Buzzing Stocks: HDFC, Tata Motors, IRCTC, RIL and other stocks in news today

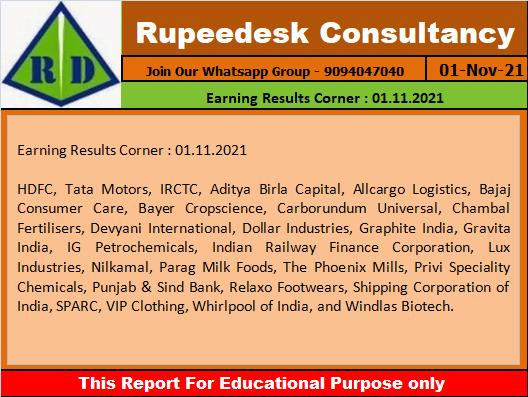

Results today: HDFC, Tata Motors, IRCTC, Aban Offshore, Aditya Birla Capital, Allied Digital Services, Allcargo Logistics, Bajaj Consumer Care, Bayer Cropscience, Chambal Fertilisers & Chemicals, Gravita India, Hind Rectifiers, I G Petrochemicals, Ind-Swift Laboratories, Indian Railway Finance Corporation, JBF Industries, Kalyani Steels, Lux Industries, Man Infraconstruction, Mold-Tek Technologies, Mold-Tek Packaging, Nilkamal, Parag Milk Foods, Patel Engineering, The Phoenix Mills, Pioneer Embroideries, Punjab & Sind Bank, Relaxo Footwears, Repro India, Rolta India, Rupa & Company, Salzer Electronics, Shipping Corporation Of India, Sun Pharma Advanced Research Company, Star Cement, Sterling Tools, Tata Motors - DVR, Vascon Engineers, Venky's (India), VRL Logistics and Whirlpool Of India are among the 149 companies to declares their quarter numbers today.

Reliance Industries: Jio and Google launched JioPhone Next. It will be available in stores from Diwali with an entry price of only Rs 1,999 and the rest paid via easy EMI over 18/24 months.

Tata Steel: NCLT approved composite scheme of amalgamation of Bamnipal Steel & Tata Steel BSL into and with the company.

Airline Stocks in focus: Directorate General of Civil Aviation (DGCA) has extended ban on scheduled commercial international passenger flights until November 30. However, the international scheduled passenger flights on select routes approved by competent authority and international cargo flights, passenger flights approved by DGCA to continue the operations .

Dr Reddy's Laboratories Q2: The company reported a consolidated profit after tax (PAT) of Rs 992 crore, up 30% from Rs 762 crore. The revenues were up 18% at Rs 5,763 crore for the quarter, compared to Rs 4,897 crore in the same period last year.

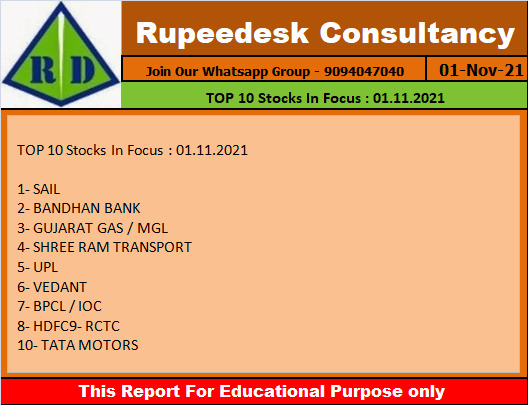

IOC Q2: The company reported 7 percent jump in its net profit at Rs 6,360 crore versus Rs 5,941,4 crore and revenue was up 14.1% at Rs 1.35 lakh crore against Rs 1.18 lakh crore, QoQ.

SAIL Q2: The company reported higher net profit at Rs 5,794.9 crore versus Rs 660.2 crore, revenue was up 58.5% at Rs 26,828 crore versus Rs 16,925.5 crore, YoY.

Vedanta Q2: Consolidated net profit higher at Rs 5,813 crore versus Rs 1,642 crore and revenue was up 42.6% at Rs 30,101 crore versus Rs 21,107 crore, YoY.

Shree Cement Q2: The company reported 5.6 percent jump in net profit at Rs 577.7 crore versus Rs 547 crore and revenue was up 5% at Rs 3,205.9 crore versus Rs 3,053.3 crore, YoY.

Apollo Tyres Q2: The company posted lower net profit at Rs 173.8 crore versus loss of Rs 246.8 crore , revenue was up 18.2% At Rs 5,077.3 crore versus Rs 4,294.9 crore, YoY.

BPCL Q2: The company's net profit was up 79.4% at Rs 2,694.1 crore versus Rs 1,501.5 crore and revenue was up 15% at Rs 81,536.8 crore versus Rs 70,921.3 crore, YoY.

Bandhan Bank Q2: The company posted net loss at Rs 3,008.6 crore versus profit of Rs 920 crore and NII was up 0.6% At Rs 1,935.4 crore versus Rs 1,923 crore, YoY.

UPL Q2: The company’s net profit was up 36.9% at Rs 634 crore versus Rs 463 crore and revenue was up 18.2% at Rs 10,567 crore versus Rs 8,939 crore, YoY.

Godfrey Phillips Q2: The company reported marginally higher net profit at Rs 104.9 crore versus Rs 103.9 crore and revenue was down 9.2% At Rs 631.9 crore versus Rs 695.8 crore, YoY.

Zen Technologies Q2: The company posted loss of Rs 0.6 crore versus profit of Rs 1.62 crore and revenue was up 27.6% at Rs 15.7 crore versus Rs 12.3 crore, YoY.

Aarti Industries Q2: The company’s net profit was up 22.6% at Rs 176 crore versus Rs 143.5 crore and revenue was up 32.3% at Rs 1,551.6 crore versus Rs 1,172.6 crore, YoY.

Punjab National Bank: The bank is under the F&O ban for November 1. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Tata Consumer Products: The company has decided to transition its Tata Cha business- a tea cafe format Quick Service Restaurant (QSR) chain to Qmin-Shops operated by a subsidiary of Indian Hotels Company Limited.

Sical Logistics: Resolution professional has received 3 resolution plans on October 29, 2021.

Adani Enterprises: The company has signed share subscription agreement and shareholders' agreement with Cleartrip Private Limited (CPL) and also shareholders' agreement with existing shareholder of CPL namely Flipkart Marketplace Private Limited for the purpose of acquiring significant minority stake in CPL.

Bhageria Industries: The company to acquire 51% in equity shares of Bhageria & Jajodia Pharmaceuticlas.

Dhampur Sugar Mills: Sugar crushing for the season 2021-22 at one of company unit situated at Dhampur, Distt. Bijnor, U.P. has started on October 29, 2021.

JMC Projects: The company board has approved raising of funds upto Rs 150 crore by issue of NCDs of the company on private placement basis.

Lyka Labs: Board of directors approved merger of Lyka Exports, a subsidiary company with itself.

Jindal Saw: The company has approved to enter into the joint venture agreement with Hunting Energy Solution Pte Ltd, and to incorporate a Joint Venture Company in India.

Ipca Laboratories: CRISIL has re-affirmed its rating for the company’s commercial paper programme at CRISIL A1+.

Union Bank of India: Fitch Ratings has assigned BBB- rating to the Long Term Issuer Default Rating and F3 to the Short Term Issuer Default Rating (IDR).

IFB Industries Q2: The company reported 21 percent rise in net profit at Rs 24.6 crore versus Rs 31.1 crore and revenue was up34.3% At Rs 989.8 crore versus Rs 737.2 crore, YoY.

DCB Bank Q2: The company’s net profit down 21.1% at Rs 64.9 crore versus Rs 82.3 crore and NII down3.2% at Rs 323.3 crore versus Rs 33.9 crore, YoY. Its gross NPA was at 4.68% versus 4.87% and net NPA at 2.63% versus 2.82%,QoQ.

Dhanuka Agritech Q2: The company’s net profit down 9.4% at Rs 63.4 crore versus Rs 70 crore and revenue down 0.8% at Rs 438.8 crore versus Rs 442.4 crore, YoY.

IDFC Bank Q2: The company’s net profit was up 49.6% at Rs 151.7 crore versus Rs 101.4 crore and NII was up 27.4% At Rs 2,722.2 crore versus Rs 1,783.9 crore, YoY.