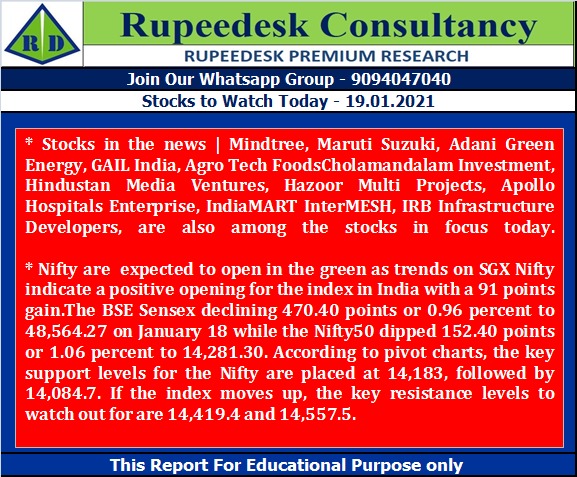

Stocks in the news | Mindtree, Maruti Suzuki, Adani Green Energy, GAIL India, Agro Tech Foods

Cholamandalam Investment, Hindustan Media Ventures, Tamil Nadu Newsprint & Papers, Hazoor Multi Projects, Apollo Hospitals Enterprise, IndiaMART InterMESH, IRB Infrastructure Developers, are also among the stocks in focus today.

Mindtree | The company has reported sharply higher profit at Rs 326.5 crore in Q3FY21 against Rs 253.7 crore, revenue rose to Rs 2,023.7 crore from Rs 1,926 crore QoQ.

Maruti Suzuki | The company increased prices by up to Rs 34,000 ex-showroom in Delhi, effective January 18.

Cholamandalam Investment | Arun Alagappan tendered his resignation as MD and Director of the company.

Adani Green Energy | Adani Trading Services LLP sold 3,61,47,571 crore equity shares in the company at Rs 915.37 per share on the BSE, whereas ACME Trade and Investment was the buyer in a deal. 100 percent shares of Universal Trade and Investments have been acquired by Total Renewables SAS, France from Dome Trade and Investments, Mauritius. Universal Trade and Investments has now become part of the Total Group, and is consequently no longer part of the promoter group of the company.

Hindustan Media Ventures | The company reported consolidated profit of Rs 34.28 crore in Q3FY21 against Rs 32.09 crore in Q3FY20, revenue fell to Rs 162.6 crore from Rs 208.48 crore YoY.

Agro Tech Foods | Pari Washington India Master Fund Ltd & Pari Washington Investment Fund increased stake in the company to 9.88 percent from 7.77 percent earlier via open market transactions.

Tamil Nadu Newsprint & Papers | Thiru R Ramaseshan resigned as Executive Director (Finance) & Chief Financial Officer of the company.

Hazoor Multi Projects | The company has received work order of Rs 6.81 crore from Varaha Infra and Rs 8.16 crore from Navayuga Engineering Company.

Apollo Hospitals Enterprise | The company opened its QIP issue on January 18 and fixed the floor price at Rs 2,508.58 per equity share.

SIEL Financial Services | Promoter Mawana Sugars proposed to sell up to 21,05,568 equity shares, representing 18.56 percent of total paid-up equity of the company via offer for sale route on January 19-20. The floor price has been fixed at Rs 1.50 per share.

Coromandel Engineering Company | K Thiyagarajan resigned as Chief Financial Officer of the company.

Vishwaraj Sugar Industries | The company reported profit at Rs 30.46 crore in Q3FY21 against Rs 11.63 crore in Q3FY20, revenue fell to Rs 82.75 crore from Rs 101.71 crore YoY.

GAIL India | The board has unanimously approved a proposal for the buyback of 6,97,56,641 equity shares at a price of Rs 150 per share, for upto Rs 1,046.35 crore.

IndiaMART InterMESH | The company reported higher profit at Rs 80.2 crore in Q3FY21 against Rs 62 crore in Q3FY20, revenue jumped to Rs 173.6 crore from Rs 164.9 crore YoY.

IRB Infrastructure Developers | The company reported consolidated profit at Rs 69.48 crore in Q3FY21 against Rs 159.73 crore, revenue fell to Rs 1,547.1 crore from Rs 1,742.6 crore YoY. SPV achieved financial closure for Gandeva – Ena HAM Project on upcoming Vadodara – Mumbai Expressway in Gujarat.

Indiabulls Real Estate | Consolidated net profit jumped 63.8 percent at Rs 80.6 crore against Rs 49.2 crore (YoY). Other Income was at Rs 35.1 crore against Rs 85.4 crore (YoY). Consolidated revenue was down 41.4 percent at Rs 721.7 crore against Rs 1,232.3 crore (YoY). Consolidated EBITDA was up 2.8 percent at Rs 128.9 crore against Rs 125.3 crore (YoY).

Yes Bank | The bank said it will consider a proposal to raise funds at its board meeting scheduled later this week. The bank may consider instruments including the issue of equity shares, depository receipts, convertible bonds, debentures, warrants, it said in a notification to exchanges.

RBL Bank | The private sector lender said its Board of Directors has approved the re-appointment of Vishwavir Ahuja as the Managing Director (MD) and Chief Executive Officer (CEO) of the bank for a period of three years, with effect from June 30, 2021 to June 29, 2024.

L&T Finance | The company said its board has fixed the price at Rs 65 per share for the Rs 3,000 crore rights issue which opens for subscription on February 1. According to a regulatory filing, the board has approved the price of Rs 65 per fully paid-up share including a premium of Rs 55 per share of face value Rs 10.

Results today | ICICI Lombard General Insurance Company, Alembic Pharmaceuticals, Ceat, CSB Bank, DCM Shriram, L&T Infotech, Skipper, Tata Communications, Tata Metaliks, Tata Steel BSL, Gateway Distriparks, Hatsun Agro Product, HT Media, JSW Ispat Special Products, Bank of Maharashtra, Mold-Tek Packaging, Network18 Media & Investments, Roselabs Finance, TV18 Broadcast, Vardhman Special Steels, Raghav Productivity Enhancers, Shree Ganesh Biotech, Wardwizard Innovations & Mobility, Add-Shop ERetail, AVI Polymers and Bigbloc Construction

No comments:

Post a Comment