Advantages and Disadvantages of Sovereign Gold Bond Scheme 2020-21 Series VII

Sovereign Gold Bond Scheme 2020-21 Series VII – Who can invest?

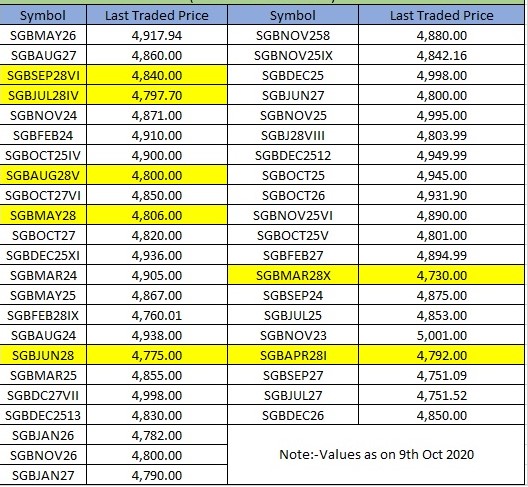

Before proceeding further just check it the current market price of past issues.

History of Sovereign Gold bond Schemes Prices

The issue price of Sovereign Gold Bond Scheme 2020-21 Series VII is Rs.5,051. However, if you look at the price of the past issues, they are well within the current issue price. Hence, rather than BLINDLY subscribing to this new issue, it is better you try to buy it from secondary market. However, make sure that you are buying the latest issues which will mature in 2028 (if you are holding for 8 years).

Advantages of Sovereign Gold Bond Scheme 2020-21 Series VII

# After the GST entry, this Sovereign Gold Bond may be advantageous over physical Gold coins or bars. This product will not come under GST taxation. However, in the case of Gold coins and bars, earlier the VAT was at 1% to 1.2%, which is now raised to 3%.

# If your main purpose is to invest in gold, then apart from physical form, investing in ETF or in Gold Funds, this seems to be a better option. Because you no need to worry about physical safekeeping, no fund charges (like ETF or Gold Funds) and the Demat account is not mandatory.

# In this Sovereign Gold Bond Issue FY 2020-21, the additional benefit apart from the typical physical or paper gold investment is that the annual interest payment on the money you invested.

Hence, there are two types of income possibilities. One is interest income from the investment and second is price appreciation (if we are positive on gold). Hence, along with price appreciation, you will receive interest income also.

But do remember that such interest income is taxable. Also, to avoid tax, you have to redeem it only on 6th, 7th or 8th year. If you sell in the secondary market, then such gain or loss will be taxed as per capital tax gain rules.

# There is no TDS from the gain. Hence, you no need to worry about TDS part like Bank FDs.

# A sovereign guarantee of the Government of India will feel you SAFE.

Disadvantages of Sovereign Gold Bond Scheme 2020-21 Series VII

# If you are planning to invest for your physical usage after 8 years, then simply stay away from this. Because Gold is an asset, which gives you volatility like the stock market but the returns of your debt products like Bank FDs or PPF.

# The key point to understand is also that the interest income of 2.5% is on the initial bond purchase amount but not the yearly bond value. Hence, let us say you invested Rs.2,500, then they pay interest of 2.5% on Rs.2,500 only even though the price of gold moved up and the value of such investment is Rs.3,000.

# Liquidity is the biggest concern. Your money will be locked for 5 years. Also, redemption is available only once a year after 5th year.

In case you want to liquidate in a secondary market, then it is hard to find the right price and capital gain tax may ruin your investment.

# Sovereign guarantee of the Government of India may feel you secure. But the redemption amount is purely based on the price movement of the gold. Hence, if there is a fall in gold price, then you will get that discounted price only. The only guarantee here is 2.5% return on your invested amount and NO DEFAULT RISK.

REMEMBER, GOLD IS AN ASSET CLASS WHICH MAY GIVE YOU RETURNS OF DEBT PRODUCT BUT VOLATILITY LIKE EQUITY MARKET-Hence, do you need this asset as an investment in your portfolio?

No comments:

Post a Comment