US and Asian Market - 01.09.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Wednesday, August 31, 2022

US and Asian Market - 01.09.2022

Stock to Watch Today - Rupeedesk Reports - 01.09.2022

Stock to Watch Today - Rupeedesk Reports - 01.09.2022

Stocks to Watch Today | Tata Motors, Zee Entertainment, Cipla and others in news today.

Tata Motors: Tata Motors acquires entire shareholding of Marcopolo S A. Tata Motors has acquired the entire shareholding of Marcopolo S A in the joint venture entity Tata Marcopolo Motors. Tata Marcopolo Motors has now become a wholly owned subsidiary of Tata Motors.

Cipla: Cipla, Kemwell India to incorporate joint venture company in US. The company and Kemwell India have entered into an "amendment-cum-assignment agreement". As per the agreement, the joint venture entity will now be incorporated in the United States of America. There is no other material change in the agreement. In a separate development, Cipla (EU) has agreed to acquire an additional 13.10 percent stake in Cipla (Jiangsu) Pharmaceutical Co Ltd, a subsidiary of Cipla EU in China.

Sunteck Realty: Sunteck Realty arm acquires Rusel Multiventures. Subsidiary Clarissa Facility Management LLP has acquired a 10% stake in Rusel Multiventures, which provides facility management services. With this acquisition, the company will leverage facility management expertise to create additional streams of revenue, cost-effectiveness and a continous supply of facilities that will improve its overall effectiveness and productivity, Sunteck said.

Infosys: Infosys sells stake in Trifacta Inc. The Indian IT company has divested its entire holding in US-based Trifacta Inc for $12 million. The transaction was completed on August 29. Infosys had made a minority investment of $10 million during 2016-2019, in Trifacta Inc, a data engineering software company headquartered in San Francisco, USA.

Zee Entertainment Enterprises: Zee Entertainment Enterprises gets TV rights for ICC men's events from Disney Star. The company has signed a strategic licensing agreement with Star India (Disney Star). With this agreement, Disney Star will lease the television broadcasting rights of the International Cricket Council's (ICC) men's and Under 19 (U-19) global events for a period of four years to the company.

Inox Wind: Inox Wind gets board nod for raising Rs 800 crore. The company has received its board's approval to raise up to Rs 800 crore through the issuance of non-convertible preference shares to promoters on a private placement basis. The funds raised through the issuance of NCPRPS will be used for repayment of the debt.

Glenmark Pharmaceuticals: Glenmark subsidiary, Hikma launch rhinitis nasal spray in US. Subsidiary Glenmark Specialty SA, and Hikma Pharmaceuticals PLC launched Ryaltris, olopatadine hydrochloride and mometasone furoate nasal spray, in the US. The nasal spray is approved by the US Food and Drug Administration for the treatment of symptoms of seasonal allergic rhinitis in adult and pediatric patients 12 years of age and older.

CreditAccess Grameen: CreditAccess Grameen raises $90 million via external commercial borrowings. As a part of the diversification of funding strategy, the company has, by way of external commercial borrowings with a door-to-door tenure of four years, entered an arrangement to avail $90 million through loan syndication arrangement led by HSBC Bank, which acted as lead arranger and book runner. The other lenders in the syndication arrangement include Bank of India, Union Bank of India and UCO Bank.

Nuvoco Vistas Corporation: Nuvoco Vistas Corporation announces redemption of NCDs worth Rs 350 crore. The company has made timely payment of redemption amount (principal) and interest for the redeemable, listed, secured and rated non-convertible debentures of Rs 350 crore.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Tuesday, August 30, 2022

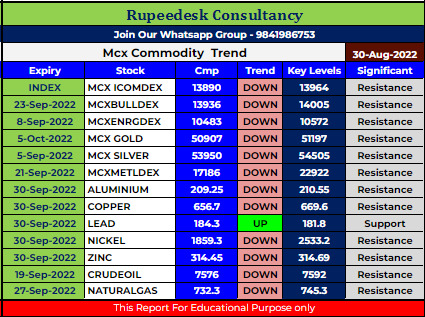

Mcx Commodity Intraday Trend Rupeedesk Reports - 30.08.2022

Mcx Commodity Intraday Trend Rupeedesk Reports - 30.08.2022

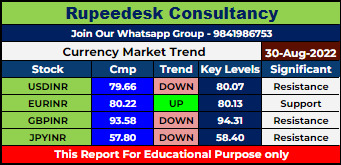

Currency Market Intraday Trend Rupeedesk Reports - 30.08.2022

Currency Market Intraday Trend Rupeedesk Reports - 30.08.2022

Top Weightage Stocks Trend Rupeedesk Reports - 30.08.2022

Top Weightage Stocks Trend Rupeedesk Reports - 30.08.2022

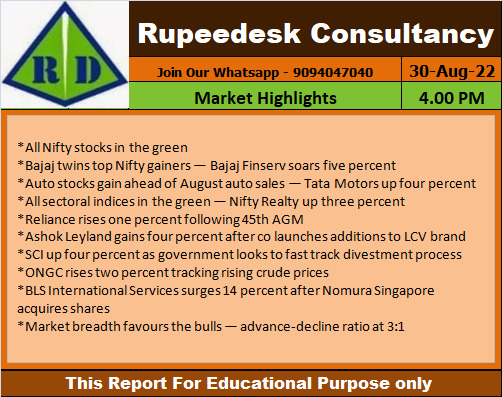

Market Highlights - 30.08.2022

Market Highlights - 30.08.2022

US Dollar Trend Update - Rupeedesk Reports - 30.08.2022

US Dollar Trend Update - Rupeedesk Reports - 30.08.2022

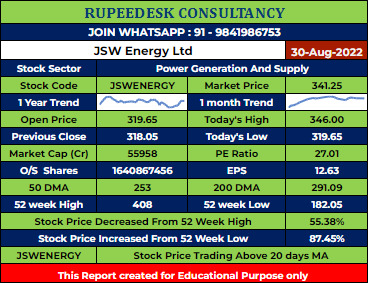

JSWENERGY Stock Analysis - Rupeedesk Reports - 30.08.2022

JSWENERGY Stock Analysis - Rupeedesk Reports - 30.08.2022

Monday, August 29, 2022

52 Week High In Large Cap - 30.08.2022

52 Week High In Large Cap - 30.08.2022

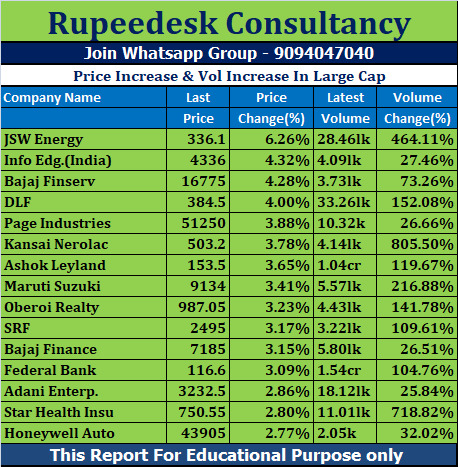

Price Increase & Vol Increase In Large Cap - 30.08.2022

Price Increase & Vol Increase In Large Cap - 30.08.2022

Price Increase & Vol Increase In Mid Cap - 30.08.2022

Price Increase & Vol Increase In Mid Cap - 30.08.2022

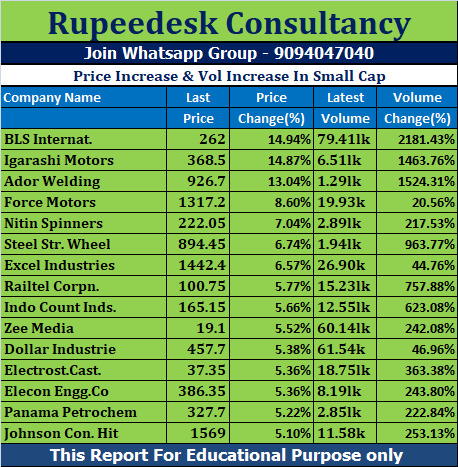

Price Increase & Vol Increase In Small Cap - 30.08.2022

Price Increase & Vol Increase In Small Cap - 30.08.2022

Positional Futures - APOLLOHOSP Target 4390/4470 - Rupeedesk Shares - 30.08.2022

Positional Futures - APOLLOHOSP Target 4390/4470 - Rupeedesk Shares - 30.08.2022

Positional Futures - HINDUNILVR target 2650/2685 - Rupeedesk Shares - 30.08.2022

Positional Futures - HINDUNILVR target 2650/2685 - Rupeedesk Shares - 30.08.2022

Positional Futures - Bergepaint Target 684/690 - Rupeedesk Shares - 30.08.2022

Positional Futures - Bergepaint Target 684/690 - Rupeedesk Shares - 30.08.2022

Will bulls manage to pull nifty above 17400 - join Whatsapp - 9841986753

Will bulls manage to pull nifty above 17400 - join Whatsapp - 9841986753

US and Asian Market - 30.08.2022

US and Asian Market - 30.08.2022

Stock to Watch Today - Rupeedesk Reports - 30.08.2022

Stock to Watch Today - Rupeedesk Reports - 30.08.2022

Stocks to Watch Today | BLS International, ICRA, Orient Cement, and others in news today.

BLS International Services: Nomura Singapore picks half a percent stake in BLS International Services. Nomura Singapore acquired 11 lakh equity shares in the company via open market transactions at an average price of Rs 230 per share.

Thyrocare Technologies: Fundsmith Emerging Equities Trust Plc offloads nearly all shares in Thyrocare Technologies. Fundsmith Emerging Equities Trust Plc sold 2,68,707 equity shares in the company at an average price of Rs 614.79 per share, and 3.2 lakh shares at average price of Rs 615.14 per share.

Ugro Capital: Ugro Capital raises Rs 50 crore through NCDs. The company said the board of directors has made an allotment of 50,000 non-convertible debentures having face value of Rs 10,000 each through private placement. The tenure of instrument is 24 months from the date of allotment and the coupon rate is 10.35% per annum.

ICRA: ICRA gets board approval for appointment of Group Chief Financial Officer. The company received board approval for the appointment of Venkatesh Viswanathan as a Group Chief Financial Officer and key managerial personnel. His appointment is effective from August 30, 2022 and the company also designated him as Chief Investor Relations Officer. Amit Kumar Gupta has stepped down as Chief Financial Officer.

BC Power Controls: BC Power Controls raises Rs 6.21 crore through preferential issue to promoters. The company has received board approval for issuance of 1.1 crore equity shares on a preferential basis to the promoter group category at a price of Rs 5.65 per share. The total fundraising is Rs 6.21 crore.

Krishna Institute of Medical Sciences: Krishna Institute of Medical Sciences picks up 51% stake in a multi-speciality hospital. The company has entered into a definitive agreement to acquire a majority stake (51%) in SPANV Medisearch Lifesciences, Nagpur. SPANV is running a multi-speciality hospital, Kingsway Hospitals, having over 300 beds. Existing promoters and shareholders will continue to hold balance 49% stake. After acquisition, the hospital will be renamed KIMS Kingsway Hospitals.

Orient Cement: Franklin Templeton Mutual Fund cuts stake in Orient Cement. Franklin Templeton Mutual Fund sold 1.52 lakh equity shares or 0.07% stake in the cement company on August 26. With this, it has reduced stake in the company to 3.12% from 3.2% earlier.

Star Housing Finance: The Coronation Castles offloads stake in Star Housing Finance. The Coronation Castles Pvt Ltd has offloaded 0.07% stake in the company via open market transactions on August 26. With this, its stake reduced to 0.06% from 0.13% earlier.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc