4 Terms Every Investor Should Know - Rupeedesk Share Market Training Chennai - 01.03.2025

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Friday, February 28, 2025

4 Terms Every Investor Should Know - Rupeedesk Share Market Training Chennai - 01.03.2025

Pharma Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

Pharma Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

Metal Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

Metal Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

FMCG Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

FMCG Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

AUTO Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

AUTO Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

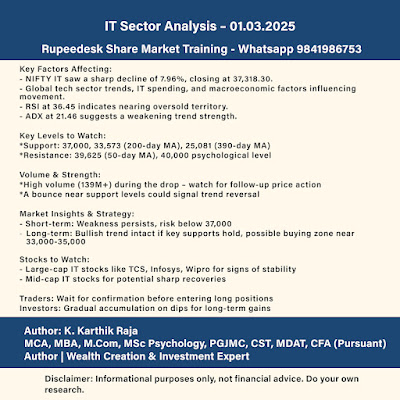

IT Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

IT Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

Financial Services Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

Financial Services Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

REALTY Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

REALTY Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

ENERGY Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

ENERGY Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

PSUBANK Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

PSUBANK Sector Analysis – K Karthik Raja Rupeedesk Share Market Training- 01.03.2025

PRIVATE BANK Sector Analysis - K Karthik Raja Rupeedesk Share Market Training Chennai - 01.03.2025

PRIVATE BANK Sector Analysis - K Karthik Raja Rupeedesk Share Market Training Chennai - 01.03.2025