tauktae and estimated impact on the production or operations is under the process of determination.

Rajesh Exports: Life Insurance Corporation of India acquired over 59.77 lakh equity shares (2.025%) of the company, increasing shareholding to 9.07% from 7.045% earlier.

Kaya: The company reported a loss of Rs 2.37 crore in Q4FY21 against a loss of at Rs 14.36 crore in Q4FY20, revenue increased to Rs 89.2 crore from Rs 87.07 crore YoY.

Clariant Chemicals (India): The company reported a profit of Rs 10.97 crore in Q4FY21 against Rs 0.45 crore in Q4FY20, revenue rose to Rs 218.84 crore from Rs 169.48 crore YoY.

Westlife Development: SBI Mutual Fund sold 3,34,951 equity shares of the company on May 18 reducing the total stake to 6.38% from 6.6% earlier.

Endurance Technologies: The company reported a consolidated profit of Rs 187.4 crore in Q4FY21 against Rs 106.8 crore in Q4FY20, revenue rose to Rs 2,132.9 crore from Rs 1,596.75 crore YoY.

JK Tyre & Industries: The company reported a consolidated profit of Rs 189.12 crore in Q4FY21 against a loss of Rs 47.2 crore in Q4FY20, revenue jumped to Rs 2,927.28 crore from Rs 1,792.56 crore YoY.

Tantia Constructions: The company executed and completed the work 'improvement and upgradation Serchhip to Buarpul road (project 2 Mizoram), for a value amounting to Rs 249.35 crore.

TD Power Systems: The company reported a consolidated profit of Rs 15.37 crore in Q4FY21 against Rs 18.81 crore in Q4FY20, revenue rose to Rs 168.34 crore from Rs 151.36 crore YoY.

MAS Financial Services: The company reported a standalone profit of Rs 36.52 crore in Q4FY21 against Rs 34.49 crore in Q4FY20, revenue fell to Rs 138.85 crore from Rs 169.59 crore YoY.

Best Agrolife: Elara India Opportunities Fund, owned by London-based investment bank Elara Capital, sold 1,78,701 equity shares at Rs 205.99 per share on the NSE, the bulk deals data showed.

No comments:

Post a Comment