52 Week High In Large Cap : 01.08.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Sunday, July 31, 2022

52 Week High In Large Cap : 01.08.2022

Price Increase & Vol Increase In Large Cap : 01.08.2022

Price Increase & Vol Increase In Large Cap : 01.08.2022

Price Increase & Vol Increase In Mid Cap : 01.08.2022

Price Increase & Vol Increase In Mid Cap : 01.08.2022

Price Increase & Vol Increase In Small Cap : 01.08.2022

Price Increase & Vol Increase In Small Cap : 01.08.2022

Earning Results Corner 01.08.2022

Earning Results Corner 01.08.2022

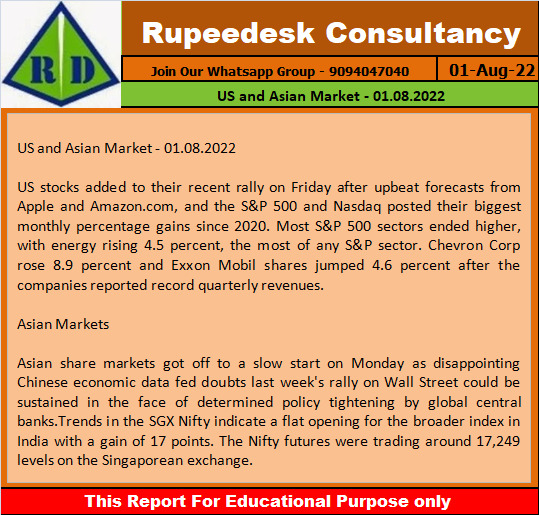

US and Asian Market - 01.08.2022

US and Asian Market - 01.08.2022

Global Market Updates - 01.08.2022

Global Market Updates - 01.08.2022

Stock to Watch Today - Rupeedesk Reports - 01.08.2022

Stock to Watch Today - Rupeedesk Reports - 01.08.2022

Stocks to Watch Today | ITC, Bank of Baroda, Rain Industries, and others in news today.

Results on August 1: ITC to be in focus ahead of its June quarter earnings today. Besides ITC, UPL, Zomato, Arvind, Bajaj Consumer Care, Barbeque-Nation Hospitality, Carborundum Universal, Castrol India, Escorts Kubota, Eveready Industries India, Indo Count Industries, Kansai Nerolac Paints, Max Financial Services, Prudent Corporate Advisory Services, Punjab & Sind Bank, The Ramco Cements, RateGain Travel Technologies, Thyrocare Technologies, Triveni Turbine, and Varun Beverages will declare their June quarter earnings on August 1.

Bank of Baroda: The public sector lender reported a 79.4 percent year-on-year growth in standalone profit at Rs 2,168 crore for the quarter ended June 2022, despite fall in other income and pre-provision operating profit. The significant decline in bad loans provisions aided the bottom line. Net interest income grew 12 percent YoY to Rs 8,838.4 crore in Q1FY23, with credit growth at 18 percent and 10.9 percent YoY increase in global deposits.

IDFC First Bank: The bank recorded highest-ever standalone profit of Rs 474.33 crore in Q1FY23, against a loss of Rs 630 crore in the corresponding period of the previous fiscal. The increase in core operating income and fall in provisions aided the profitability, with the sequential growth in profit at 38 percent. Net interest income grew 26 percent to Rs 2,751.1 crore YoY during the quarter, with 39 bps YoY improvement in net interest margin at 5.89 percent for the quarter. But there was 38 bps decline in net interest margin on a sequential basis.

Dr Reddy's Laboratories: The pharma major entered into a licensing agreement with Slayback Pharma to obtain exclusive rights in the first-to-file ANDA for the private label version of Lumify in the US. Lumify is an over-the-counter (OTC) eyedrop that can be used to relieve redness of the eye due to minor eye irritations. The agreement also provides Dr Reddy’s exclusive rights to the product outside the US.

Rain Industries: The company recorded a 184 percent year-on-year increase in consolidated profit at Rs 668.50 crore for the quarter ended June 2022, driven by healthy top line and operating performance. Revenue grew by 52 percent to Rs 5,540.6 crore due to solid growth in average blended realisation for carbon and advanced material sales, though volumes declined. Operating profit grew 78.5 percent to Rs 1,210.5 crore during the same period.

Zee Entertainment Enterprises: The company has received no-objection letters from BSE and National Stock Exchange of India, for the proposed Composite Scheme of Arrangement amongst Zee Entertainment, Bangla Entertainment, and Culver Max Entertainment (formerly Sony Pictures Networks India). These observation letters permit the company to file the Composite Scheme of Arrangement with National Company Law Tribunal, Mumbai.

Yes Bank: The bank is going to raise Rs 8,898.47 crore from The Carlyle Group and Verventa Holdings (affiliate of Advent) by selling 10 percent stake each. The board of directors has approved the allotment of 369.61 crore equity shares at a price of Rs 13.78 per share and 256.75 crore warrants exchangeable into equity shares, at a price of Rs 14.82 per share, through preferential allotment on a private placement basis, which is subject to approval of shareholders and RBI. The Carlyle Group and Verventa Holdings (affiliated of Advent) will pour in money into the bank against 184.8 equity shares each and 128.37 crore warrants each.

Cipla: The pharma company recorded a 4 percent year-on-year decline in consolidated profit at Rs 686 crore for the quarter ended June 2022 as EBITDA fell by 15 percent YoY to Rs 1,143 crore and revenue fell by 2.3 percent to Rs 5,375 crore in the same period. India business declined 8.4 percent to Rs 2,483 crore and North America business grew by 15.5 percent to Rs 1,199 crore in Q1FY23.

CARE Ratings: The rating agency recorded a 22.4 percent year-on-year growth in consolidated profit at Rs 14.14 crore for the quarter ended June 2022 on operating income and top line growth. Revenue during the quarter rose by 10.9 percent YoY to Rs 54.57 crore. The consolidated numbers included CARE Ratings and its four subsidiaries.

CEAT: The company has entered into a First Amendment Agreement with Greenzest Solar Private Limited, for making a further investment Rs 3.5 crore in Greenzest, which is into captive power generation projects and development of renewable energy. Upon completion of the investment, the total holding of the company in Greenzest shall be 27.52 percent.

State Bank of India: The country's largest lender signed an agreement for sale of entire 97,500 equity shares held in HDFC Venture Capital, to HDFC. The cash consideration will be Rs 9.75 lakh and the transaction is expected to be completed by August 11.

3i Infotech: The consolidated loss by the company narrowed to Rs 1.52 crore in the quarter ended June 2022, from loss of Rs 7.87 crore in Q1FY22 and loss Rs 3.9 crore in Q4FY22, aided by foreign exchange gain of Rs 12.8 crore. Revenue from operations grew by 12.1 percent YoY to Rs 179.22 crore during the quarter and the sequential increase in top line was 2 percent.

GMR Infrastructure: The company posted consolidated loss at Rs 112.99 crore for the quarter ended June 2022, narrowed from loss Rs 180.08 crore in same period last year. Total income grew by 62.3 YoY to Rs 1,641.4 crore during the quarter. Delhi Airport and Hyderabad Airport exhibit strong recovery of international traffic at 79 percent and 87 percent of pre-Covid levels respectively as post removal of restriction on scheduled international flights, various international carriers resumed flights and added capacity to various Indian destinations.

Nilkamal: The company reported 1,604 percent year-on-year growth in consolidated profit at Rs 28.63 crore for the quarter ended June 2022 due to low base in year-ago period that impacted by second Covid wave. Revenue grew by 50.3 percent YoY to Rs 739.94 crore during the same period.

JSW Energy: JSW Steel subsidiary JSW Energy (Barmer) owned 1,080 MW power plant at Barmer retained access to uninterrupted supply of lignite for its operations. The Rajasthan government informed Barmer Lignite Mining Company Limited (BLMCL) that it is in receipt of ex-post facto- previous approval from the Central Government for transfer of two lignite mining leases (Kapurdi and Jalipa in Rajasthan) from Rajasthan State Mines and Minerals Limited (RSMML) to BLMCL with effect from the date of transfer of the said mining leases and accordingly, the previous letters issued by the Rajasthan Government directing BLMCL to stop mining operations at the two lignite mines stand withdrawn.

Torrent Pharmaceuticals: The company recorded a 7.3 percent year-on-year growth in consolidated profit at Rs 354 crore for the quarter ended June 2022 as revenue grew by 10 percent YoY to Rs 2,347 crore and EBITDA increased by 5.2 percent to Rs 712 crore in the same period, with India revenue growing 14% to Rs 1,245 crore.

Metro Brands: The company reported consolidated profit of Rs 105.78 crore for the quarter ended June 2022, against loss of Rs 12.13 crore in same period last year. Revenue grew by 287% YoY to Rs 508 crore for the June FY23 quarter. The year-ago quarter was impacted by second Covid wave.

Indian Bank: The bank registered a 3 percent YoY growth in standalone profit at Rs 1,213 crore for the quarter ended June 2022 as provisions remained elevated at Rs 2,219 crore that declined 13.3 percent YoY, and other income that fell by 12 percent YoY. Net interest income increased by 13 percent YoY to Rs 4,534 crore and operating profit rose by 4 percent YoY to Rs 3,564 crore during the quarter.

Nazara Technologies: Mobile gaming company Nazara Technologies reported more than 22% year-on-year growth in its consolidated net profit at Rs 16.5 crore for the quarter ended June 2022, backed by strong revenue growth. Revenue during the quarter surged 70 percent to Rs 223.1 crore compared to the corresponding period of the last fiscal. The sequential growth in the bottom line was 237 percent and it was a 27.4 percent increase in the top line for the June FY23 quarter.

CreditAccess Grameen: The microfinance institution recorded a 588.2% YoY growth in profit after tax at Rs 140 crore in Q1FY23 as impairment of financial instruments declined by 46.3 percent YoY to Rs 100.9 crore. Net interest income increased by 30.9 percent YoY to Rs 461.5 crore in the quarter ended June 2022. Pre-provision operating profit grew 33.9 percent YoY to Rs 290 crore and its portfolio rose by 23.3 percent YoY to Rs 15,615 crore in Q1FY23.

VST Industries: The company clocked a 23.7 percent YoY growth in profit at Rs 87.14 crore for the quarter ended June 2022, driven by operating income and other income. Revenue grew by 9.15% YoY to Rs 401.82 crore during the same period.

DLF: The real estate developer reported a 36% year-on-year increase in profit at Rs 470 crore for the quarter ended June 2022. Consolidated revenue at Rs 1,516 crore grew by 22% YoY in the same period with net sales bookings rising 101% YoY to Rs 2,040 crore.

Cholamandalam Investment and Finance Company: The company registered a 73% year-on-year growth in profit at Rs 565.66 crore for the quarter ended June 2022 as impairment on financial instruments dropped 47% YoY to Rs 298.62 crore for the quarter. Total income grew by 12% YoY to Rs 2,770.93 crore in Q1FY23.

JK Paper: The company clocked a 154% YoY growth in consolidated profit at Rs 264.23 crore for June FY23 quarter as total turnover grew by 109% to Rs 1,508 crore and EBITDA increased by 104% to Rs 458 crore during the quarter.

Shilpa Medicare: The US FDA has concluded Remote Record Review of company's Unit III, advanced analytical characterization laboratory at Dabaspet, Bengaluru without any objectionable conditions. The review was conducted during November 15-18. The facility is designed with advanced analytical equipment to provide testing services such as In-vitro Permeation testing, nitrosamine testing, elemental impurity testing, extractable & leachable testing, glass delamination testing etc.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Friday, July 29, 2022

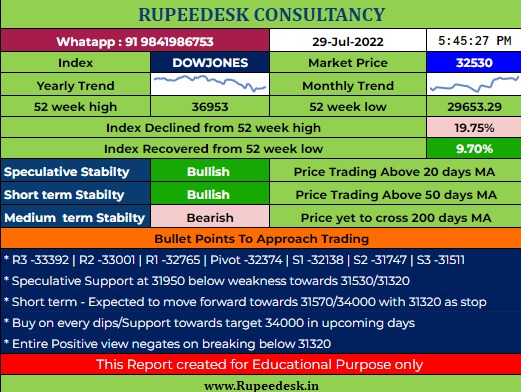

Dowjones Outlook -Rupeedesk Shares - 29.07.2022

Dowjones Outlook -Rupeedesk Shares - 29.07.2022

Market Highlights - 29.07.2022

Market Highlights - 29.07.2022

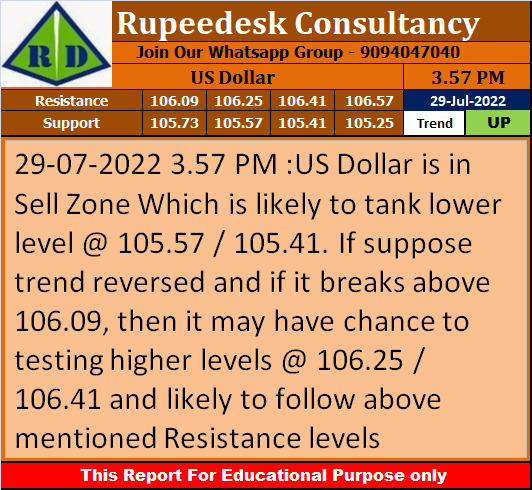

US Dollar Trend Update - Rupeedesk Reports - 29.07.2022

US Dollar Trend Update - Rupeedesk Reports - 29.07.2022

FINCABLES Stock Analysis - Rupeedesk Reports - 29.07.2022

FINCABLES Stock Analysis - Rupeedesk Reports - 29.07.2022

SBILIFE Stock Analysis - Rupeedesk Reports - 29.07.2022

SBILIFE Stock Analysis - Rupeedesk Reports - 29.07.2022

Increased demand by workers to raise costs of festive season hiring - Rupeedesk Reports - 29.07.2022

Increased demand by workers to raise costs of festive season hiring - Rupeedesk Reports - 29.07.2022

Google, Meta muscle into short video game, threatening smaller local firms - Rupeedesk Reports - 29.07.2022

Google, Meta muscle into short video game, threatening smaller local firms - Rupeedesk Reports - 29.07.2022

Women gravitate towards companies offering opportunities to work remotely - Rupeedesk Reports - 29.07.2022

Women gravitate towards companies offering opportunities to work remotely - Rupeedesk Reports - 29.07.2022

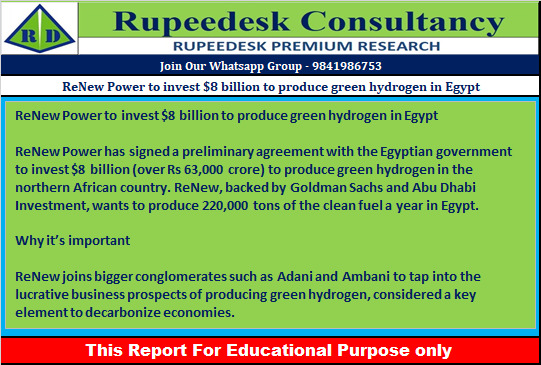

ReNew Power to invest $8 billion to produce green hydrogen in Egypt - Rupeedesk Reports - 29.07.2022

ReNew Power to invest $8 billion to produce green hydrogen in Egypt - Rupeedesk Reports - 29.07.2022

Chinese phone maker Vivo denies charges of financial terrorism - Rupeedesk Reports - 29.07.2022

Chinese phone maker Vivo denies charges of financial terrorism - Rupeedesk Reports - 29.07.2022

Increasing infra investment pushing down logistics costs, offering efficiency gains - Rupeedesk Reports - 29.07.2022

Increasing infra investment pushing down logistics costs, offering efficiency gains - Rupeedesk Reports - 29.07.2022