Morning Market Mint - Rupeedesk Reports - 15.01.2021

Join Our Whatsapp Group : 9841986753

Twitter : https://twitter.com/rupeedesk12

Morning Market Mint - Rupeedesk Reports - 15.01.2021

Morning Market Mint - Rupeedesk Reports - 15.01.2021

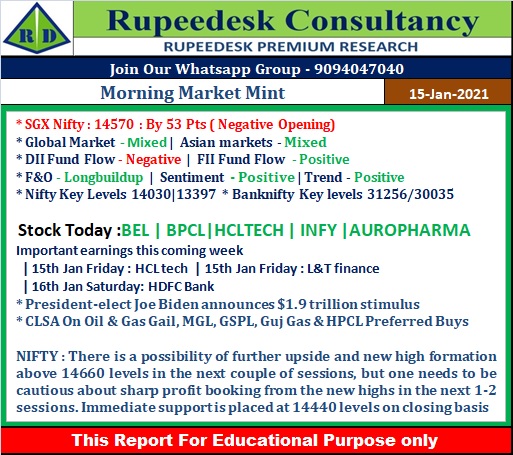

Trends on SGX Nifty indicate a negative opening for the index in India with a 60 points loss.

* US Markets

Wall Street closed lower on Thursday after making a u-turn toward the end of the session as reports emerged about U.S. President-elect Joe Biden’s pandemic aid proposal following earlier data that showed a weakening labor market.

* Asian Markets

Asian shares rose on Friday, brushing off a late Wall Street dip as expectations of large U.S. stimulus under President-elect Joe Biden shored up sentiment while oil prices perked up on upbeat Chinese trade figures.

* SGX Nifty

Trends on SGX Nifty indicate a negative opening for the index in India with a 60 points loss. The Nifty futures were trading at 14,563 on the Singaporean Exchange around 07:30 hours IST.

* Oil prices climb

Oil prices edged higher on Thursday, boosted by a weak dollar and bullish signals from Chinese import data but pressured by renewed worries about global oil demand due to surging coronavirus cases in Europe and new lockdowns in China.

* Budget session to begin from January 29, Budget 2021 on February 1

The Union Budget 2021-22 would be presented on February 1, confirmed the Lok Sabha Secretariat. The Parliament session would be starting from January 29, and would be held in two phases.

* Economic recovery likely to boost gold demand in India this year: WGC

Gold demand appears to be positive in India as the consumer sentiment is likely to recover in 2021, from its dismal performance due to the coronavirus pandemic-related disruptions and volatile price movement, according to a report by the World Gold Council (WGC).

* Real estate | Outlook negative for residential and retail segments; stable for office leasing: ICRA

Despite recovery of residential sales to pre-COVID levels in the second quarter of the financial year 2021 on account of pent-up demand and improved affordability, timely liquidation of the high unsold inventory, particularly in over-supplied regions such as MMR and NCR, would still remain a challenge, ICRA has warned.

* MSCI to raise weight of Bharti Airtel in February quarterly index review, after hike in FPI limit

The weightage of telecom operator Bharti Airtel stock in the MSCI Global Standard Indexes will be raised in the February 2021 quarterly review, said the MSCI. National Securities Depository Limited (NSDL), on January 12, had updated the foreign investment limit for Bharti Airtel from 49 percent to 100 percent.

* US unemployment claims jump to 965,000 as virus takes toll

The number of people seeking unemployment aid soared last week to 965,000, the most since late August and evidence that the resurgent virus has caused a spike in layoffs.

* Results on January 15

HCL Technologies, L&T Finance Holdings, PVR, Shoppers Stop, Bhakti Gems and Jewellery, Aditya Birla Money, Gautam Gems, Hathway Cable & Datacom, Indo Asian Finance, Mardia Samyoung Capillary Tubes, Next Mediaworks, Onward Technologies, Plastiblends India, Soril Infra Resources, Yaarii Digital Integrated Services and Ardi Investment will announce their quarterly earnings.

* FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,076.62 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 188.1 crore in the Indian equity market on January 14, as per provisional data available on the NSE.

* Stocks under F&O ban on NSE

One stock - BHEL - is under the F&O ban for January 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

RUPEEDESK PREMIUM RESEARCH

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE,BSE,MCX,NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

No comments:

Post a Comment