Stock to Watch Today - Rupeedesk ReportStock to Watch Today - Rupeedesk Reports

Buzzing Stocks: Tata Technologies, Zomato, SBI Life, UltraTech Cement, Zee, others in news.

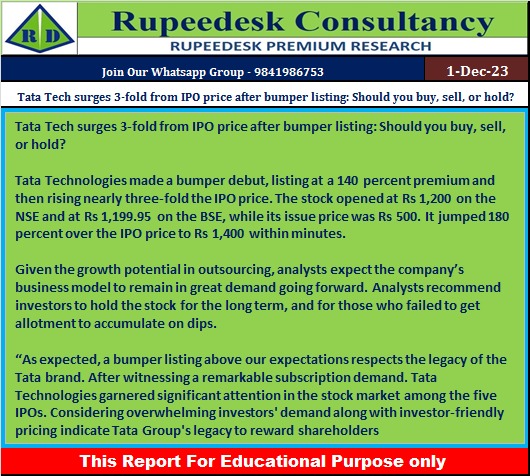

Tata Technologies: The subsidiary of Tata Motors and the global engineering services company will be available for trading on the BSE and NSE from November 30. The issue price was fixed at Rs 500 per share. The grey market indicates the listing premium may be around 75 percent over the offer price, analysts on anonymity said.

Zomato: Alipay Singapore Holding Pte Ltd exited the food delivery giant by selling its entire shareholding of 3.44 percent, or 29,60,73,993 equity shares, via open market transactions at an average price of Rs 112.70 per share, amounting to Rs 3,336.75 crore. However, Morgan Stanley Asia (Singapore) Pte. Ltd. bought 4,39,73,993 equity shares, or 0.51 percent of Zomato, at the same average price.

SBI Life Insurance Company: The shareholders have given approval for the appointment of Amit Jhingran as Managing Director and Chief Executive Officer of the company.

PCBL: The company has received board approval for entering into a joint venture with Australian company Kinaltek Pty. Ltd. to expand into the growing battery application market. The company will own a 51 percent shareholding in the joint venture company and will be infusing $16 million in the JV company, with a commitment to infuse funds up to $28 million in stages in the JV for setting up a manufacturing facility. The proposed transaction will be financed through a mix of internal accruals and external funds raised by the company.

UltraTech Cement: The cement major has acquired the 0.54 mtpa cement grinding assets of Burnpur Cement at Patratu in Jharkhand for Rs169.79 crore. This investment marks the company’s entry into Jharkhand. Now its capacity in India stands at 133 mtpa (million tonnes per annum).

Thomas Cook (India): Promoter Fairbridge Capital (Mauritius) is going to sell up to an 8.50 percent stake or 4 crore equity shares in Thomas Cook via offer-for-sale on November 30 and December 1. The OFS comprises a base offer size of 6.8 percent shares and a greenshoe option of 1.7 percent shares. The issue will open for non-retail investors on November 30, and retail investors can participate on December 1. The floor price for the offer will be Rs 125 per share.

Zee Entertainment Enterprises: In a clarification note to the exchanges, the media and entertainment company said the news (Sony-Zee merger risks collapse over eleventh-hour CEO drama) is factually incorrect. "The company is continuing to work towards a successful closure of the proposed merger as per the Composite Scheme of Arrangement approved by the NCLT, Mumbai."

Metro Brands and FSN E-Commerce Ventures: Foot Locker, Inc., the New York-based specialty athletic retailer, signed a long-term licencing agreement with Metro Brands and Nykaa Fashion. Metro Brands is granted exclusive rights to own and operate Foot Locker stores within India and to sell authorised merchandise in Foot Locker stores. Nykaa Fashion will serve as the exclusive e-commerce partner, operate Foot Locker's India website, and retail authorised merchandise on Foot Locker's branded shop on Nykaa’s existing e-commerce platforms.

Max Estates: Subsidiary Max Estates Gurgaon (MEGL) and the real estate arm of Max Group proposed to develop a group housing project in Harsaru, Gurugram. It also proposed 33 percent of the available FAR (floor area ratio) for the said project, translating to approximately 6.07 lakh square feet to be allocated for the development of senior living units and associated facilities and amenities, including any club for the said senior living development, for which Antara Senior Living (ASLL) has been engaged by MEGL. ASLL will provide its expertise and advisory services for the design, conceptualization, training, and development of project personnel, as well as expert advice on marketing and sales for the senior living project.

Karur Vysya Bank: The Reserve Bank of India has given its approval to SBI Mutual Fund for acquiring an aggregate holding of up to 9.99 percent in the bank. Meanwhile, the private sector lender has opened three branches in Tamil Nadu and one in Karnataka. With this, the total branch network of the bank increased to 831.

Man Infraconstruction: The company's board has approved a fund raising of Rs 550 crore through the issuance of convertible equity warrants via preferential issue. The funds will be raised through the issue and allotment of up to 3,55,05,000 warrants, with each warrant convertible into one equity share of the face value of Rs 2 each on a preferential basis at an issue price of Rs 155 per warrant.

City Union Bank: The private sector lender said the board of directors has appointed K Jayaraman as the Chief Compliance Officer of the bank with effect from December 1, 2023, for three years. K. Jayaraman is the general manager of the bank.

Gujarat Narmada Valley Fertilisers & Chemicals: GNFC's buyback offer will be opening on December 1 and closing on December 7. The company is going to buy back 84,78,100 equity shares at a price of Rs 770 per share.

JSW Infrastructure: Subsidiary Masad Infra Services has entered into a concession agreement with the Karnataka government's Karnataka Maritime Board for the development of an all-weather, deep-water, greenfield port at Keni in Karnataka. The greenfield port will be developed on a public-private partnership (DBFOT) basis.

Fedbank Financial Services: The non-banking financial institution is set to start trading on the BSE and NSE with effect from November 30. The issue price has been fixed at Rs. 140 per share. The grey market suggests the stock is not attracting any premium, analysts on anonymity said.

Shivalik Bimetal Controls: The bimetal/trimetal strips, shunt resistors, and electrical contacts manufacturer has signed a Memorandum of Understanding (MoU) with Switzerland-headquartered Metalor Technologies International SA to explore the feasibility of setting up a joint venture in India to produce electrical contacts. This strategic collaboration aims to enhance Shivalik's manufacturing capability for producing electrical contacts.

Apar Industries: The company closed its qualified institution placement (QIP) issue and raised Rs 1,000 crore as it allocated 18,99,696 equity shares to qualified institutional buyers at an issue price of Rs 5,264 per share.

Insolation Energy: The company has received board approval for the appointment of Madhuri Maheshwari as Chief Financial Officer and Key Managerial Personnel, with effect from November 29. Sneha Goenka is appointed as the company secretary and compliance officer of the company.

Repco Home Finance: P. K. Vaidyanathan has joined the housing finance company as the Chief Development Officer for 3 years, with effect from November 29. Vaidyanathan is the General Manager, Repatriates Co-operative Finance and Development Bank (Promoter).

Raghuvir Synthetics: Prateek Pareek has resigned as Chief Financial Officer (CFO) and Swati Jain as the Company Secretary and Compliance Officer (CS) of the company, due to their personal commitments, with effect from November 30.

Rockingdeals Circular Economy: The company will list its equity shares on the NSE Emerge on November 30. The issue price is Rs. 140 per share. Its equity shares will be available for trading in the trade-for-trade segment.

Gandhar Oil Refinery India: The white oil manufacturer will debut on the bourses on November 30. The final issue price has been set at Rs. 169 per share. According to the grey market, the opening price premium could be around 35–40 percent over the issue price.