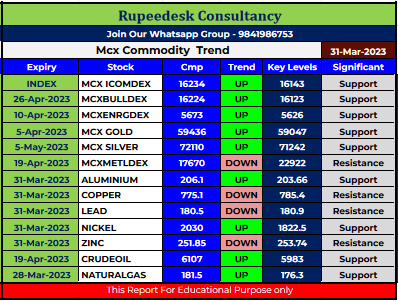

Mcx Commodity Intraday Trend Rupeedesk Reports - 31.03.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Friday, March 31, 2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 31.03.2023

Currency Market Intraday Trend Rupeedesk Reports - 31.03.2023

Currency Market Intraday Trend Rupeedesk Reports - 31.03.2023

Thursday, March 30, 2023

EICHERMOT Stock Report - 31.03.2023

EICHERMOT Stock Report - 31.03.2023

Stock to Focus Techm - 31.03.2023

Stock to Focus Techm - 31.03.2023

Stock to Watch Today - Rupeedesk Reports - 31.03.2023

Stock to Watch Today - Rupeedesk Reports - 31.03.2023

Buzzing Stocks: GR Infraprojects, BEL, Alembic Pharma, JSW Steel & others in news today.

Jindal Steel & Power: The OP Jindal Group company has appointed Damodar Mittal & Sabyasachi Bandyopadhyay as additional directors. The appointment of both was made in the category of executive directors of the company after Dinesh Kumar Saraogi and Sunil Kumar Agrawal stepped down as directors of the company.

Global Surfaces: The engineered quartz stones manufacturer said the board will meet on April 6 to consider the setting up of a subsidiary in State of Texas, United States.

Lumax Industries: Shruti Kant Rustagi has resigned as Chief Financial Officer of the auto ancillary company after his transfer to group corporate materials function, with effect from March 31. Kenjiro Nakazono has also resigned as Executive Director - Whole Time Director of the company with effect from April 7. The board has appointed Ravi Teltia as the Vice President and Chief Financial Officer designated of the company with effect from April 1.

Tata Consumer Products: The board has approved the re-appointment of L Krishnakumar as Whole-time Director designated as Executive Director & Group CFO of the company, for seven months starting from April 1, until October 31, 2023.

GR Infraprojects: The infrastructure company has emerged as L-1 bidder for construction of 4-lane access controlled greenfield highway in Mahabubabed district, on Hybrid Annuity Mode in Telangana. The project cost is Rs 847.87 crore and the completion period is 730 days from appointed date. Further, the company has also received Letter of Award from NHAI for 4 road projects worth Rs 3,713 crore in Karnataka, Maharashtra, and Uttar Pradesh.

Aether Industries: The pharmaceutical company has executed a Letter of Intent with Saudi Aramco Technologies Company, Saudi Arabia. Aether said the Letter of Intent captured the preliminary terms regarding the finalization of a detailed licensing agreement towards the manufacturing and commercialization of the Converge polyols technology and product series, the manufacturing process. The said manufacturing process has been previously jointly developed and validated at commercial scale by Aramco and Aether.

Securekloud Technologies: Subsidiary Healthcare Triangle Inc has signed a new $3 million agreement to provide cloud DevOps managed services for a leading life sciences customer.

Muthoot Capital Services: The company has completed a securitization transaction of Rs 96.87 crore. This is the seventh securitization or direct assignment transaction carried out by the company during FY23. The entire pool is from the non - priority sector.

Narayana Hrudayalaya: The multispeciality hospital company said the board has inducted Naveen Tewari as an additional director in the capacity of an independent director. Naveen is the founder of InMobi, a mobile advertising technology company, and was board member at Paytm.

Kesar Enterprises: The distilleries company said the board has approved one-time settlement (OTS) sanctioned by UCO Bank. Company's loan had classified as non-performing assets by UCO Bank due to non-payment of dues in time, due to financial problems being faced by the company.

Heads UP Ventures: Manish Mandhana has resigned as Chief Executive Officer of the retail company with effect from March 31. He resigned due to pursue his personal interest outside the company.

AGS Transact Technologies: The omni-channel payment solutions provider said the board has approved an appointment of Sudip Bandyopadhyay as an Additional Director in the category of non-executive, non-independent director. Anupama R Goyal resigned as non-executive, non-independent director of the company with immediate effect due to personal reasons.

Sansera Engineering: The automotive components manufacturer has entered into a definitive agreement for a strategic investment in MMRFIC Technology (MMRFIC) which manufactures sub-systems for next generation Radars by leveraging machine learning with artificial intelligence. Sansera would make an investment Rs 20 crore in MMRFIC for 21% stake.

Dynacons Systems & Solutions: The company has won contract worth Rs 106 crore from (n)Code Solutions of Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), for supply, installation, commissioning and O&M of PKI solutions, IT infrastructure components and connectivity services for e-Passport project.

Jain Irrigation Systems: Subsidiary Jain International Trading B.V. (JITBV) closed the transaction to merge international irrigation business with Rivulis. Merged entity - Rivulis – In alliance with Jain International - will create a global irrigation and climate leader - being 2nd largest in the world with $750 million in revenues. Jain (Israel) B.V. (step down subsidiary of JITBV) will hold a strategic minority stake of 18.7% in Rivulis Pte Ltd post merger.

JSW Steel declares as preferred bidder in auctions for 3 coal mines in Chattisgarh & JharkhandJSW Steel: Ministry of Coal has declared JSW Steel as a preferred bidder in an auction for two coal mines in Chattisgarh & Jharkhand. In Jharkhand, it is the preferred bidder for Sitanala coking coal block in Jharia Coalfield with projected coal resources of 108.85 million tonnes and Parbatpur Central Coking Coal Block in Jharia Coalfield with 235.718 million tonnes, while in Chattisgarh, it is the preferred bidder for Banai & Bhalumuda coal block in Mand-Raigarh coalfield with projected coal resources of 1,376.057 million tonnes.

Housing Development Finance Corporation: HDFC entered into an agreement to sell 19.35 lakh equity shares or 16.13% stake in Next Gen Publishing, for Rs 1.7 crore.

Max Ventures and Industries: The company has completed transfer of 41.92 lakh equity shares or 10% stake of Max Speciality Films (MSF) to Toppan Inc, for Rs 133 crore.

Punjab National Bank has sold its entire shareholding of 10.01% in Asset Reconstruction Company (India) (ARCIL) to Avenue India Resurgence Pte Ltd. With stake sale, PNB has ceased to be a sponsor in ARCIL.

Shree Renuka Sugars: The sugar company has commenced commercial production of ethanol from expanded capacity in Athani and Munoli. It has expanded ethanol production capacity at Athani plant from 300 KLPD to 450 KLPD and at Munoli plant, from 120 KLPD to 500 KLPD.

Tejas Networks: The company has appointed Anand Athreya as the CEO and MD designate, with effect from April 3. Atherya would be appointed as CEO and MD post all regulatory and shareholders approvals. The board also appointed Alice G Vaidyan as Non-Executive, Independent (Additional) Director, while Sanjay Nayak, Chief Executive Officer and Managing Director has expressed his desire to seek voluntary retirement from the services of the company to pursue other personal interest.

CIL Nova Petrochemicals: The board members will meet on March 31 to consider the sale of or dispose off the polyster yarn unit in Ahmedabad through slump sale via business transfer agreement (BTA). This is subject to approval of shareholders of the company.

Lupin: The US Food and Drug Administration (USFDA) has issued a Form-483 with 10 observations for company's Pithampur Unit-2 manufacturing facility. The said facility was inspected by USFDA during March 21 to March 29, 2023.

Spandana Sphoorty Financial: The company has raised $20 million via external commercial borrowings, with a tenure of 36 months. Further, the board will meet on April 4 to consider the fund raising via issue of debentures on private placement basis.

Texmaco Rail & Engineering: Hemant Bhuwania is appointed as the Chief Financial Officer (CFO) of the company with effect from April 1. AK Vijay, who is currently designated as the Executive Director & CFO, has resigned as CFO of the company with effect from April 1 and accordingly, he will continue to act as Executive Director of the Company.

Bharat Electronics: The Ministry of Defence has signed 10 contracts worth Rs 5,498 crore with Bharat Electronics for Indian Armed Forces.

Alembic Pharmaceuticals: The company has received final approval from US Food & Drug Administration (USFDA) for its abbreviated new drug application (ANDA) Brimonidine Tartrate ophthalmic solution. This ANDA is therapeutically equivalent to listed drug product (RLD), Alphagan P ophthalmic solution of AbbVie Inc. Brimonidine Tartrate Ophthalmic Solution is an alpha adrenergic receptor agonist indicated for the reduction of elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension.

Aurobindo Pharma: The company has signed voluntary sub-licensing with Medicines Patent Pool (MPP), a UN organization, for developing and marketing Cabotegravir tablets & long acting injectables, originally developed by ViiV Healthcare, for the prevention of HIV in 90 low and middle-income countries (LMIC), including India. For the generic version of Cabotegravir, Aurobindo will utilize their vertically integrated capabilities to develop in-house API manufacturing which will enable stronger control on supply chain and cost efficiencies.

Gujarat Ambuja Exports: The company has successfully commissioned a 100 TPD sorbitol unit at existing unit of Sitarganj, in Uttarakhand, taking the sorbitol manufacturing capacity to 220 TPD at Sitarganj. With this, the company becomes the largest sorbitol manufacturer in India with a cumulative capacity of 400 TPD at 3 locations.

Power Finance Corporation: Subsidiary PFC Consulting has transferred Dharamjaigarh Transmission, Bhadla Sikar Transmission, and Raipur Pool Dhamtari Transmission, to Power Grid Corporation of India, for around Rs 38 crore.

Mahindra Lifespace Developers: Subsidiary Mahindra World City Developers has transferred land admeasuring 9.24 acres on perpetual lease within the Mahindra World City, Chennai to Alliance Budget Housing India for the development of a multi-storey residential project.

Sportking India: The company has commenced its commercial production of 63,072 spindles at its manufacturing unit in Bathinda, Punjab, for manufacturing of cotton yarn (compact).

Quess Corp: Fairbridge Capital (Mauritius), a subsidiary of private equity investment firm Fairfax Financial Holdings, has bought 66 lakh equity shares or 4.4 percent stake in Quess Corp via open market transactions at an average price of Rs 384.99 per share, amounting to Rs 254 crore. However, Smallcap World Fund Inc sold 28.46 lakh shares in the company at an average price of Rs 385 per share, Aditya Birla Sun Life Mutual Fund A/C - Aditya Birla Sun Life Tax Relief 96 offloaded 11.36 lakh shares at an average price of Rs 383.79 per share, and ICICI Prudential Life Insurance Company sold 13.49 lakh shares at an average price of Rs 385 per share.

Max Financial Services: Max Ventures Investment Holdings has sold 30 lakh shares or 0.86 percent stake in the company via open market transactions at an average price of Rs 606.6 per share, amounting to Rs 182 crore. However, Plutus Wealth Management LLP bought 20 lakh shares in the company at same price.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Wednesday, March 29, 2023

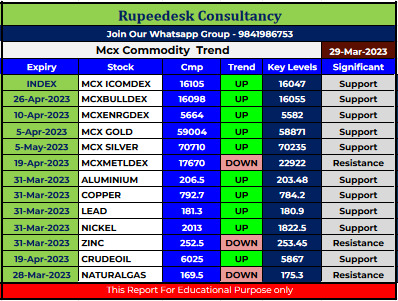

Mcx Commodity Intraday Trend Rupeedesk Reports - 29.03.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 29.03.2023

Stock to Focus GRINFRA - 29.03.2023

Stock to Focus GRINFRA - 29.03.2023

MANAPPURAM Stock Report - 29.03.2023

MANAPPURAM Stock Report - 29.03.2023

Tuesday, March 28, 2023

Currency Market Intraday Trend Rupeedesk Reports - 29.03.2023

Currency Market Intraday Trend Rupeedesk Reports - 29.03.2023

Stock to Watch GRANULES - 29.03.2023

Stock to Watch GRANULES - 29.03.2023

CYIENT Stock Report - 29.03.2023

CYIENT Stock Report - 29.03.2023

US & Asian Market - 29.03.2023

US & Asian Market - 29.03.2023

Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Vedanta announces fifth interim dividend of Rs 20.50 per share - 29.03.2023

Vedanta announces fifth interim dividend of Rs 20.50 per share - 29.03.2023

Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Crudeoil - Dollar - Gold - 29.03.2023

Crudeoil - Dollar - Gold - 29.03.2023

Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Global Market Updates - 29.03.2023

Global Market Updates - 29.03.2023

Stock to Watch Today - Rupeedesk Reports - 29.03.2023

Stock to Watch Today - Rupeedesk Reports - 29.03.2023

Buzzing Stocks: Vedanta, Zydus Lifesciences, GR Infraprojects and others in news today.

Vedanta: The mining company said its board of directors has approved the fifth interim dividend of Rs 20.50 per equity share on a face value of Re 1 per share for FY23, which amounted to Rs 7,621 crore. The record date for payment of dividend has been fixed as April 7. Meanwhile, Ajay Goel has resigned as the acting chief financial officer of the company effective from April 9, to pursue career outside of the Group.

Jindal Stainless: The stainless steel maker has entered into a collaboration agreement with New Yaking Pte Ltd for the investment in development, construction and operation of a nickel pig iron (NPI) smelter facility in Halmahera Islands, Indonesia. JSL will acquire a 49% equity interest in nickel pig iron company for $157 million. The facility is planned to be commissioned within 2 years, with an annual nameplate production capacity of up to 2 lakh metric tonnes of NPI with average 14% Ni Content.

Zydus Lifesciences: The pharma company has received the final approval for Loperamide hydrochloride capsules (USP 2 mg) from the US Food and Drug Administration (USFDA). Loperamide hydrochloride capsule is indicated for the control and symptomatic relief of acute nonspecific diarrhea and chronic diarrhea associated with inflammatory bowel disease. The drug will be manufactured at the group’s formulation manufacturing facility at SEZ, Ahmedabad.

REC: Subsidiary REC Power Development & Consultancy has transferred entire shareholding in Khavda II-A Transmission Limited, at par value along with all its assets and liabilities, to Adani Transmission. Adani Transmission is the successful bidder selected through tariff based competitive bidding process for 'transmission scheme for evacuation of 4.5 GW RE injection at Khavda P.S. under Phase-II - Part A.

NBCC (India): The company has secured work orders worth Rs 146.39 crore. The first order of Rs 46.39 crore is for construction of a hostel building, a boundary wall, and other works at Ghani Khan Choudhary Institute of Engineering and Technology (GKCIET) in Malda, West Bengal. The second order of Rs 100 crore is bagged from Small Industrial Development Bank of India (SIDBI) for various work of SIDBI buildings on a pan-India basis.

GR Infraprojects: The company has secured the letter of acceptance (LOA) from the East Coast Railway for kthe construction of tunnel work and allied works of Khurda - Bolangir new rail line project. The project is worth Rs 587.59 crore.

RPP Infra Projects: The company has received a letter of acceptance for a project - repair and construction works of old buildings for reopening of old district jail at Bareilly, Uttar Pradesh, on an EPC basis. The project worth Rs 148.08 crore is expected to be completed by October 31, 2024.

SML Isuzu: The company has decided to increase the prices of trucks and buses by up to 4% and 6%, with effect from April 1, to cover the increase in input prices due to new compliances - BS6 Integrated On-Board Diagnostic II (IOBD-II) and Electronic Stability Control (ESC) for buses, being implemented with effect from April 1, 2023.

Asian Energy Services: Promoter entity Oilmax Energy has acquired an additional 2.14 lakh equity shares or 0.56% stake in Asian Energy Services, the services provider to the energy and minerals sector, at an average price of Rs 99.4 per share. On March 23, Oilmax had bought 0.58% stake at an average price of Rs 104.84 per share.

Kalyan Jewellers India: Mauritius-based Highdell Investment, owned by New York-based private equity investment firm Warburg Pincus, has sold 2.33 crore equity shares or 2.26% shareholding in the jewellery maker at an average price of Rs 110.04 per share, which amounted to Rs 256.67 crore.

Shalby: Ace investor Porinju Veliyath-owned Equity Intelligence India has bought 6.1 lakh shares in the multispecialty hospitals chain or 0.56% stake at an average price of Rs 117 per share.

Shilpa Medicare: Foreign portfolio investor India Opportunities Growth Fund Ltd - Pinewood Strategy has sold 5 lakh shares or 0.57% stake in the pharmaceutical firm via open market transaction, at an average price of Rs 225.3 per share. The fund had 1.66% stake in the company as of December 2022.

CE Info Systems: Foreign firm Zenrin Co Ltd has sold 8 lakh shares or 1.49% stake in the MapmyIndia operator via open market transactions at an average price of Rs 1,000.05 per share, which amounted to Rs 80 crore. Zenrin held 6.16% stake in C E Info Systems as of December 2022.

South Indian Bank: The board has considered the request of Murali Ramakrishnan, Managing Director & CEO, not to offer himself for re-appointment due to personal reasons. Murali will complete his current term on September 30, 2023. The Search Committee will identify and evaluate suitable candidates for the position of Managing Director & CEO.

Inox Wind Energy: Inox Wind Energy has received board approval for approved the sale of wind energy business, to its holding company, Inox Leasing and Finance, by way of slump sale through business transfer agreement, for Rs 17 crore. Inox Leasing and Finance currently holds 51.82% shares in Inox Wind Energy.

IFCI: The board has given its approval for preferential issue of equity share capital for FY23, worth Rs 400 crore to the Government of India.

DB Corp: The company has appointed Lalit Jain as Chief Financial Officer with effect from April 1, 2023 after Pradyumna Mishra retired as the Group Chief Financial Officer on March 31, 2023.

Apollo Tyres: The tyre manufacturer has approved the incorporation of a wholly owned subsidiary, to create an online D2C (direct to customer) platform. The platform will make passenger vehicle aftermarket services on site for convenience of customers.

Dev Information Technology: The company has secured an order from National Informatics Centre Service Inc. for Ministry Of Electronics and Information Technology for its project – Lok Sabha Secretariat, for design, development, implementation and maintenance of its application software and website.

NHPC: The hydro power generation company has received board approval for raising of debt upto Rs 5,600 crore in FY24 through issuance of non-convertible corporate bonds in one or more series or tranches on private placement basis, and/ or raising of term loans/ external commercial borrowings (ECB) in suitable tranches.

Fortis Healthcare: The board members have approved appointment of Mehmet Ali Aydinlar, and Tomo Nagahiro as additional directors (non-executive & non-independent) of the company with effect from March 28. However, Takeshi Saito, and Dr. Farid Bin Mohamed Sani have resigned as non-executive & non-independent directors of the company.

Larsen & Toubro: The infrastructure major has issued 2 lakh non-convertible debentures of Rs 1 lakh each, amounting to Rs 2,000 crore. The said debentures, which will mature on April 28, 2028, are proposed to be listed on the National Stock Exchange of India.

DCB Bank: The bank has announced allotment of Basel III compliant Tier II bonds of face value of Rs 1 crore each, on a private placement basis, amounting to Rs 300 crore. The bonds will be redeemed on its original maturity of 10 years. The fund raising will support the business growth and also further improve the capital adequacy of the bank.

KEI Industries: The electrical wires and cables manufacturer has become Principal Partner with Royal Challengers Bangalore, for the Indian Premier League (IPL) for three years. The association will help KEI Industries strengthen its growing brand and business presence nationally.

RHI Magnesita India: The refractory products supplier said the board on April 1 will consider raising of Rs 200 crore funds via issue of equity shares to its promoters.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Mcx Commodity Intraday Trend Rupeedesk Reports - 28.03.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 28.03.2023

Currency Market Intraday Trend Rupeedesk Reports - 28.03.2023

Currency Market Intraday Trend Rupeedesk Reports - 28.03.2023