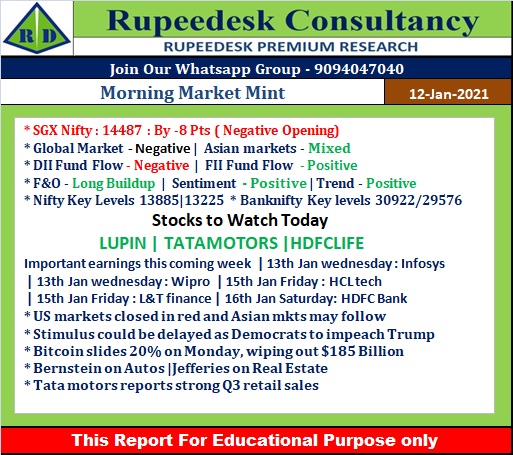

Morning Market Mint - Rupeedesk Reports - 12.01.2021

Join Our Whatsapp Group : 9841986753

Twitter : https://twitter.com/rupeedesk12

Morning Market Mint - Rupeedesk Reports - 12.01.2021

Morning Market Mint - Rupeedesk Reports - 12.01.2021

* US Markets

Wall Street’s main indexes closed lower on Monday as investors took some profits after last weeks’ records while they waited for earnings season to begin and eyed events in Washington with trepidation.

*Asian Markets

Asian stocks were mostly lower on Tuesday, tracking Wall Street declines as political turmoil in Washington and rising coronavirus cases worldwide weighed on sentiment ahead of the start of the quarterly earnings season.

*SGX Nifty

Trends on SGX Nifty indicate a negative opening for the index in India with a 23 points loss. The Nifty futures were trading at 14,473 on the Singaporean Exchange around 07:30 hours IST.

*COVID-19 vaccine | Bharat Biotech to provide 55 lakh Covaxin doses at Rs 295 per dose

Bharat Biotech inked a purchase agreement with the Government of India on January 11 to provide 55 lakh doses of COVID-19 vaccine Covaxin at Rs 295 per dose,

*Oil prices sapped by rising virus cases

Oil prices slipped on Tuesday as investors remained concerned about climbing coronavirus cases globally, though an anticipated drawdown in crude oil inventory in the United States for a fifth straight week stemmed losses.

*Invest more in IT platforms to fortify public confidence in digital transactions: RBI to banks

Banks must invest more in building robust IT platforms to fortify public confidence in digital banking, Reserve Bank of India (RBI) Governor Shaktikanta Das said on January 11.

*NSE launches derivatives on Nifty Financial Services Index

The National Stock Exchange (NSE) on Monday launched derivatives on the Nifty Financial Services Index, which will give more flexibility to institutional as well as retail investors to manage their hedge. This is the first time that the exchange has made available weekly futures for stock index derivatives.

*More states consider reducing stamp duty to boost real estate sales: Housing Secretary

Following in the footsteps of Maharashtra and Karnataka, more states are considering reducing stamp duty to boost real estate sales, Housing Secretary Durga Shanker Mishra

*RBI FSR report cautions growing disconnect between financial markets and real sector

The growing disconnect between certain segment of financial markets and real sector has widened further since the publication of last financial stability report (FSR), the Reserve Bank of India (RBI) said on January 11.

*COVID-19 impact: Govt not to print Budget documents this year

The voluminous Budget documents will not be printed this year following the COVID-19 protocol and will instead be distributed electronically to the Members of Parliament (MPs). This will be the first time since the presentation of independent India's first Budget on November 26, 1947, that the documents containing income and expenditure statement of the Union government along with finance bill, detailing new tax and other measures for the new financial year, will not be physically printed.

*Twitter shares slump 8% after Donald Trump account suspension

Twitter's German-listed shares slumped as much as 8 percent on Monday, the first trading day after it permanently suspended US President Donald Trump's account late on Friday. The company said suspension of Trump's account, which had more than 88 million followers, was due to the risk of further violence, following the storming of the US Capitol on Wednesday..

*Results on January 12

Karnataka Bank, Tata Elxsi, Steel Strips Wheels, Filatex India, Hathway Bhawani Cabletel, HPL Electric & Power, Indbank Merchant Banking Services, Ind Bank Housing, ATV Projects India, Continental Securities, Mideast Integrated Steels, Trade Wings, Vikas Multicorp will announce their quarterly earnings on January 12.

*FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 3,138.9 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,610.13 crore in the Indian equity market on January 11, as per provisional data available on the NSE.

*1 stock under F&O ban on NSE

SAIL is under the F&O ban for January 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

RUPEEDESK PREMIUM RESEARCH

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE,BSE,MCX,NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

No comments:

Post a Comment