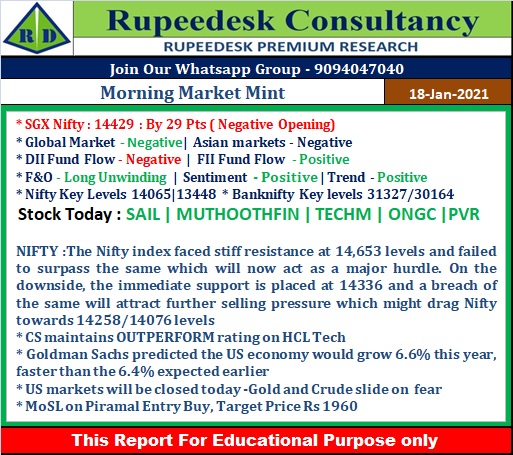

Morning Market Mint - Rupeedesk Reports - 18.01.2021

Join Our Whatsapp Group : 9841986753

Twitter : https://twitter.com/rupeedesk12

Morning Market Mint - Rupeedesk Reports - 18.01.2021

Morning Market Mint - Rupeedesk Reports - 18.01.2021

* US Markets

Wall Street’s main indexes finished lower on Friday, weighed down by big U.S. banks after their earnings reports, while the energy fell sharply due to a regulatory probe into Exxon Mobil Corp.

* Asian Markets

Asian share markets retreated from highs on Monday as disappointing news on U.S. consumer spending tempered risk sentiment ahead of a closely-watched reading on the health of the Chinese economy.

* Bank credit grows 3.2% to Rs 107.05 lakh crore in first nine months of FY21

Bank credit grew 3.2 percent to Rs 107.05 lakh crore in the first nine months of the current financial year, against a growth of 2.7 percent registered in the corresponding period of 2019-20. In the fortnight ended March 27, 2020, bank advances stood at Rs 103.72 lakh crore.

* Indian Railway Finance Corporation IPO opens today

State-owned Indian Railway Finance Corporation will open its initial public offering for subscription on January 18 and the same will close on January 20. This will be the first IPO in 2021. Indigo Paints is scheduled to launch its IPO in the latter part of the coming week.

* FPIs invest Rs 14,886 crore in first half of January

Foreign portfolio investors (FPI) put in Rs 14,866 crore in Indian markets in the first half of January with participants expecting strong third-quarter results by companies. As per depositories data, FPIs invested a net Rs 18,490 crore into equities but pulled out Rs 3,624 crore from debt segment between January 1-15.

* HDFC Bank Q3 profit jumps 18% to Rs 8,758 crore

HDFC Bank, the country's largest private sector lender, has reported a standalone profit of Rs 8,758.3 crore for the quarter ended December 2020, rising 18.1 percent year-on-year, thus beating the CNBC-TV18 poll estimate which was pegged at Rs 8,264.8 crore. The growth was led by non-interest income and pre-provision operating profit with improved asset quality performance.

* RBI open to idea of ‘bad bank’ if there is a proposal: Governor

The Reserve Bank of India (RBI) was open to the idea of a bad bank if there were to be a proposal, central bank governor Shaktikanta Das said on January 16.

* India's forex reserves up by $758 million to lifetime high of $586.082 billion

The country's foreign exchange reserves rose by $758 million to reach a record high of $586.082 billion in the week ended January 8, RBI data showed on Friday. In the previous week ended January 1, the reserves had increased by $4.483 billion to $585.324 billion.

* RBI governor Shaktikanta Das calls for stronger governance structure in banks, NBFCs

Reserve Bank of India governor Shaktikanta Das said banks and non-banking financial companies (NBFCs) need to strengthen the governance structure to ensure larger financial stability in the system. “A good governance structure will have to supported by effective risk management, compliance and assurance mechanism,”

* Rakesh Jhunjhunwala-backed Nazara Technologies refiles IPO papers with Sebi

Billionaire investor Rakesh Jhunjhunwala-backed Nazara Technologies, a leading India-based diversified gaming and sports media platform, has refiled the draft red herring prospectus with the capital market regulator Sebi on January 14, for its initial public offering.

* Results on January 18

Mindtree, Indiabulls Real Estate, IndiaMART InterMESH, IRB Infrastructure Developers, Majesco, Rallis India, Alok Industries, Deccan Gold Mines, Hindustan Media Ventures, Alexander Stamps, I-Power Solutions India, Maharashtra Scooters, Modern Converters, Sagarsoft (India), Shree Ganesh Remedies, Shakti Pumps, Snowman Logistics, Suraj, Trident, Ultracab (India), Vishwaraj Sugar Industries will announce their quarterly earnings on January 18.

* FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 971.06 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 942.07 crore in the Indian equity market on January 15, as per provisional data available on the NSE.

* 3 stocks under F&O ban on NSE

BHEL, Vodafone Idea and SAIL are under the F&O ban for January 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

RUPEEDESK PREMIUM RESEARCH

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE,BSE,MCX,NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

No comments:

Post a Comment